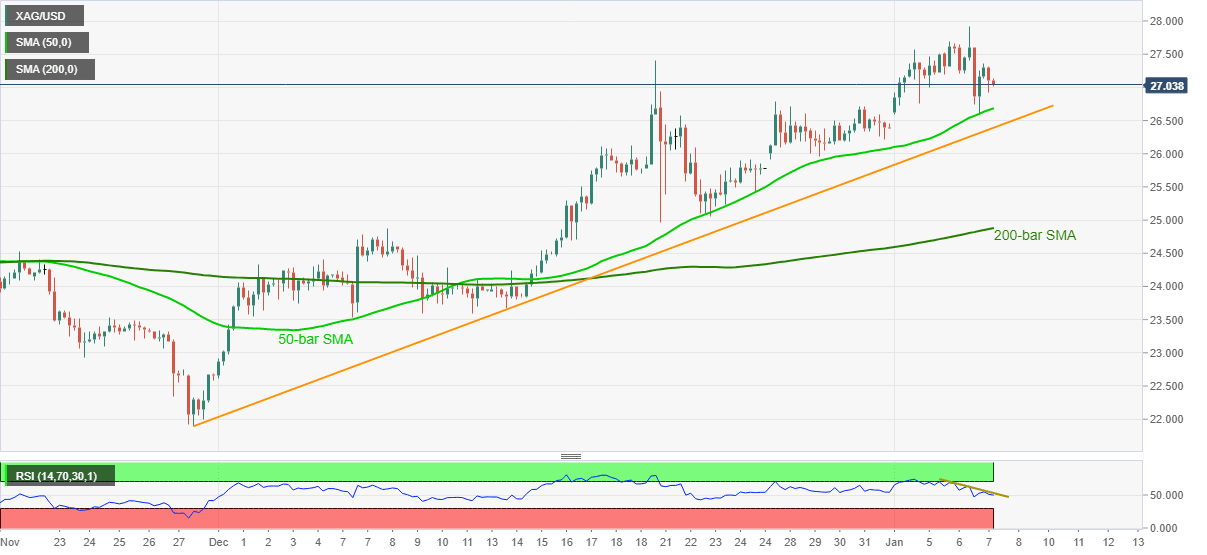

Silver Price Analysis: XAG/USD sellers attack $27.00 with eyes on five-week-old support line

- Silver fades bounce off 50-bar SMA, drops for the second consecutive day.

- Downward slopping RSI, failures to cross $28.00 favor sellers.

- Key SMA, short-term rising trend line become immediate supports to watch.

Silver prices seesaw around $27.10 while heading into Thursday’s European session. Even so, the white metal extends the previous day’s losses, down 0.56% intraday by press time, when it reversed from the highest since early September.

Considering the lower high formation of the bullion, coupled with the inability to cross September’s top and descending RSI line, silver is likely preparing for a trend change.

However, 50-bar SMA and a rising trend line from November 30, respectively around $26.70 and $26.40, become the tough nut to crack for the metal sellers.

In a case where the silver bears manage to conquer $26.40, an area comprising December 21 low, December 02 high and 200-bar SMA, between $24.95 and $24.86, will be the key to watch.

Alternatively, $27.50 and the $28.00 threshold can test corrective pullback of the metal prices ahead of highlighting the four-month high of $28.90 and the previous year’s peak close to $29.85 on their radars.

It should be noted that the $30.00 and January 28, 2013 bottom near $30.75 will lure the silver bulls beyond the $29.85 resistance.

Silver four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.