Silver Price Analysis: XAG/USD remains depressed near $24.00, downside seems limited

- Silver struggles to capitalize on a two-day-old strong uptrend and edges lower on Friday.

- The technical setup favours bullish traders and supports prospects for additional gains.

- Corrective slide back towards the 200-day SMA could get bought into and remain limited.

Silver (XAG/USD) comes under some selling pressure on Friday, snapping a two-day winning streak to over a one-week high touched the previous day and stalling this week's strong recovery from mid-$22.00s or a near one-month low. The white metal remains on the defensive through the early European session and currently trades just above the $24.00 round figure, down nearly 0.40% for the day.

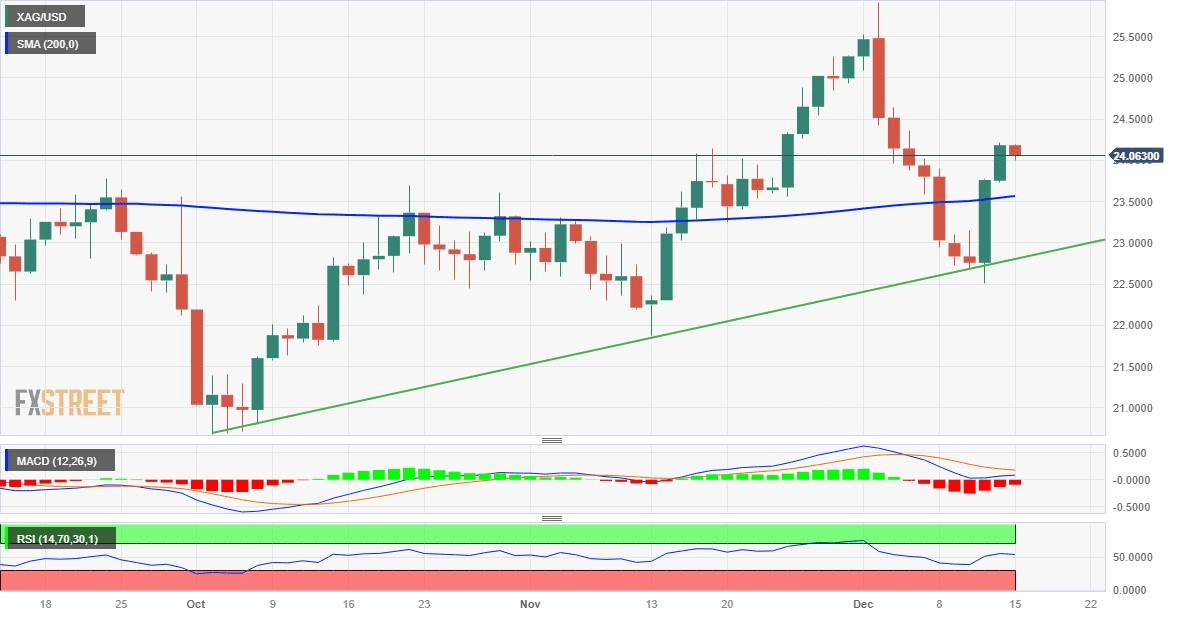

From a technical perspective, the XAG/USD earlier this week showed some resilience below and defend an upward-sloping sloping line extending from a multi-month low touched in October. The subsequent surge beyond the very important 200-day Simple Moving Average (SMA) favours bullish traders and supports prospects for a further appreciating move. Moreover, oscillators on the daily chart have again started gaining positive traction and validate the near-term constructive setup.

Hence, any subsequent decline might still be seen as a buying opportunity and remain limited near the 200-day SMA, currently pegged near the $23.60 region. Some follow-through selling, however, might turn the XAG/USD vulnerable to accelerate the slide towards the $23.00 mark en route to the aforementioned ascending trend-line support, around the $22.85-$22.80 region. A convincing break below the latter will negate the positive outlook and shift the bias in favour of bearish traders.

On the flip side, bulls might wait for a move beyond the $24.20 area before placing fresh bets and positioning for a move towards reclaiming the $25.00 psychological mark. The upward trajectory could get extended further towards the $25.25 intermediate hurdle en route to the $25.45-$25.50 region and the $26.00 neighbourhood, or the highest level since May 5 touched earlier this month.

Silver daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.