Silver Price Analysis: XAG/USD refreshes weekly top, seems poised to appreciate further

- Silver scales higher for the third straight day and climbs to a fresh weekly high on Thursday.

- The technical setup seems tilted in favour of bulls and supports prospects for further gains.

- A sustained break below the $24.00 mark is needed to negate the near-term positive bias.

Silver gains strong follow-through positive traction for the third successive day on Thursday and climbs to a fresh weekly top during the early part of the European session. The white metal currently trades just above the $25.00 psychological mark and remains well within the striking distance of over a two-month peak touched last week.

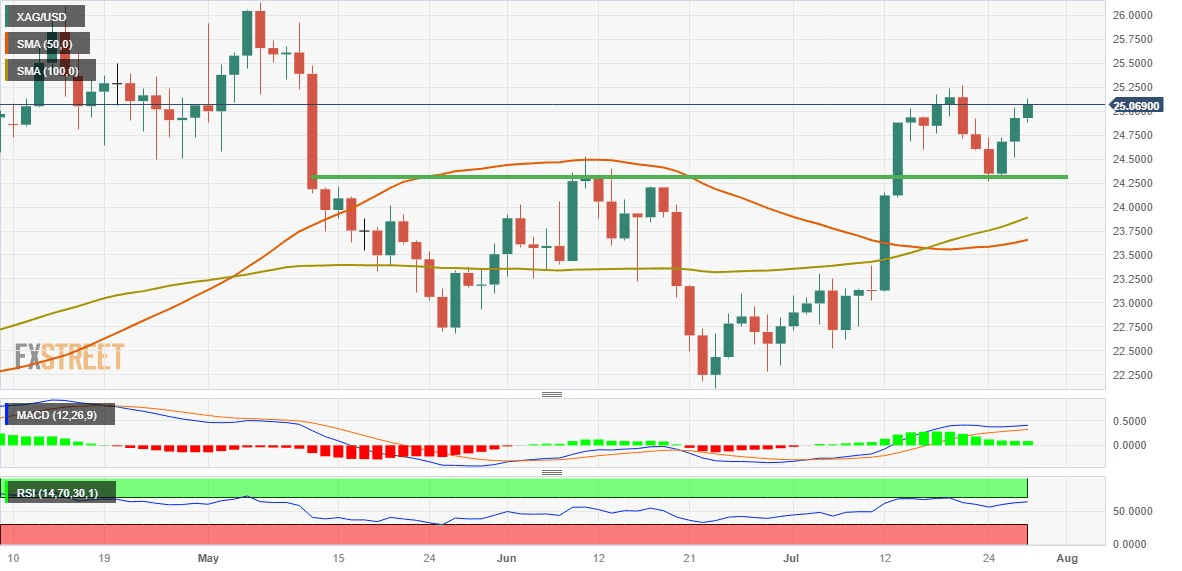

The technical setup, meanwhile, favours bullish traders and suggests that the path of least resistance for the XAG/USD is to the upside. The positive outlook is reinforced by the fact that oscillators on hourly/daily charts are holding comfortably in bullish territory and are still far from being in the overbought zone. That said, it will still be prudent to wait for some follow-through buying beyond the $25.25 area, or the monthly peak, before positioning for any further appreciating move.

The XAG/USD might then accelerate the positive momentum towards the $25.50-$25.55 intermediate hurdle and eventually aim towards reclaiming the $26.00 round figure. This is closely followed by the YTD peak, around the $26.10-$26.15 area touched in May. A sustained strength beyond will be seen as a fresh trigger for bullish traders and pave the way for additional gains.

On the flip side, any corrective pullback is more likely to attract some buying near the $24.85-$24.80 region. This should help limit the downside for the XAG/USD near the $24.60 zone. Failure to defend the said support will expose the weekly low, around the $24.25 region, which if broken decisively will negate the positive outlook and shift the bias in favour of bearish traders. Silver might then drop further below the $24.00 mark, towards the $23.65-$23.60 support.

The XAG/USD could then extend the downward trajectory further towards the $23.20-$23.15 region. Some follow-through selling below the $23.00 mark, nearing the very important 200-day SMA, will make silver vulnerable to challenge the multi-month low, around the $22.15-$22.10 area.

Silver daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.