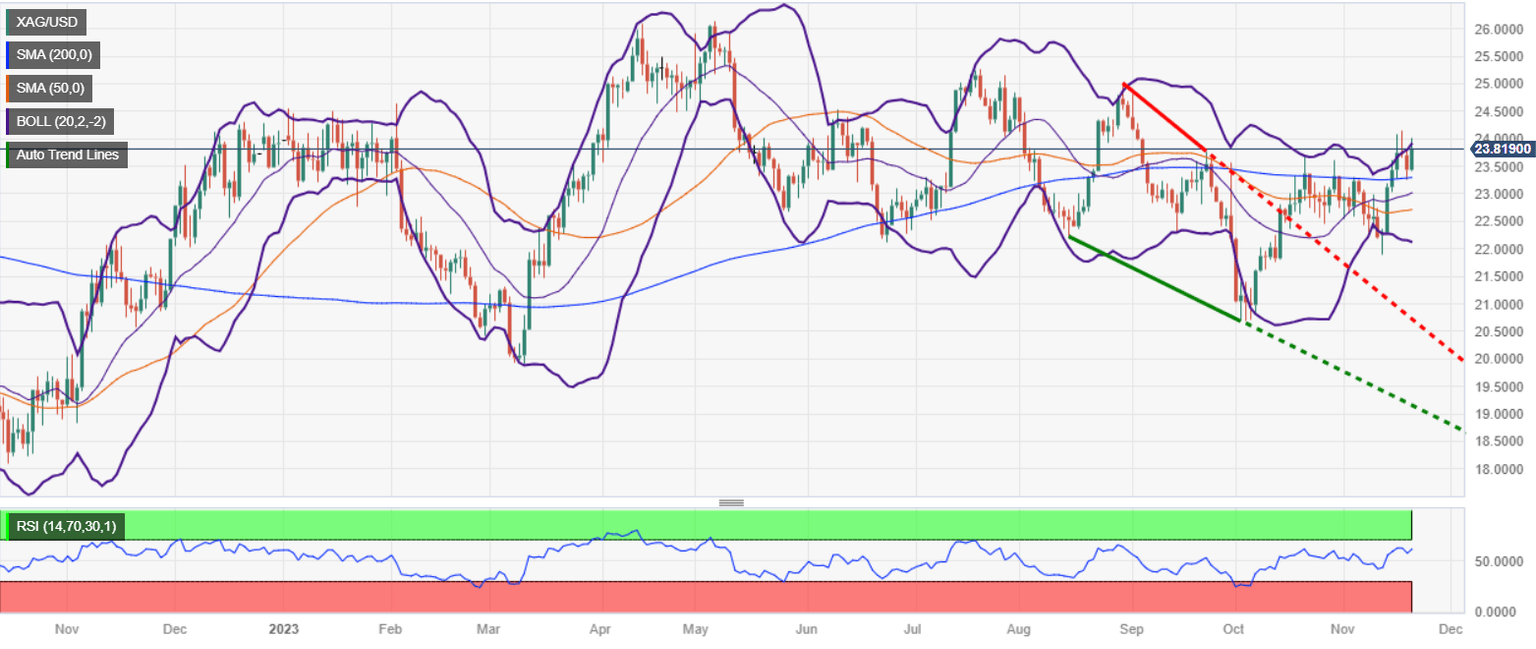

Silver Price Analysis: XAG/USD rebounds, eyeing key resistance levels

- Silver prices have rebounded from Monday's four-day low of $23.25, printing gains of over 1.80%.

- XAG/USD maintains an upward bias, though it would require breaking above the November 17 high of $24.14 to solidify this trend.

- Silver’s drop below $23.50 might lead to a test of the 200-day moving average (DMA) at $23.29, and further down, the 50-DMA at $23.01.

Silver price erased Monday losses, which witnessed the grey metal dropping to a four-day low of $23.25, climbing more than 1.80%, and trading at around $23.90 a troy ounce at the time of writing.

Market sentiment shifted negatively as Wall Street traded with minuscule losses. The US 10-year Treasury bond yield is almost flat at 4.43%, though it has failed to cap Silver’s advance.

From a technical perspective, XAG/USD is still upward biased but it needs to climb above the November 17 high at $24.14, so it could further cement its bias. Once done, the next resistance would be the August 30 high at $25.00, followed by the July 20 swing high at $25.26.

On the other hand, if XAG/USD remains below $24.00, that would keep sellers hopeful of lower prices. If Silver drops below $23.50, that could pave the way to test the 200-day moving average (DMA) at $23.29, followed by the 50-DMA at $23.01. A breach of the latter would expose the 20-DMA at $22.69.

XAG/USD Price Analysis – Daily Chart

XAG/USD Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.