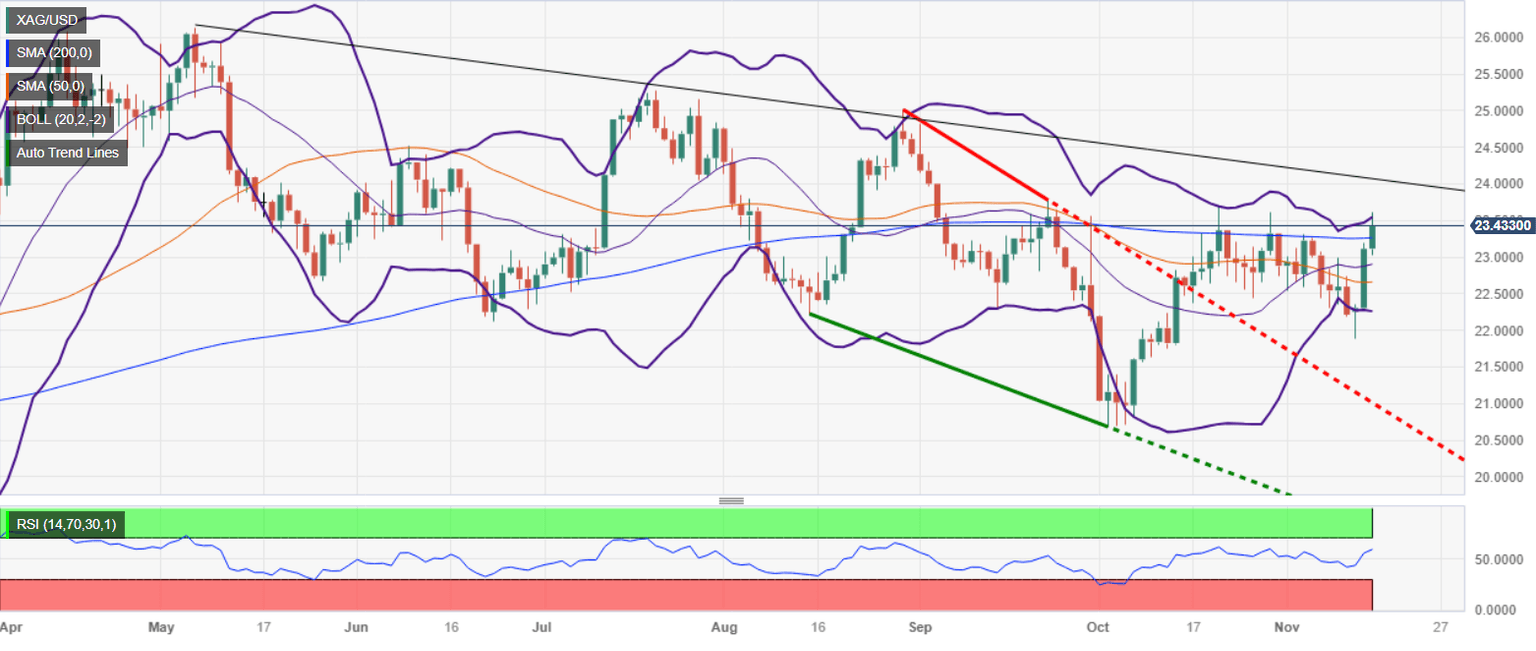

Silver Price Analysis: XAG/USD rally as buyers reclaim the 200-DMA

- Silver prices sharply rise to $23.40, up 1.47%, following a soft US inflation report fueling expectations of a pause in Fed rate hikes.

- The metal tests the 200-day moving average at $23.26, potentially extending gains towards $24.00 if the bullish momentum sustains.

- A failure at the 200-DMA could trigger a pullback towards the 20-DMA at $22.89 and the 50-DMA at $22.64.

Silver price climbs on Wednesday, following last Tuesday’s soft US inflation report, which sent US Treasury bond yields plummeting on expectations the US Federal Reserve is done hiking rates. Hence, the XAG/USD advances sharply, reaching key resistance levels like the 200-day moving average (DMA) at $23.26. If Silver bulls hold price above the latter, the uptrend would likely continue toward year’s end, as buyers target $24.00. The XAG/USD is trading at $23.40, up 1.47%.

From a daily standpoint, the grey metal is neutrally biased, though about to shift neutral-upwards if buyers reclaim the latest cycle high seen at $23.69, October 20 daily high. Upside risks remain above that level, with a seven-month-old resistance trendline at $23.80-90, before challenging $24.00 a troy ounce.

On the other hand, if XAG/USD couldn’t remain above the 200-DMA, that could exacerbate a pullback toward the 20-DMA at $22.89, before sliding to the 50-DMA at $22.64 before challenging the November 13 swing low of $21.88.

XAG/USD Price Analysis – Daily Chart

XAG/USD Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.