- Silver is trading 6.69% higher as precious metals soar.

- The price smashed through the resistance area at USD 21.13 per ounce.

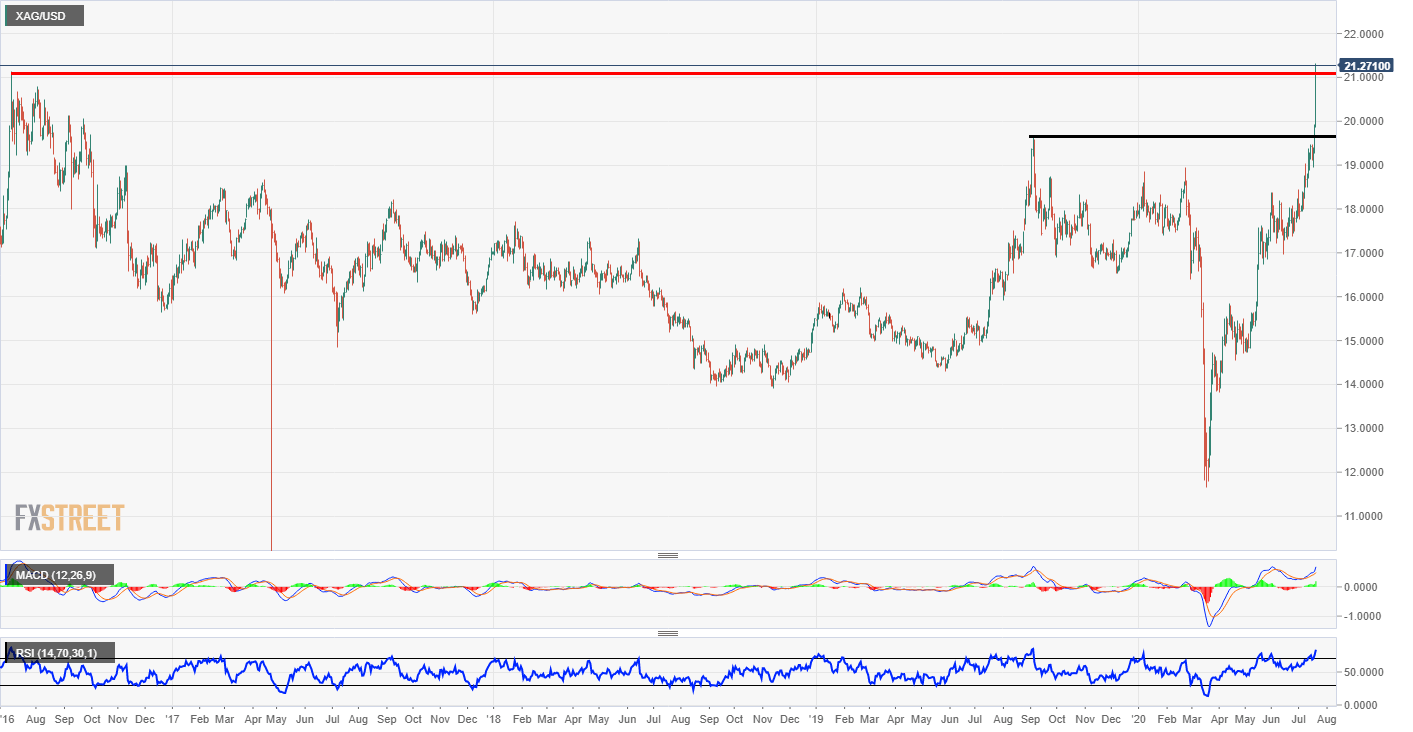

XAG/USD daily chart

The precious metals have been off the charts recently and silver has been the pick of the bunch. The push higher has seen the metal break yet another resistance zone and it now trades 6.69% higher on Tuesday. The bottom of the 2011 consolidation area is USD 26.11 and this could be the big target for the bulls. The all-time high is still some way off at USD 49.83 per ounce.

Looking closer at the chart below, the price took the previous wave high of USD 19.65 per ounce. Just now the red resistance zone has been broken but we should wait for the daily close to see if the price can hold the break. The indicators are looking very bullish too. The MACD histogram is firmly green and the signal lines are about the mid-zone too. The Relative Strength Index is also in a very positive area above 70. It is looking slightly oversold but this can happen with the indicator.

XAG/USD monthly chart

The monthly chart really highlights the major levels. The black resistance zone at USD 26.17 per ounce looks very firm. The bulls look set to try and target that level and there could be some resistance. The Indicators are still positive very much like on the daily chart above but the Relative Strength Index has way more room on the monthly.

Additional levels

All information and content on this website, from this website or from FX daily ltd. should be viewed as educational only. Although the author, FX daily ltd. and its contributors believe the information and contents to be accurate, we neither guarantee their accuracy nor assume any liability for errors. The concepts and methods introduced should be used to stimulate intelligent trading decisions. Any mention of profits should be considered hypothetical and may not reflect slippage, liquidity and fees in live trading. Unless otherwise stated, all illustrations are made with the benefit of hindsight. There is risk of loss as well as profit in trading. It should not be presumed that the methods presented on this website or from material obtained from this website in any manner will be profitable or that they will not result in losses. Past performance is not a guarantee of future results. It is the responsibility of each trader to determine their own financial suitability. FX daily ltd. cannot be held responsible for any direct or indirect loss incurred by applying any of the information obtained here. Futures, forex, equities and options trading contains substantial risk, is not for every trader, and only risk capital should be used. Any form of trading, including forex, options, hedging and spreads, contains risk. Past performance is not indicative of future FX daily ltd. are not Registered Financial Investment Advisors, securities brokers-dealers or brokers of the U.S. Securities and Exchange Commission or with any state securities regulatory authority OR UK FCA. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest, with or without seeking advice, then any consequences resulting from your investments are your sole responsibility FX daily ltd. does not assume responsibility for any profits or losses in any stocks, options, futures or trading strategy mentioned on the website, newsletter, online trading room or trading classes. All information should be taken as educational purposes only.

Recommended content

Editors’ Picks

AUD/USD remains weak near 0.6600 amid firmer US Dollar

The AUD/USD pair remains on the defensive near 0.6605 during the early Asian session on Monday. The downtick of the pair is pressured by the firmer US Dollar amid the less dovish stance of the Federal Reserve and strong University of Michigan sentiment data.

EUR/USD: It’s all about economic growth

The EUR/USD pair fell to an almost four-month low of 1.0760 on Wednesday but managed to recover the 1.0800 mark to set a handful of pips above the level at the end of the week. The US Dollar maintained its positive momentum throughout the first half of the last week, led by a dismal market mood, but later lost some ground.

Gold holds below $2,750, potential downside seems limited

Gold price edges lower to near $2,735, snapping the two-day losing streak during the early Asian session on Monday. However, the downside of the precious metal might be limited amid the ongoing geopolitical tensions and uncertainties surrounding the US presidential election.

Solana Price Forecast: SOL corrects even as on-chain metric hits record high

Solana price slips to $170 at the time of writing, down nearly 4% on the day. Solana economic activity hit its fourth consecutive all-time high, according to Blockworks data. SOL could correct over 5% if it extends its losses further.

US elections: The race to the White House tightens

Trump closes in on Harris’s lead in the polls. Neck and neck race spurs market jitters. Outcome still hinges on battleground states.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637309566607761632.png)