Silver Price Analysis: XAG/USD is pushing against $24.00 support area

- Silver retreats from $24,50 highs and tests support at $24.00 area.

- Precious metals dip with the USD picking up on inflation concerns.

- XAG/USD remains positive while above $23.40.

Silver futures are testing support at $24.00 after pulling back from six-week highs near $.24.50 weighed by a stronger US dollar with the risk rally coming to an end.

Metal prices pull back on inflation fears

Precious metals are trading lower on Friday, as higher inflation pressures have returned to the market, pushing US Treasury bond yields higher and ultimately buoying demand for the US dollar.

The US benchmark 10-year bond yield has edged up to fresh 4-month highs at 1.68% on Thursday, with the investors assuming that the persistently high inflation will force the Federal Reserve to accelerate its monetary policy normalization plan.

The US Dollar Index, which measures the value of the dollar against a basket of the most traded currencies, has edged up about 0.2% today, following a five-day decline from year-to-date highs at 94.54.

XAG/USD: remains positive while above $23.40

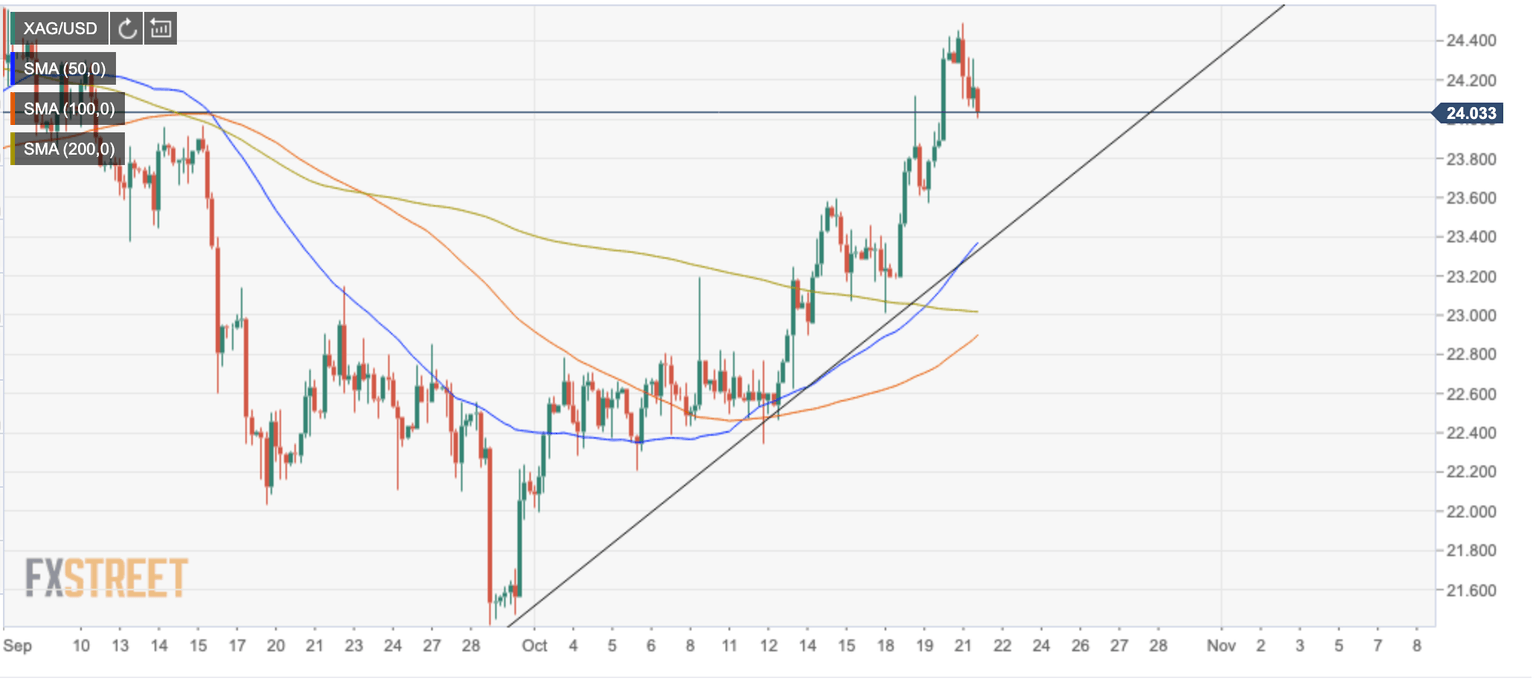

In a broader view, silver futures remain positive while above $23.40, where trendline support from late-September lows and the 50-period SMA meet. Below here, the next potential targets might be $23.00 (October 18 low), and 22.20/35 (October 6 and 12 lows).

On the upside, a bullish reaction past $24.45 (Intra-day high) would open the path towards early September highs at $24.80 and $25.20 (August 3, 4 lows).

XAG/USD 4-hour chart

Technical levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.