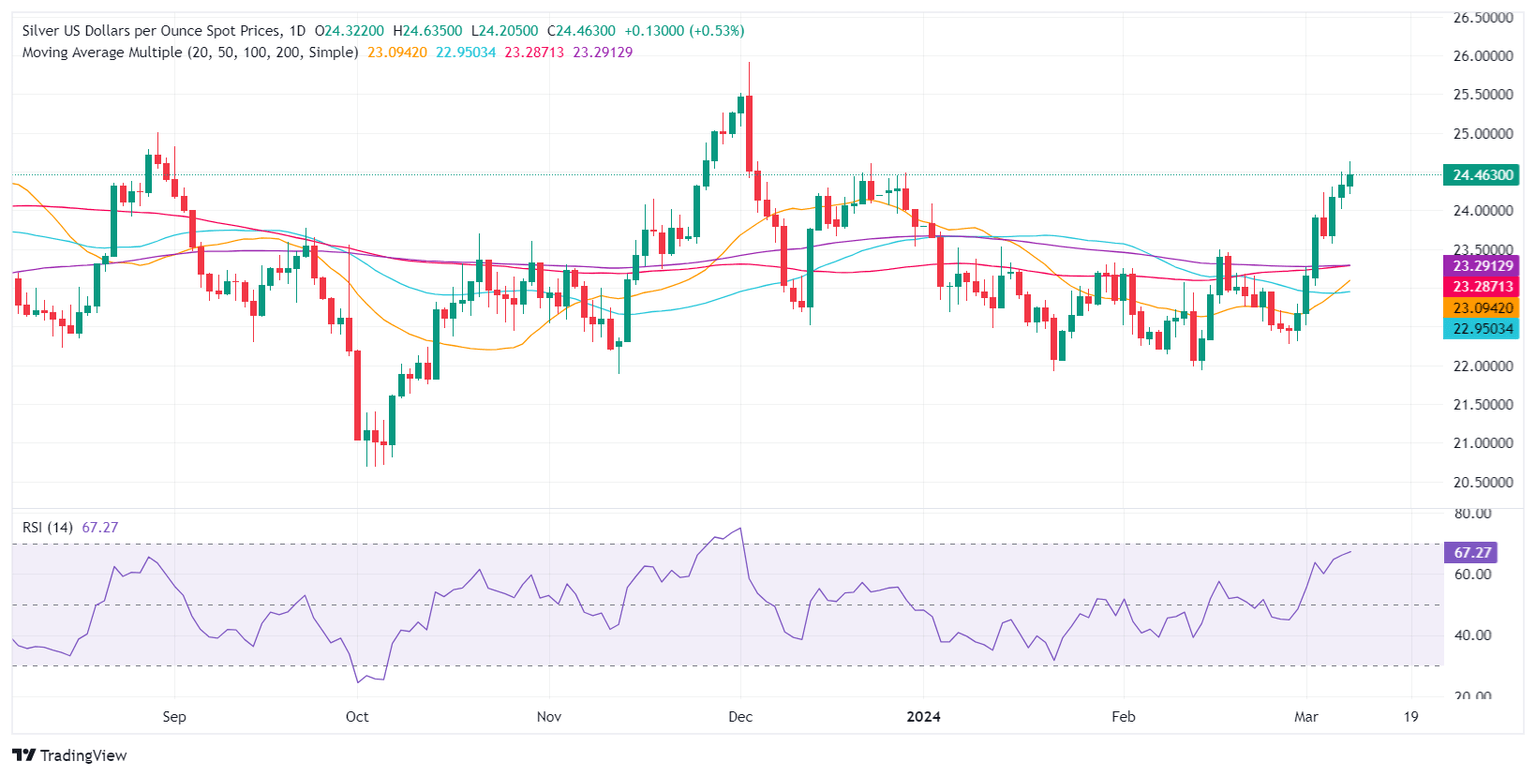

Silver Price Analysis: XAG/USD holds near YTD high around $24.50

- Silver inches closer to retesting its year-to-date high of $24.63, after marking a 0.86% increase.

- Technical dynamics suggest potential for further gains if silver surpasses the $24.50 resistance.

- Downside risks loom if silver falls below $24.31, targeting supports at $24.00 and the March 6 low of $23.57.

Silver's price rallies, but it remains below the new year-to-date (YTD) high of $24.63. It reached earlier, post gains of 0.86%, and trades at around $24.50 during the mid-North American session.

XAG/USD Price Analysis: Technical outlook

Silver retreated during the day, below the March 7 daily close of $24.31, which could sponsor a leg down if sellers push the prices lower. However, buyers are keeping Silver’s price above the latter, and if they reclaim the $24.50 level, that could push XAG/USD to re-test $24.63, ahead of $25.00.

On the flip side, if sellers drag Silver’s prices below $24.31, XAG/USD could dive to $24.00. A breach of the latter will expose the March 6 low of $23.57, followed by the confluence of the 100 and 200-day moving average (DMA) at $23.27.

XAG/USD Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.