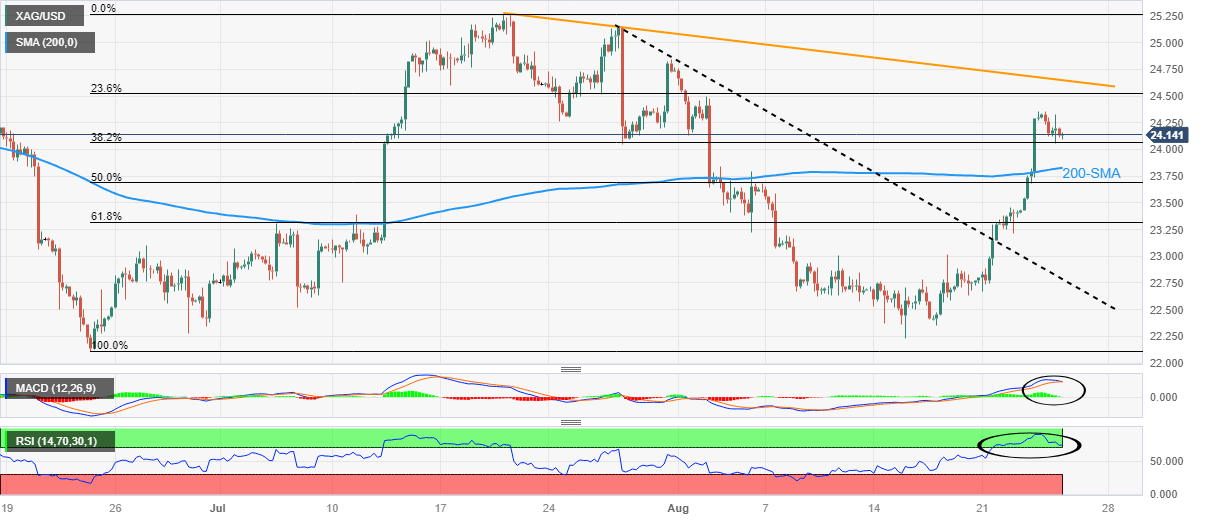

Silver Price Analysis: XAG/USD grinds higher past $24.00 but oscillators tease bears

- Silver Price stays depressed after reversing from three-week high.

- Overbought RSI, impending bear cross on MACD lures XAG/USD sellers.

- 200-SMA, fears of Fed policy pivot put a floor under the Silver Price.

- XAG/USD rebound remains elusive below five-week-old descending resistance line.

Silver Price (XAG/USD) remains pressured around $24.15 amid the early hours of Friday’s Asian session after reversing from a three-week high the previous day. In doing so, the bright metal portrays the market’s cautious mood ahead of today’s top-tier central bankers’ speeches at the Jackson Hole Symposium, including Federal Reserve (Fed) Chairman Jerome Powell.

That said, the XAG/USD justified the overbought RSI (14) line and a looming bear cross on the MACD while reversing from a multi-day high on Thursday. However, the 38.2% Fibonacci retracement level of the commodity’s late June-July upside, near the $24.00 round figure, prods the sellers amid anxious markets.

Even if the quote breaks the immediate Fibonacci ratio, the 200-SMA level of around $23.80 can act as the final defense of the buyers.

Following that, a quick slump toward the 61.8% Fibonacci retracement surrounding $23.30, also known as the “Golden Ratio”, can’t be ruled out.

Meanwhile, the latest peak of around $24.35 can lure Silver buyers during the fresh recovery.

Even so, the 23.6% Fibonacci retracement and a downward-sloping resistance line from late July, respectively near $24.55 and $24.65, will challenge the XAG/USD bulls before giving them control.

Silver Price: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.