Silver Price Analysis: XAG/USD fluctuates around $20.00 as bears take a respite

- Silver price stabilizes after sliding close to 5% on Tuesday.

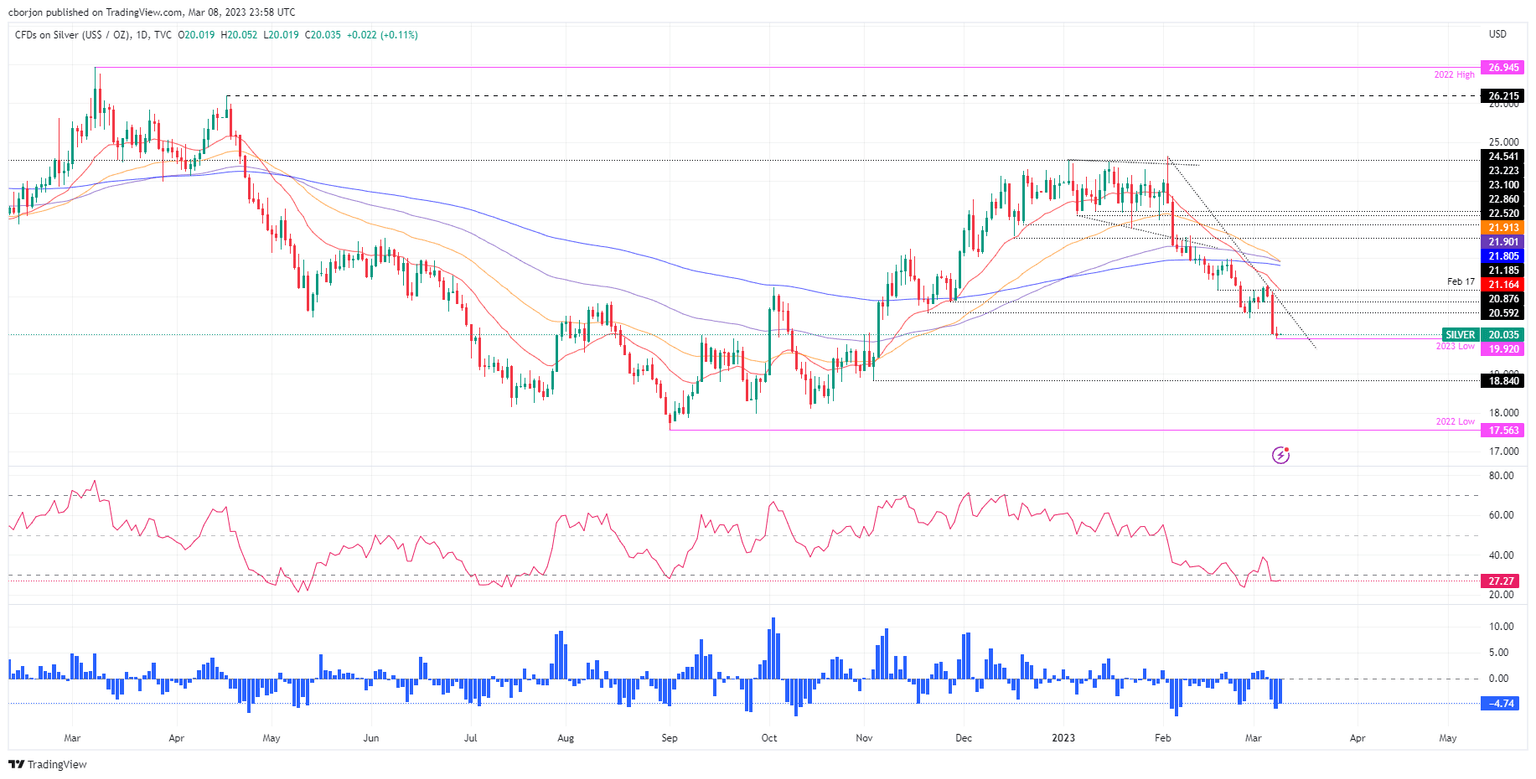

- XAG/USD Price Analysis: To resume its downward bias after dropping below $21.00.

Silver price reached a multi-month low of around $19.92, but buyers stepped in, dragging the XAG/USD price above the $20.00 figure.

Wall Street finished the session mixed. The US Federal Reserve Chair Jerome Powell rattled the US equities market after commenting that to testify against the US Congress with a consistent hawkish tone. Therefore, the US Dollar (USD) consolidates yesterday’s gains, as shown by the US Dollar Index up 0.09%, at 105.710.

XAG/USD Price Action

After dropping almost 5% on Tuesday, the XAG/USD collapse appears to have found a temporal bottom. The XAG/USD printed a new YTD low at $19.92. Wednesday’s price action formed a doji, indicating that buyers and sellers are at equilibrium. The Relative Strength Index (RSI) is at oversold conditions as sellers take a breather, while the Rate of Change (RoC) suggests that sellers are gathering momentum.

If the XAG/USD tumbles below the YTD low at $19.92, the next line of defense for XAG bulls would be $19.00, ahead of sliding toward November’s 3 low at $18.84.

In an alternate scenario, the XAG/USD first resistance would be February’s 28 daily low turned resistance at $20.43. A breach of the latter will clear the pave toward March’s 2 low at $20.68, before testing the $21.00 psychological level.

XAG/USD Daily chart

XAG/USD Technical levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.