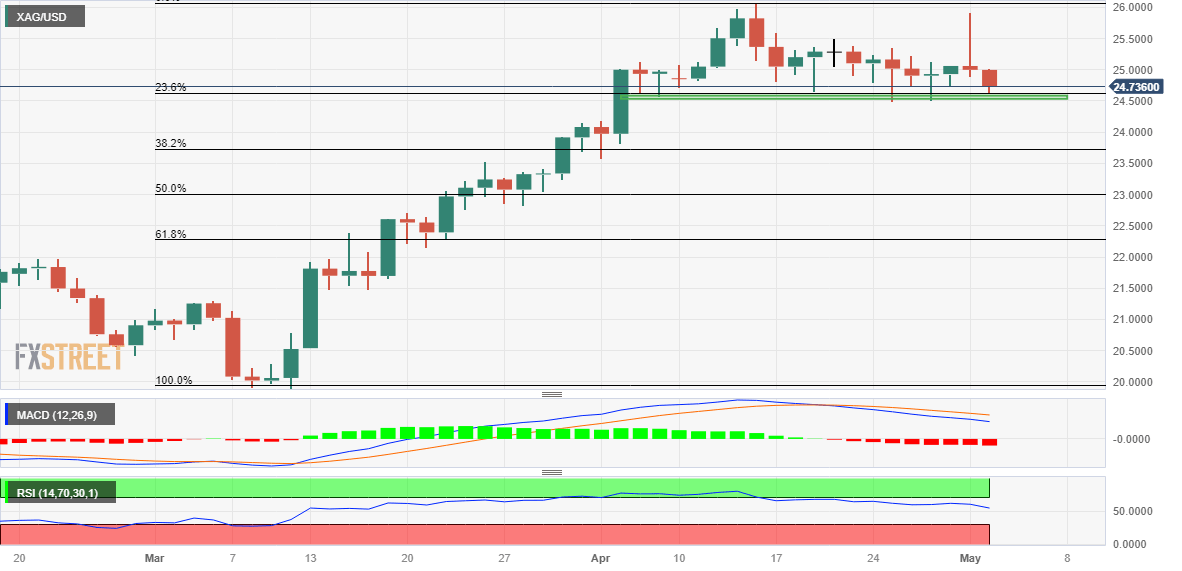

Silver Price Analysis: XAG/USD flirts with 23.6% Fibo., bears await break below $24.50-40 support

- Silver extends the overnight sharp fall and drifts lower for the second successive day on Tuesday.

- The mixed technical setup warrants caution before positioning for any further depreciating move.

- A sustained weakness below the $24.50-40 area is needed to support prospects for deeper losses.

Silver extends the previous day's sharp retracement slide from the vicinity of the $26.00 mark and remains under heavy selling pressure for the second successive day on Tuesday. The steady intraday descent extends through the first half of the European session and drags the white metal back closer to the $25.50-$25.40 strong horizontal resistance breakpoint, now turned support.

The said area coincides with the 23.6% Fibonacci retracement level of the March-April rally, which if broken decisively will be seen as a fresh trigger for bearish traders and pave the way for deeper losses. The XAG/USD might then turn vulnerable to weaken further below the $24.00 mark and aim to test 38.2% Fibo. level, around the $23.70 area. The corrective decline could get extended further towards the $23.35-$23.30 horizontal support en route to the $23.00 confluence, comprising the 50% Fibo. level and the 50-day Simple Moving Average (SMA).

Oscillators on the daily chart, meanwhile, are still holding in the positive territory and support prospects for the emergence of some dip-buying at lower levels. That said, any intraday move up might now confront resistance near the $25.00 psychological mark. Some follow-through buying has the potential to lift the XAG/USD towards the $25.50 supply zone, above which bulls could attempt to conquer the $26.00 mark. The next relevant hurdle is pegged near the $26.25-$26.30 area, which if cleared will expose the 2022 high, just ahead of the $27.00 mark.

Silver daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.