- Silver is suffering heavy losses for the second straight day on Friday.

- Next support for XAG/USD is located ar $26.60.

- Sellers are likely to remain in control unless silver rebounds above $27.30.

The XAG/USD pair lost nearly 2% on Thursday after the surging US Treasury bond yields provided a boost to the greenback in the late American session. On Friday, the bearish pressure surrounding silver remains intact and the pair was last seen losing 1.7% on the day at $26.95.

Silver technical outlook

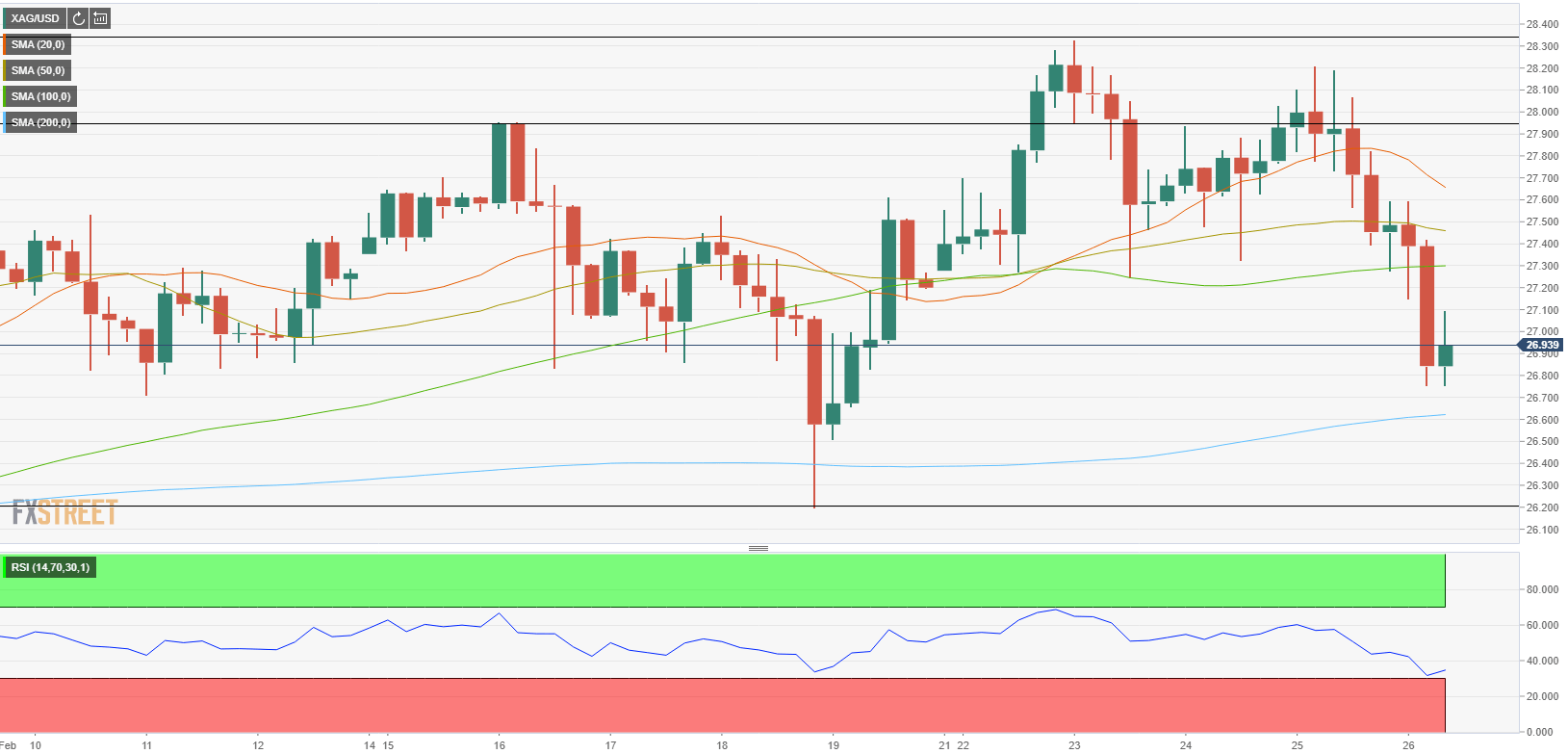

Following Thursday's sharp drop, XAG/USD closed below the 20-day SMA for the first time in a month and the Relative Strength Index (RSI) indicator on the daily chart dropped below 50, pointing to a bearish shift in the near-term outlook.

The 200-period SMA on the four-hour chart is forming the first technical support at $26.60. If a candle on that chart manages to close below that level, $26.20 (February 18 low) could be seen as the next target ahead of $25.90 (February low).

On the other hand, the immediate hurdle could be seen at $27.30 (100-period SMA on the four-hour chart) before $28 (psychological level/February 26 high) and $28.35 (February 23 high).

XAG/USD four-hour chart

Additional levels to watch for

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD jumps above 1.1100, targets new 2025-high

EUR/USD gathers bullish momentum and closes in on a fresh 2025-high above 1.1100 in the American session on Thursday. The soft inflation data from the US and the growing fears over a deepening US-China trade conflict weigh heavily on the USD, fuelling the pair's rally.

GBP/USD retreats from daily highs, holds above 1.2900

GBP/USD retreats from the daily high it set near 1.2950 but manages to stay in positive territory above 1.2900. The US Dollar stays under strong selling pressure following the weaker-than-expected Consumer Price Index (CPI) data but the risk-averse market atmosphere limits the pair's upside.

Gold climbs to five-day highs around $3,150

Gold now accelerates its upside momentum and advances to multi-day peaks around the $3,150 mark per troy ounce, remaining within a touching distance of the record-high it set last week. The persistent selling pressure surrounding the US Dollar and the negative shift seen in risk mood help XAU/USD push higher.

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.