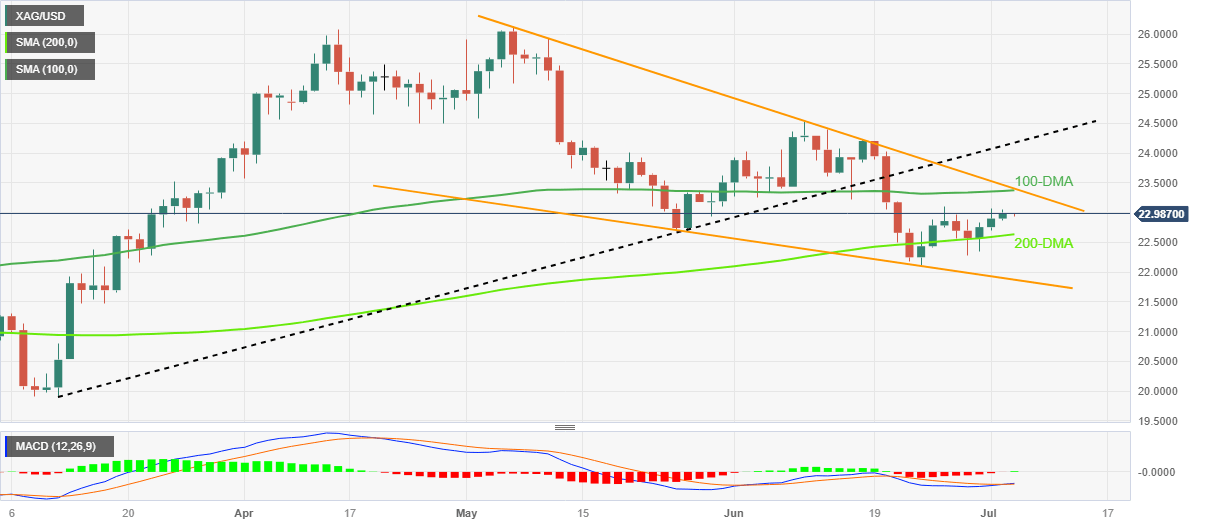

Silver Price Analysis: XAG/USD bulls struggle near $23.00 within falling wedge

- Silver Price pares intraday losses, the first in four days, inside bullish chart formation.

- Clear break of 200-DMA, bullish MACD signals favor XAG/USD buyers.

- 100-DMA adds strength to wedge’s top line, making $23.40 the key hurdle toward the north.

Silver Price (XAG/USD) fades upside momentum around the weekly top surrounding $23.00 amid an early Asian session on Wednesday, following the four-day uptrend. In doing so, the XAG/USD bulls appear taking a breather within a two-month-old falling wedge bullish chart formation.

In addition to the falling wedge chart pattern, the Silver Price run-up beyond the 200-DMA and bullish MACD signals also keep the buyers hopeful.

As a result, the XAG/USD’s latest retreat appears elusive unless the quote offers a daily closing below the 200-DMA level of around $22.60.

Even so, the previous monthly low of near $22.10, the $22.00 round figure and the stated wedge’s bottom line, close to $21.85 at the latest, can challenge the Silver bears.

In a case where the XAG/USD remains weak past $21.85, it defies the bullish chart pattern and becomes vulnerable to revisit the $20.00 psychological magnet.

On the flip side, a convergence of the 100-DMA and the stated wedge’s top line, near $23.40, becomes a crucial resistance to watch during the Silver Price advances.

Following that, the previous support line stretched from early March, surrounding $24.20, can act as a buffer during the metal’s run-up towards the theoretical target of the falling wedge breakout, around $27.40.

It should be noted that the $25.00 threshold and the previous monthly high near $26.15 can also prod the Silver buyers between $24.20 and $27.40.

Silver Price: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.