Silver Price Analysis: XAG/USD bulls retain control near three-week top, around mid-$24.00s

- Silver edges higher for the fourth straight day and climbs a near three-week top on Friday.

- The technical setup favours bulls and supports prospects for a further appreciating move.

- Corrective pullback could now be seen as a buying opportunity near the 24.00 round figure.

Silver (XAG/USD) gains positive traction for the fourth straight day on Friday and trades around the $24.45-$24.50 region, or a near three-week high during the first half of the European session.

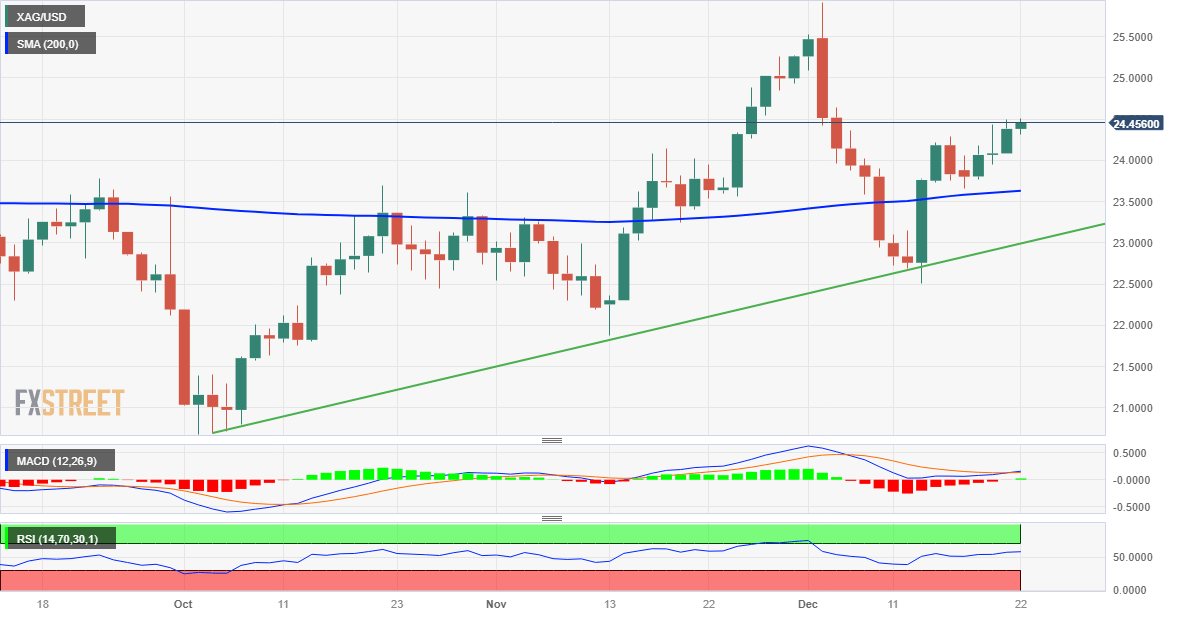

Looking at the broader picture, the recent rally from a multi-month-old ascending trend-line support, a subsequent move beyond the 200-day Simple Moving Average (SMA) and the $24.00 round figure was seen as a fresh trigger for bullish traders. Adding to this, oscillators on the daily chart have been gaining positive traction and support prospects for an extension of a two-week-old upward trajectory.

Hence, some follow-through strength, towards reclaiming the $25.00 psychological mark, looks like a distinct possibility. The momentum could get extended further towards the $25.25 intermediate resistance en route to the $25.45-$25.50 supply zone, above which the XAG/USD could jump back closer to the $26.00 round figure or its highest level since May touched earlier this month.

On the flip side, any meaningful corrective slide now seems to find decent support and attract fresh buyers near the $24.00 mark. This should help limit the downfall near the 200-day SMA, around the $23.60 region. That said, a convincing break below the latter might prompt some technical selling and make the XAG/USD vulnerable to retesting the aforementioned trend-line support, currently near the $23.00 mark.

The latter should act as a key pivotal point, which if broken decisively will shift the near-term bias in favour of bearish traders. The XAG/USD might then accelerate the downfall further towards the monthly swing low, around mid-$22.00s, before dropping to the $22.25 support and the $22.00 round-figure mark.

Silver daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.