Silver Price Analysis: XAG/USD bears gather strength to breach 100-DMA support

- Silver tracked the sell-off in gold price after Fed’s hawkish turn.

- XAG/USD battles 50-DMA as bears gather strength for the next downswing.

- RSI has turned flat but stays bearish, keeping sellers hopeful.

Silver price (XAG/USD) tumbled in tandem with gold price on Wednesday, as the US Federal Reserve (Fed) surprised markets with hawkish signals, suggesting sooner-than-expected rate hikes and tapering prospects.

The US returns on the market jumped and drove the US dollar higher, weighing on the non-yielding bullion prices. Further, China’s announcement that their measures to curb the surge in commodity prices are achieving results also continue to keep the bearish undertone intact in silver.

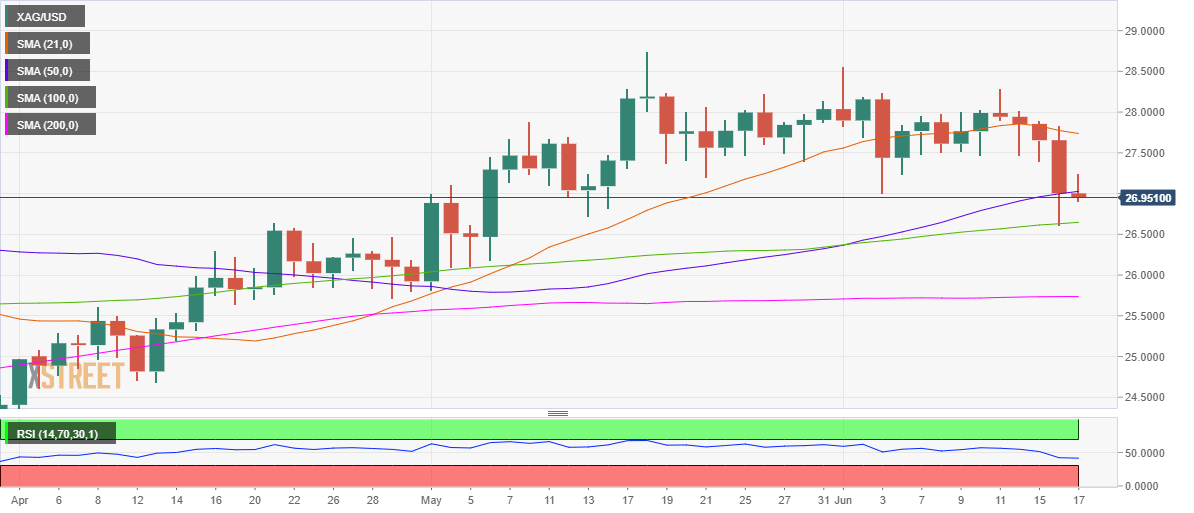

Looking at it technically, the white metal seems to have found rejection above the 50-Daily Moving Average (DMA) at $27.02 on its road to recovery from Wednesday’s crash to multi-week lows of $26.61.

That said, the downside remains open for a test of the critical 100-DMA support at $26.64, around where the previous low coincides.

A daily closing below the latter could fuel a sharp drop towards the $26 level, below which the horizontal 200-DMA at $25.73 emerges as the last line of defense for silver bulls.

The Relative Strength Index (RSI) has turned flat but remains below 50.00, backing the case for further declines.

Silver Price Chart: Daily chart

Alternatively, silver bulls need to recapture the 21-DMA barrier at $27.73 on a sustained basis, in order to negate the downbeat momentum.

However, the $27.50 psychological level could test the bullish commitment before.

Silver Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.