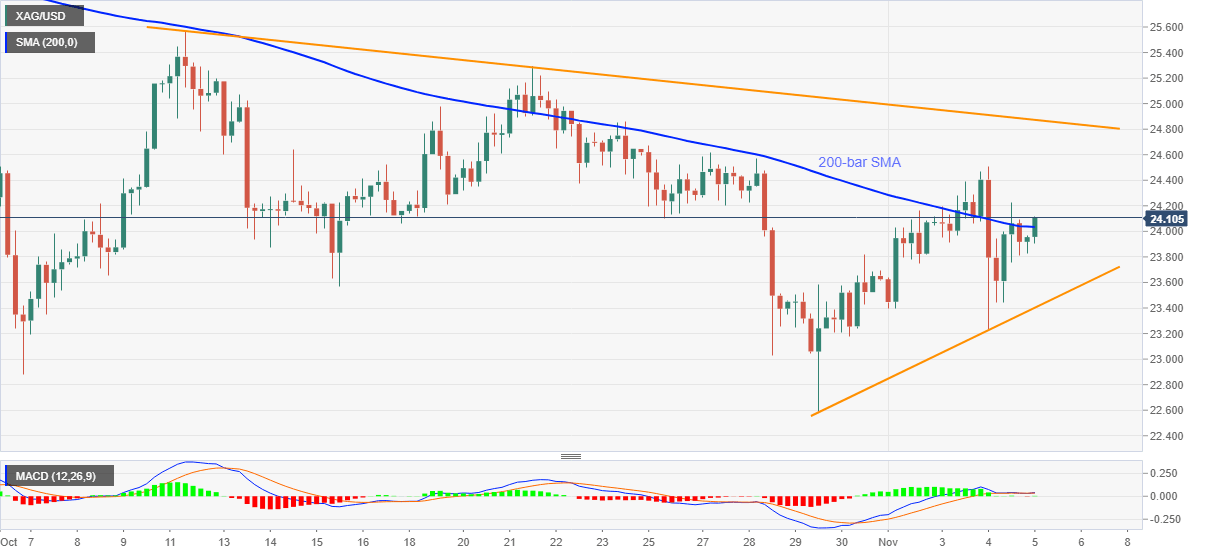

Silver Price Analysis: XAG/USD battles key SMA resistance around $24.00

- Silver prices print mild gains after Wednesday’s downbeat performance.

- A three-week-old falling trend line on the bulls’ radars, weekly support line blocks sellers’ entry.

- MACD suggests further recovery but a clear break of $24.50 becomes necessary.

Silver picks up the bids near $24.05, up 0.64% intraday, during Thursday’s Asian session. In doing so, the white metal confronts 200-bar SMA after bouncing off $23.22 amid mildly bullish MACD signals.

However, the silver bulls will need a clear break above the previous day’s high of $24.50 to challenge a short-term resistance line from October 12, currently around $24.90.

Also acting as the upside barrier, beyond $24.90, will be the $25.00 threshold.

On the downside, an ascending trend line from last Thursday, at $23.40 now, offers immediate support during the quote’s pullback moves.

If the silver sellers dominate past-$23.40, The recent bottom surrounding $23.20 and the $23.00 round-figure will be additional challenges for them ahead of eyeing the previous month’s low near $22.60.

Silver four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.