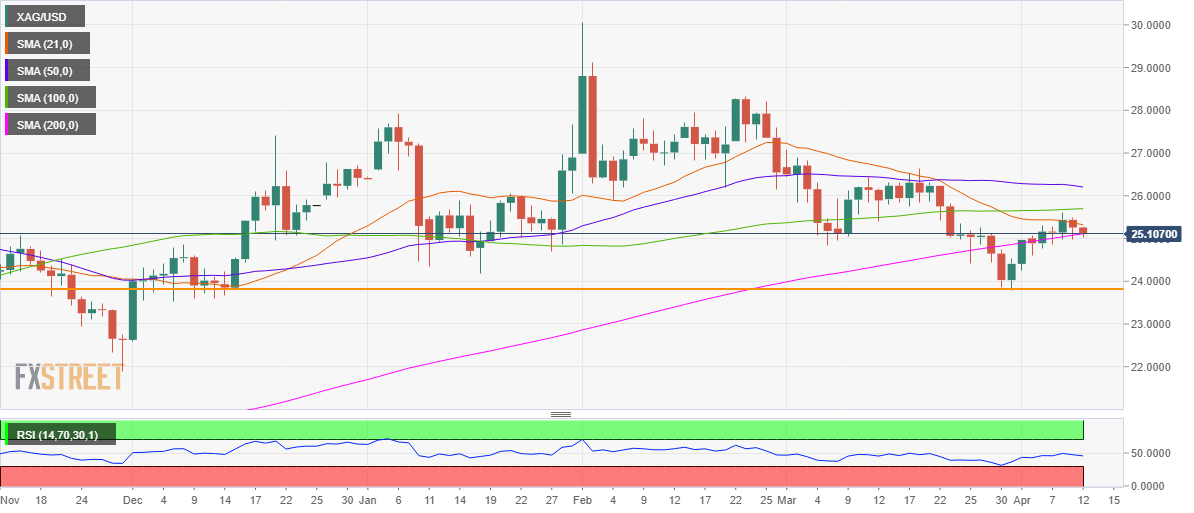

- Silver looks south, as 200-DMA support gives way once again.

- RSI has turned south below the midline while 21-DMA caps the upside.

- A test of the horizontal support sub-$24 is back on the table.

Silver (XAG/USD) is battling the critical 200-daily moving average (DMA) support at $25.11, as sellers look for an entry, in a bid to test the $24 mark.

The white metal breached the abovementioned support on Friday but managed to recapture it on a daily closing basis.

However, the XAG bulls continue to lack conviction, as the bears step in and fight back control on Monday.

The 14-day Relative Strength Index (RSI) edges lower, moving away from the midline, allowing room for more declines.

A daily closing below the 200-DMA could expose the April 5 low of $24.61.

Further south, the $24 round figure could offer some reprieve to the XAG bulls.

The sellers would then target the three-month lows of $23.78, where the horizontal trendline (orange) coincides.

Silver Price Chart: Daily

Alternatively, any recovery attempts would need to clear the bearish 21-DMA, now at $25.32.

The horizontal 100-DMA at $25.70 will then get tested, with the bulls seeking total control.

Silver Additional levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds losses near 1.1350 ahead of ECB policy decision

EUR/USD stays on the back foot near 1.1350 in European session on Thursday. The pair loses ground on the back of a broad US Dollar rebound and as traders turn cutious ahead of the European Central Bank interest rate decision and Lagarde's press conference.

Gold price remains on the defensive below all-time peak amid positive risk tone

Gold price enters a bullish consolidation phase after hitting a fresh all-time peak on Thursday. A modest USD bounce and a positive risk tone cap the commodity amid overbought conditions. US-China trade war concerns, recession fears, and Fed rate cut bets support the XAU/USD pair.

GBP/USD stays offered below 1.3250 as US Dollar attempts a bounce

GBP/USD remains under pressure below 1.3250 in Thursday's European trading, snapping its seven-day winning streak. A tepid US Dollar recovery amid risk appetite prompts the pair to pullback from six-month highs of 1.3292 set on Wednesday. Traders look to tariff headlibnes and US data for fresh impetus.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.