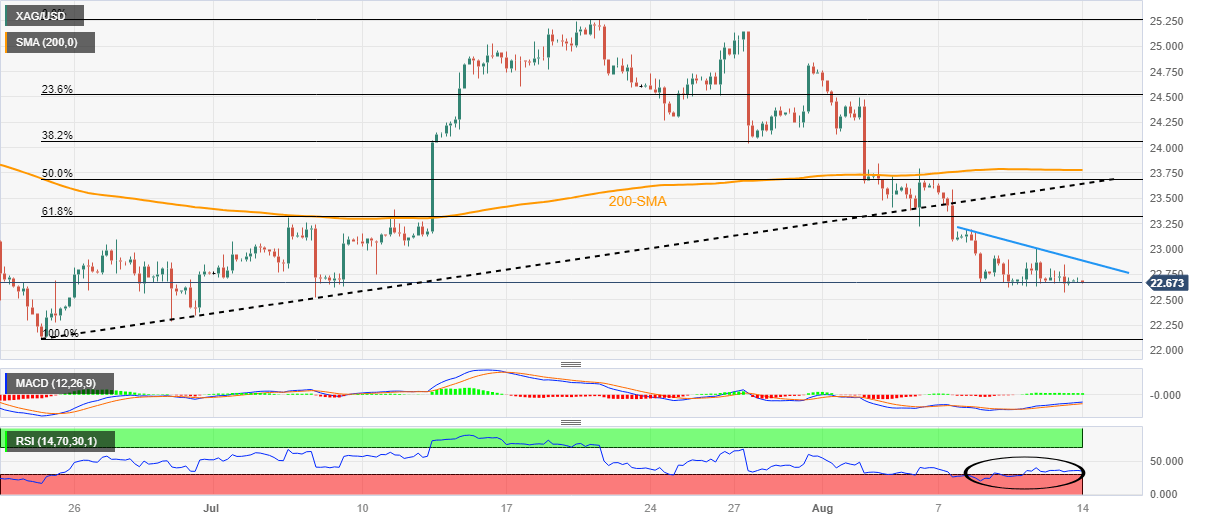

Silver Price Analysis: RSI conditions prod XAG/USD bears below $23.00

- Silver Price licks its wounds after falling the most since mid-June.

- Nearly oversold RSI conditions join recently firmer MACD signals to prod XAG/USD bears.

- 200-SMA holds the gate for Silver buyer’s entry, previous support line from late June guards immediate recovery.

- Silver bears need validation from $22.00 to challenge yearly low marked in March.

Silver Price (XAG/USD) remains on the back foot at the lowest levels in five weeks despite portraying inaction at around $22.70 during early Monday in Asia. That said, the bright metal posted a four-week downtrend with the biggest weekly fall since June in the last.

It’s worth noting that the XAG/USD’s downside break of the 200-SMA and ascending trend line from late June previously pleased the bears.

However, the nearly oversold RSI (14) line and the bullish MACD signals seem to recently challenge the bullion’s further downside.

Even so, the Silver Price stays on the way to challenging the yearly low surrounding $19.90 with June’s bottom of around $22.10 and the $22.00 round figure acting as intermediate halts.

That said, a one-week-old descending resistance line near $22.90 precedes the $23.00 round figure to restrict the quote’s corrective bounce. Though, more importance will be given to a seven-week-old previous support line and the 200-SMA, respectively near $23.65 and $23.80, for luring the bulls.

Even if the quote rises past $23.80, the late July swing low of around $24.05 will act as the final defense of the XAG/USD bears.

To sum up, the Silver Price remains on the bear’s radar unless crossing $24.05 and hence the sellers can consider the latest corrective bounce as an opportunity for buying, considering the metal gains support from fundamentals.

Silver Price: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.