Silver Price Analysis: Inverted head and shoulders breakout favours XAG/USD bulls

- Silver witnessed a subdued/range-bound price action through the early European session.

- The overnight break through the $23.20 key barrier supports prospects for further gains.

- Any meaningful corrective slide might be seen as a buying opportunity and remain limited.

Silver oscillated in a narrow band, around mid-$23.00s through the first half of the trading action on Friday and consolidated its recent gains to one-month tops.

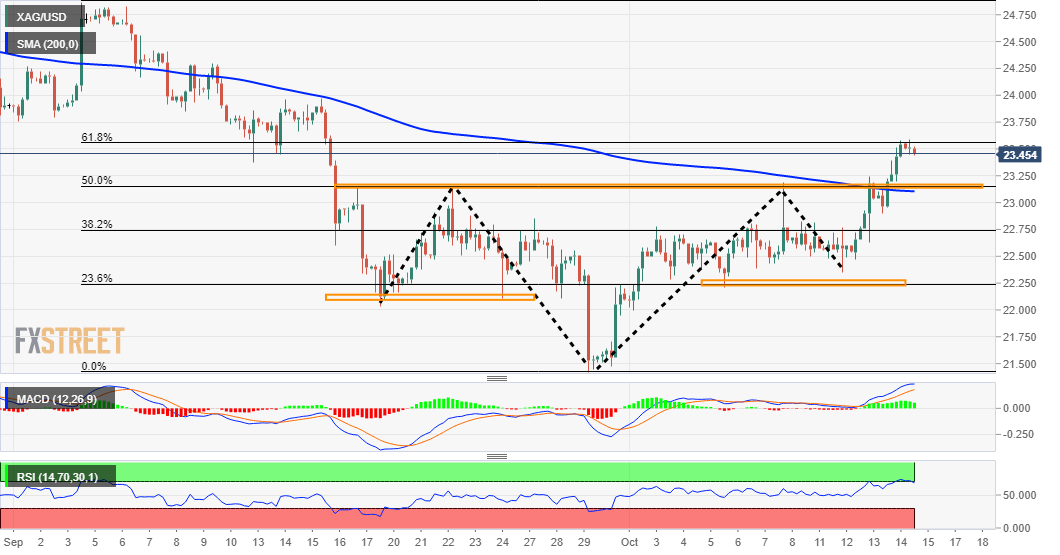

From a technical perspective, this week's strong bullish momentum stalled near a resistance marked by the 61.8% Fibonacci level of the $24.87-$21.42 downfall. The mentioned barrier should now act as a pivotal point, which if cleared decisively will set the stage for a further near-term appreciating move.

Meanwhile, the overnight sustained move beyond the $23.20 confluence hurdle confirmed a near-term bullish breakout through an inverted head and shoulder pattern. Moreover, technical indicators on the daily chart have just started gaining positive traction and further add credence to the constructive outlook.

A sustained strength above the 61.8% Fibo. resistance will reaffirm the bullish bias and allow bulls to aim back to reclaim the $24.00 mark. Some follow-through buying beyond the $24.25-30 region should push the XAG/USD to September monthly swing highs near the $24.75-80 zone en-route the key $25.00 psychological mark.

On the flip side, any meaningful pullback now seems to find decent support and attract fresh buying near the $23.20 confluence resistance/neckline breakpoint. The mentioned region comprises 200-period SMA on the 4-hour chart and the 50% Fibo. level, which should now act as a strong near-term base for the XAG/USD.

Silver 4-hour chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.