- Silver prices have been choppy on Wednesday, swinging between gains and losses, and recovering sharply from late European morning lows at $24.20.

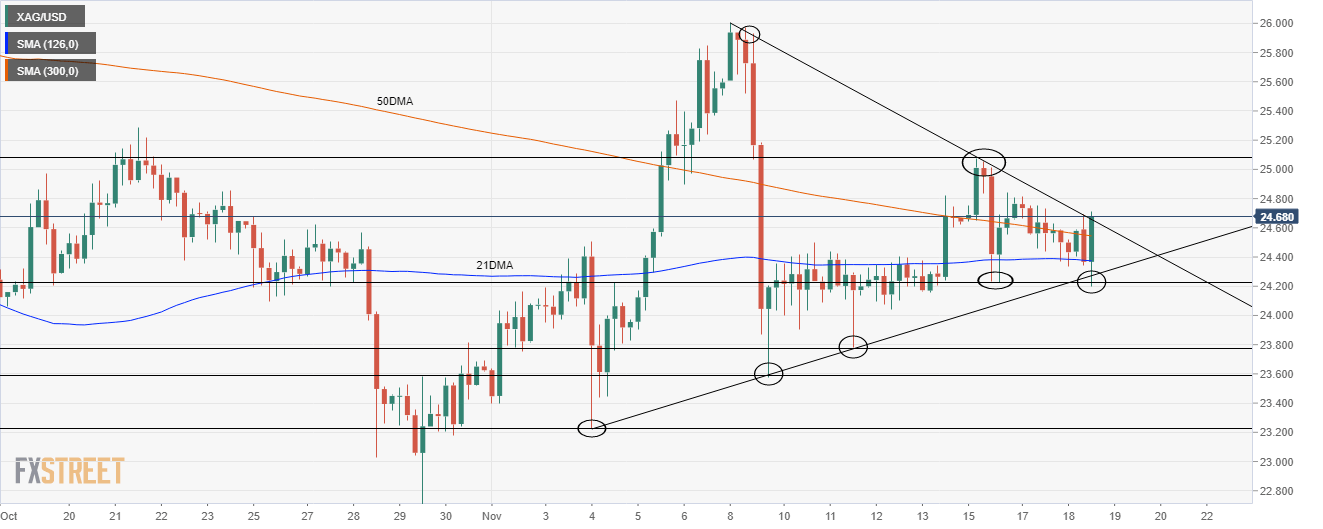

- XAG/USD has been consolidating within a pennant structure this month and looks subject to breakout.

Spot silver prices (XAG/USD) have been choppy on Wednesday, swinging between gains and losses, but have broadly continued to consolidate close to the $24.50 mark, as has been the case most of the time since the start of Tuesday’s US session. The precious metal bounced sharply from fresh weekly lows around $24.20, set around midday London time after Pfizer said its vaccine had actually shown 95% efficacy, and now trades back above its 21-day moving average (DMA) at $24.38 and its 50DMA at $24.62.

A continued gradual softening in USD that has seen the Dollar Index slip from weekly highs above 92.80 to current levels close to 92.30, which has been exacerbated more recently by dovish-tilting FOMC commentary, ought to offer silver some support going forward. On the other hand, recent bouts of vaccine optimism have proven to be XAG/USD negative and may continue to be so going forward.

Silver breakout likely as prices consolidate with tight pennant

Since 3 November, Silver prices have seen considerable volatility but have in recent days shown considerable consolidation. XAG/USD now looks to have former a pennant structure, with prices being squeezed to the downside by an upwards trendline linking the 3, 9, 11 and now 18 November lows and to the upside by a downwards trendline linking the 8, 9, 16 and 18 November highs.

Further contributing to recent consolidation is the fact that silver prices have spent most of the last 36 hours trading between its 21 and 50DMAs at $24.38 and $24.61 respectively.

Such pennants are subject to breakouts, with an upside break being signalled by a move above the 50DMA and $24.60 mark and a downside break being signalled by a move below Wednesday’s lows and the $24.20 mark.

In the downside scenario, the next levels of support in focus will be the 11, 9 then 3 November lows at $23.75, $23.60 and then $23.22 respectively, followed by the October low at $22.60. In the upside break scenario, the levels of resistance in focus will be the psychological $25.00 and accompanying 16 November high, followed by the November high at just above $26.00.

XAG/USD four-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.