- Shopify stock dropped more than 10% on Q4 earnings miss.

- SHOP traded down to $48.

- CEO Tobias Lütke said Shopify remained on course for steady move toward profits.

- Revenue grew 24% YoY.

Shopify (SHOP) stock took a hit late Wednesday when the company reported fourth quarter GAAP earnings per share (EPS) that missed their mark. The online retail platform reported GAAP EPS of $-0.49, which was 32 cents below Wall Street consensus. Additionally, stock-based compensation (SBC) grew as a percentage of revenue to 9.8% – something that has become more troublesome to tech investors since the equity sell-off in 2022. Adjusted EPS of $0.07 was 9 cents ahead of consensus however.

Shopify stock ended the afterhours session Wednesday down 10.3% at $47.90.

Shopify stock news: Revenues, GMV, SBC continue to grow

Shopify's GAAP earnings miss was triggered by one-time legal, real estate and severance costs. Without these expenses going forward, Shopify would seem to be on a trajectory toward regular GAAP profits, so the SHOP sell-off may be unwarranted. However, at least some investors were triggered by full-year 2022 stock-based compensation that amounted to nearly 10% of revenue. In 2021, SBC amounted to 7.2% of sales. Other shareholders complained about valuation at this unprofitable juncture.

$SHOP looks massively overvalued every way I look at it.

— Daniel Pronk (@PronkDaniel) February 16, 2023

Revenue growth is impressive, but that's about it.

Margins aren't amazing and it's not making any money.

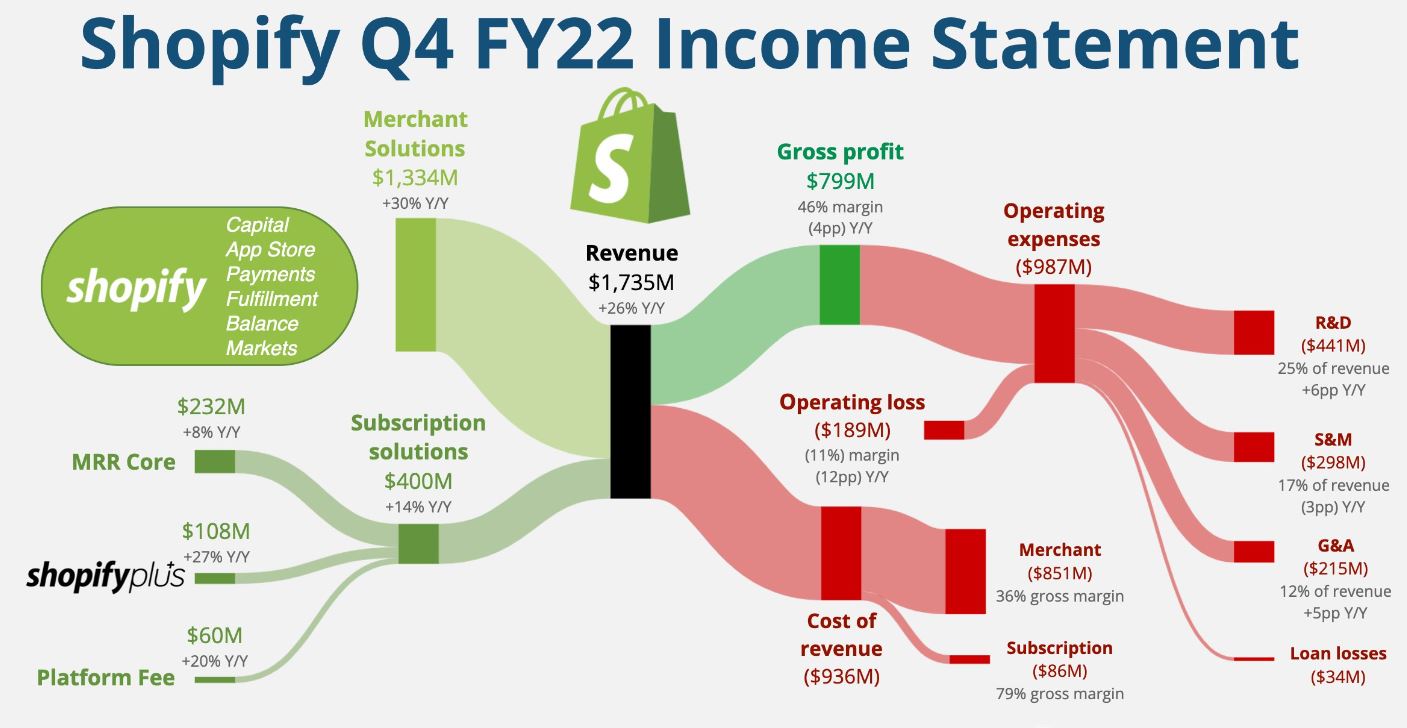

Still the business continues to grow its customer base and revenues. Sales for the fourth quarter came in at $1.73 billion, a healthy length ahead of consensus of $1.65 billion. This figure for the heightened period surrounding the holiday shopping season showed 25% growth compared with the quarter one year ago. Merchant revenue rose 30% YoY to $1.3 billion, while subscription revenue gained 14% YoY to $400 million.

Gross merchandise value of $61 billion showcased a 13% gain on the prior year and arrived nearly $2 billion ahead of consensus. However, guidance for the first quarter of 2023 left much to be desired. CEO Tobias Lütke guided for YoY revenue growth in the high teens, which demonstrates that a clear decline in platform growth seems to be expected. Despite that forward glance, Shopify added a number of significant influencer and established brands in the fourth quarter like Kim Kardashian's SKKN skincare company, Mattel, Glossier, Supreme and YouTube personality Mr. Beast's Feastables.

Source: App Economy Insights

Analysts did remain somewhat inflexible regarding the company's slowmotion pivot toward profitability. "Investors were hoping that the headcount reductions and the price increases would translate to operating leverage and higher profitability, not a return to losses in the first quarter as is implied by guidance," said analyst Gil Luria of D.A. Davidson, according to Reuters.

CEO Toby Lütke rather nonchalantly hit back at comments regarding profitability: "I believe that over time, profitability will take care of itself."

President Harley Finkelstein added some color to that stream of questions from analysts. "If you look at our seven years since IPO, we were profitable five out of the seven. And we like being profitable, and we're going to work toward that. We were cash flow positive in Q4."

Both famed investor Stanley Druckenmiller and hedge fund Coatue Management exited their positions in Shopify stock during the fourth quarter, according to 13Fs filed with the Securities & Exchange Commission.

Shopify stock forecast

Shopify stock was already flirting with reentering the overbought range on the Relative Strength Index (RSI) after rallying on Tuesday and Wednesday as traders had expected an earnings beat. The 10% sell-off in SHOP only pushed shares down to the $48 support level where the stock consolidated recently. This is also in line with the 21-day moving average that could add support value to the price action.

Bulls hoping to reenter the fray should probably wait to see if SHOP stock breaks below $48 in a regular session to consolidate within the $40 to $41 demand zone. This region has seen fairly regular volume since April of 2022. A break below this region would entail Shopify stock retesting support from late December at $32.40. SHOP stock will not achieve any real bullish status until it sees a close above $54.50.

SHOP daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold sits at fresh record high above $3,300 as US Dollar wilts on trade woes

Gold price remains within a striking distance of new record highs above $3,300 on Wednesday. Persistent worries about the escalating US-China trade war and US recession fears revive brroad US Dollar downtrend, boosting the traditional safe-haven Gold ahead of Fed Powell's speech.

EUR/USD holds firm above 1.1350 amid renewed US Dollar weakness

EUR/USD is storngly bid above 1.1350 in European trading on Wednesday. The pair draws support from a fresh round of selling in the US Dollar amid persistent fears over US-China trade war and a lack of progress on EU-US trade talks. US consumer data and Powell speech are in focus.

GBP/USD hangs close to fresh 2025-high above 1.3250 after UK CPI data

GBP/USD holds its six-day winning streak and stays close to its highest level since October above 1.3250 in the European session on Wednesday. The data from the UK showed that the annual CPI inflation softened to 2.6% in March from 2.8% in February but had little impact on Pound Sterling.

BoC set to leave interest rate unchanged amid rising inflation and US trade war

All the attention is expected to be on the Bank of Canada this Wednesday as market experts widely anticipate the central bank to maintain its interest rate at 2.75%, halting seven consecutive interest rate cuts.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.