- NYSEAMERICAN:SENS adds over 20% on Tuesday.

- Senseonics investors continue to await FDA approval for its continuous glucose monitoring device.

- SENS has spiked on no apparent news, SEC filings today show no new info.

Update February 18: Senseonics Holdings Inc (NYSEAMERICAN: SENS) has been changing hands at around $.395 in Thursday's premarket session, up some 4% – pointing to a bounce after the falls. Shares of the Maryland-based pharma firm have suffered a setback on Wednesday, shedding 9.68% or 51 cents to close at $4.76. Some investors took profits after SENS stock jumped in several waves in early 2020. The most recent drop suggests that if the FDA approves Senseonics' diabetes monitoring device, there is room for gains rather than a "buy the rumor, sell the fact." The wait may be nerve-wracking to some, but provides opportunities to others. See all Equities breaking news

Update: Stock trading is never a one-way street and even the Federal Reserve with all its money-pumping is unable to guarantee neverending rises. The S&P 500 is trading lower by some 0.50% after several days that have not seen meaningful downside moves. The same phenomenon is repeated in shares of Senseonics Holdings Inc which are correcting lower without a significant trigger, apart from profit-taking. NYSEAMERICAN: SENS is down some 5%, losing the $5 level. Nevertheless, it is substantially above the 52-week low of $0.35. An FDA approval for its glucose monitoring device is critical for the firm's fortunes.

Update: Senseonics Holdings Inc (NYSEAMERICAN: SENS) has closed Tuesday's trade at $5.27, up some 27% on the day. The Maryland-based pharmaceutical firm is still awaiting a seal of approval from the Food and Drugs Administration (FDA) for its diabetes product. Wednesday's premarket trading is pointing to further advances – another 4.17% to $5.48. It is essential to note that SENS closed January at only $2.37 and that in the last 52 weeks, it was a penny stock – trading under $1. Diabetes has a risk factor for COVID-19 and will outlast the disease that is gripping the world.

Update: Shares in Sensonics Holdings are up 20% in Tuesday's trading at $4.96. SENS shares have been strong of late as investors await information on FDA approval for its diabetes monitoring product. SEC filings released today don't appear to be the reason behind the rally as all are from Dec 2020. Roche Finance has reduced its holding in SENS to below 20% to 11.5% as of Dec 2020.

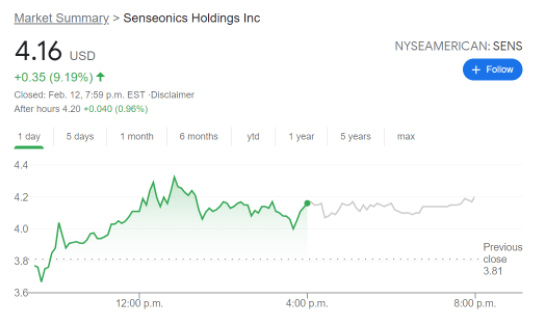

NYSEAMERICAN:SENS finished the week off strong on Friday as the Maryland-based med-tech company extends its bullish run in 2021. During the final trading session before the Presidents Day long weekend, Senseonics added 9.19% to close the week at $4.16, after briefly hitting a new 52-week high price of $4.35 earlier in the day. Shares have already run up by nearly 350% since the start of the year, and retail investors on platforms like FinTwit and Reddit have rallied around the stock.

One of the main reasons that Senseonics has been a popular penny stock amongst traders is the impending FDA approval of its continuous glucose monitoring system. The Eversense CGM system is thought by many to be a disruptive form of technology in the ongoing fight against diabetes, one of the most devastating and commonly diagnosed diseases in the United States. Rather than intermittently testing blood throughout the day, the new Eversense CGM system places a sensor beneath the patient's skin and updates it in a smartphone app every five minutes. If approved, it will save diabetes patients hundreds or even thousands of needle injections per year for blood tests.

SENS stock forecast

Senseonics’ recent popularity has catapulted the penny stock into the mainstream med-tech conversation and it has gone from one of Reddit’s meme stocks to a $1.5 billion market cap. Senseonics has already announced that it expects to receive FDA approval for the Eversense CGM system by the second quarter of 2021, which accounts for much of the stock’s recent success.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trims some gains, recedes to 1.1350 Premium

Despite losing some upside momentium, EUR/USD keeps the firm tone around the mid-1.1300s on Thursday, buoyed by renewed US Dollar weakness as investors grappled with the continued stalemate in US–China trade negotiations.

GBP/USD puts the 1.3300 level to the test

GBP/USD hovers around the 1.3300 area on Thursday, supported by a broad rebound in risk-sensitive assets, renewed weakness in the Greenback and lingering uncertainty over US–China trade talks.

Gold sticks to the bullish stance near $3,330

On Thursday, gold regained lost ground after two consecutive days of declines, with XAU/USD climbing back toward $3,300 per troy ounce following an earlier rally to roughly $3,370. The metal drew safe-haven buying as renewed fears of a US–China trade flare-up weighed on broader markets.

Bitcoin Price corrects as increased profit-taking offsets positive market sentiment

Bitcoin (BTC) is facing a slight correction, trading around $92,000 at the time of writing on Thursday after rallying 8.55% so far this week. Institutional demand remained strong as US spot Exchange Traded Funds (ETFs) recorded an inflow of $916.91 million on Wednesday.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.