Sellers returning fast

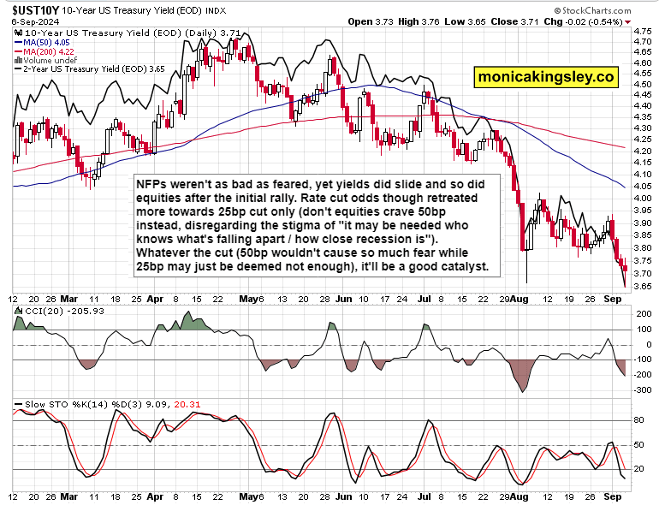

NFPs weren‘t weak at first glance, but the buying squeeze anticipated, was really short-lived, and shifting rate cut odds influenced. In spite of Waller opening the 50bp Sep cut possibility, the real odds didn‘t go up and remained at 30% only, and that‘s after Williams quite confirming 25bp cut. This comes after the (in my view clear) policy mistake in Jul of not cutting, and then we had the early Aug Monday with Siegel calling for 75bp emergency cut and then 75bp more in Sep.

While disinflation lasts and the Jackson Hole inflation victory lap is over, the job market is quite steadily deteriorating, and for all the orderly assurances would require energetic Fed action even if it doesn‘t come in my view in Sep (yeah, only 25bp), but only later (the bigger cut).

It wasn‘t the job market data that brought the stock market down after the swing higher, it was about acceleration of selling into (receding bout of) strength following the 50bp cut statement by Waller before EST lunch time. Remember my extensive analysis a week ago where I discussed hard landing as an underappreciated risk to stock market upswing – the data this week weren‘t stellar.

And that implies certain confusion about how the upcoming cut (25bp or 50bp) will be perceived by the market – reassuring and calming, or rushed and belated.

Market rates are reflecting the deteriorating but not yet recessionary (not declared as such) data, and 25bp cut isn‘t in sync, meaning the necessity to cut more, is underappreciated in the now even if 125bp cut till Dec is the mainstream expectation. Sep 25bp just doesn‘t go far enough given the job market challenges, that‘s what the market rates are saying.

We have continued Nasdaq underperformance lasting weeks, with S&P 500 being propped up by financials, defensives and generally income and interest rate sensitive plays. Smallcaps and equal weighted S&P 500 are doing a bit better, and next week we have to pay close attention to how banks big and small are doing – together with AAPL reaction inspiring a tech reprieve or not.

Inverted head and shoulders in the making in S&P 500? Well, that would be a premature call, now at the right head top, wouldn‘t it. The right shoulder wouldn‘t be carved out of nowhere, and Wednesday‘s CPI is still far away – but way more details are discussed below for clients, looking at VIX and upcoming data.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.