Scentre Group Elliott Wave technical forecast [Video]

![Scentre Group Elliott Wave technical forecast [Video]](https://editorial.fxstreet.com/images/i/bearish-line_XtraLarge.png)

ASX: SCG Elliott Wave technical analysis

Our Elliott Wave analysis today provides an update on the Australian Stock Exchange (ASX) focusing on SCENTRE GROUP – SCG.

We foresee upside potential for ASX:SCG in the near term. The short-term outlook emphasizes waiting for a pullback within the second wave and, based on that, identifying high-quality long trade setups. This analysis guides you on when to stay out, when to enter positions, and how to approach trading scientifically and intuitively.

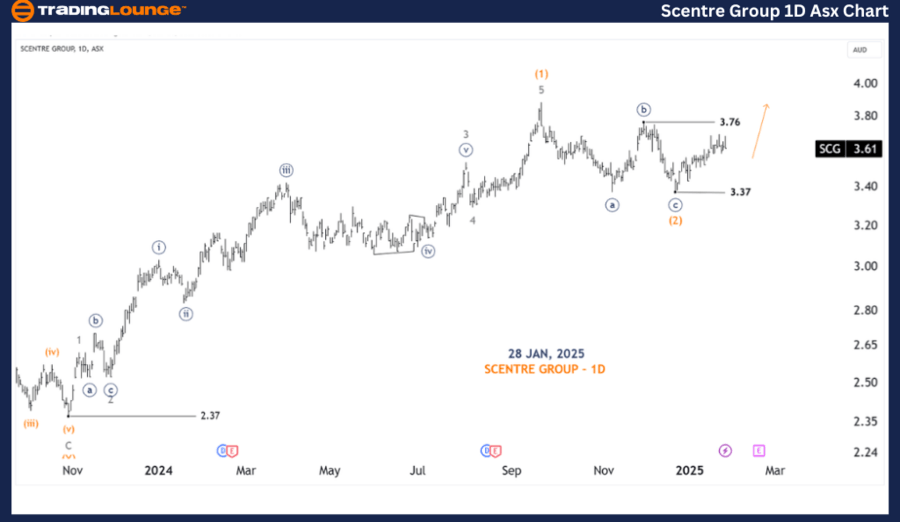

One-day chart (semilog scale) analysis

-

Function: Major Trend (Intermediate degree, orange).

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Wave (3) - orange.

-

Details: Wave (2) - orange appears to have ended as a Zigzag at the low near 3.37, and upside potential is developing with Wave (3) - orange. Specifically, this is an Extended Wave, and we are currently in Wave 1 - grey.

-

Invalidation Point: 3.37.

ASX: SCG Elliott Wave technical analysis

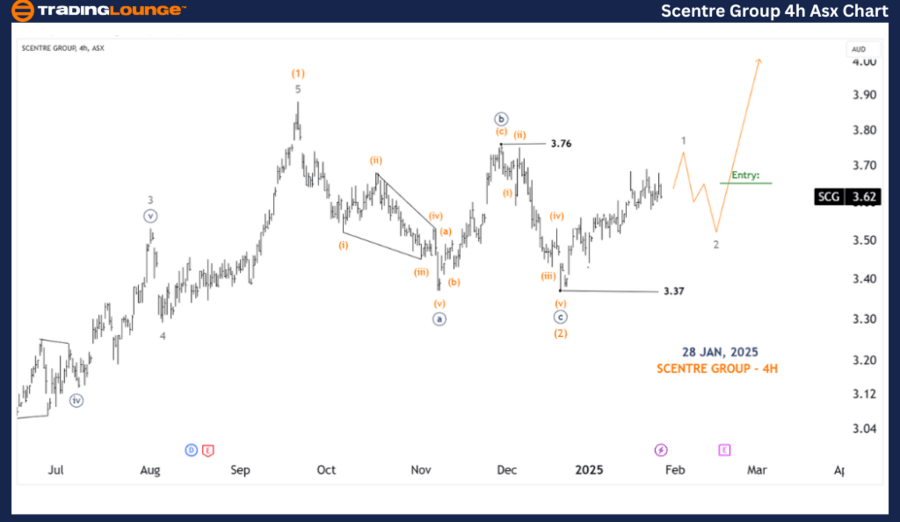

Four-hour chart analysis

-

Function: Major Trend (Minute degree, navy).

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Wave 1 - grey of Wave (3) - orange.

-

Details: The shorter-term outlook indicates that Wave 1 - grey of Wave (3) - orange is nearing completion. A decline with Wave 2 - grey is anticipated shortly, which offers a key opportunity to identify Long Trade Setups.

-

Invalidation point: 3.37.

-

Key point: Wave b of Wave 2 - grey.

Conclusion

Our analysis and forecast for ASX: SCENTRE GROUP – SCG focus on contextual trends and short-term outlooks, offering insights into current market movements and strategies to capitalize on them effectively. We provide specific price points as validation or invalidation signals for our wave count, enhancing confidence in our perspective. By combining these elements, we deliver an objective and professional outlook on market trends.

Scentre Group Elliott Wave technical forecast [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.