Russia/Ukraine tensions rising: British gov says it has uncovered a plot by Moscow to install a pro-Russian leader in Kiev

The BBC reports that ''the UK has accused Russia’s President Vladimir Putin of plotting to install a pro-Moscow figure to lead Ukraine's government.''

The news was reported on Sunday after the Deputy Prime Minister Dominic Raab told the BBC's Sunday Morning programme that there was "a very serious risk" of invasion but there would be "severe economic consequences", including sanctions, if Russia took that step.

Geo-politics has been present in the markets again as Russia-Ukraine tensions continue.

The US dollar is renowned for benefitting from such angst in geopolitics and markets, so such an escalation should be a clear dollar positive for the open this week. If the US administration sends troops over, which is being considered, then this would intensify matters even more.

This would be a double whammy for the euro due to the view that Europe’s dependence on Russia’s energy exports would be exposed even more.

Key notes

The BBC article stated the following:

''Russia has moved 100,000 troops near to its border with Ukraine but denies it is planning an invasion.

UK ministers have warned that the Russian government will face serious consequences if there is an incursion.

In a statement, Foreign Secretary Liz Truss said: "The information being released today shines a light on the extent of Russian activity designed to subvert Ukraine, and is an insight into Kremlin thinking.

"Russia must de-escalate, end its campaigns of aggression and disinformation, and pursue a path of diplomacy."

Deputy Prime Minister Dominic Raab said there was "a very serious risk" of invasion but there would be "severe economic consequences", including sanctions if Russia took that step.

However, he told the BBC's Sunday Morning programme it was "extremely unlikely" British troops would be sent to defend Ukraine, adding that the country was not a Nato ally.''

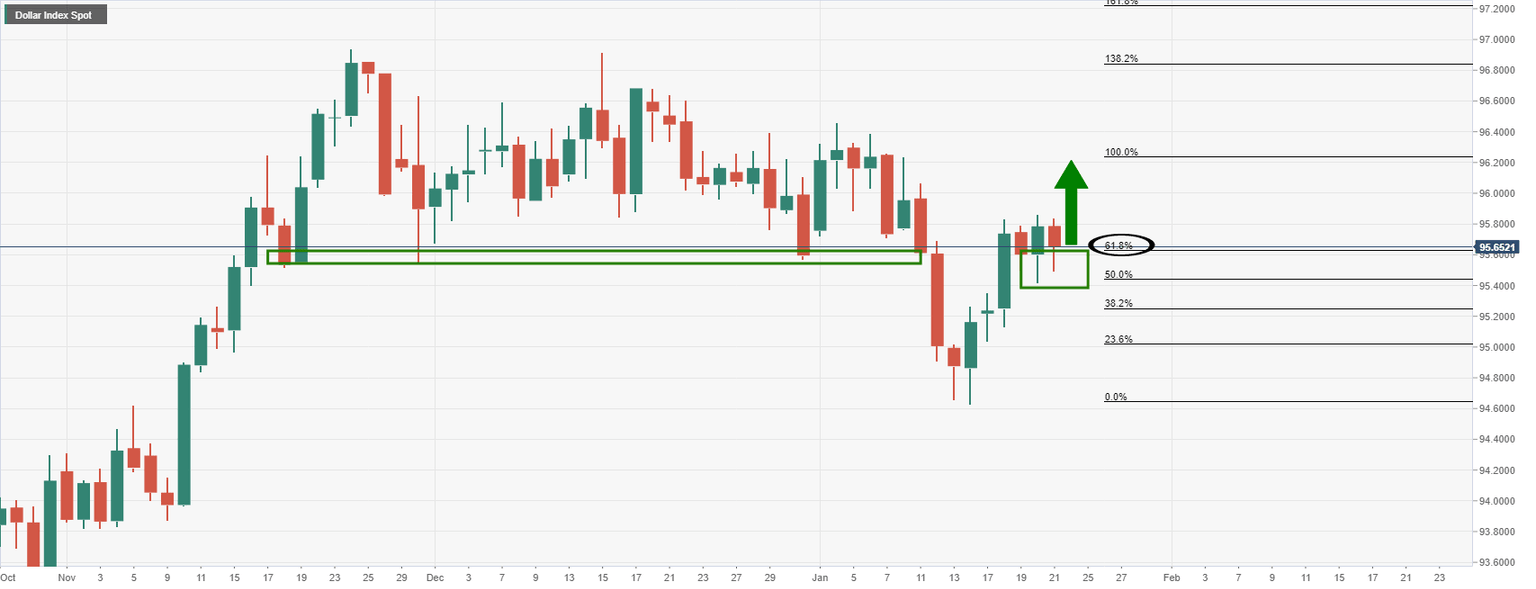

DXY daily chart

As per the DXY index, which measures the US dollar vs a basket of currencies, the greenback declined on Friday, along with US Treasury yields. Despite the risk-off price action displayed in the US stock market and concerns over Russia, the US dollar was pressured as investors looked through the headlines and instead towards this week's Federal Reserve meeting for more clarity on the outlook for rate hikes. However, a close eye will be paid to this type of escalation for today's open and the support could be expected to hold around the 61.8% Fibonacci level if safe haven flows dominate.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.