- RBLX shares had a direct listing on March 10 but is struggling for momentum.

- The DIY video game platform went for a direct listing, $45 reference price.

- Roblox shares are up on Thursday but not a convincing move.

Update March 25: Yesterday I said I thought Roblox was worth a small investment and I continue to believe so. However, the price action on Thursday is not helping bullish sentiment. Yes, Roblox is up on Thursday at $65.26, a gain of 1% but it is struggling and has been ignored by the meme stock crowd who are chasing AMC and Gamestop higher. Stability is the goal for a long term investment so stick with this one.

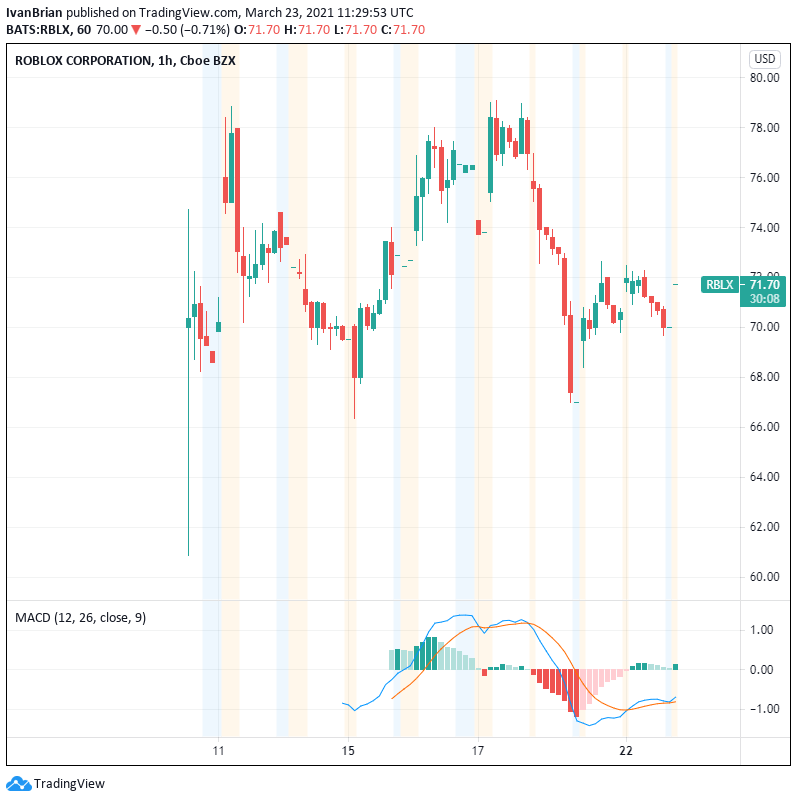

Roblox shares have remained strong since their listing earlier in March with initial gains to $80 being scaled back, but RBLX has for the most part held the $70 level. Roblox shares had a reference price of $45 for their listing as the company went direct rather than the more familiar IPO route.

Roblox is a social gaming phenomenon with hundreds of millions of players globally. The company is looking to expand its offering into entertainment, toys and other social gaming aspects. RBLX has what it terms "experiences" that are built by developers and used by hundreds of millions of players globally. Roblox was set up in 2004 by David Baszucki and Erik Cassel. It has over 8 million developers and average daily users of 37 million, according to Reuters. Roblox is based in San Mateo, California.

Stay up to speed with hot stocks news!

Roblox stock forecast

Roblox certainly has impressive growth numbers as the global lockdown increased its target teen and tween playing group. If the outlook given by Roblox is achieved it will be an impressive rate of growth.

Roblox aims for daily active users to grow by over 60% and revenue to grow by over 100% for Q1 2021 YoY in its most recent outlook.

These figures are impressive, but Roblox trades at a very high valuation relative to peers in the gaming industry. While it may be revolutionizing social gameplay and its ability for spin-off revenue may yet to be fully tapped, this high valuation represents a problem in the current environment. High growth stocks command high valuations, but in a potentially inflationary environment these same high growth stocks tend to struggle. The US 10-year and University of Michigan inflation expectations index are all flagging higher interest rates and inflationary pressure, despite what the Fed may say.

Stiefel recently issued a bullish note on Roblox, giving it an $85 price target. It does make and explain well the impressive growth figures achievable by Roblox. Certainly, the game looks to be another social phenomenon, capturing the zeitgeist. My only issue is social phenomenons can come and go quickly. In this case though, I am going to overlook those concerns. Roblox is quite established. Opportunities for added revenue creation grow as social monetization grows. We are likely only at the infancy of the whole monetization of social gaming platforms, and Roblox is one of the biggest if not the biggest. Roblox already has its own digital currency, Robux! Parents will no doubt be familiar with Robux as the second currency in their household and the number one currency of their children.

Roblox's savvy management and growing user and developer base should mean it is able to respond quickly to shifts in user behaviour. This means it will be able to identify and capitalize on new revenue generation ideas. There is an element of how Facebook developed in the Roblox story. Q4 numbers are not yet confirmed but are due for release in March. Income grew from $312 to $488 million from 2018-2019. This was the infancy stage of Roblox, but growth will speed up rapidly.

Roblox has $810 million in cash on its balance sheet and no debt! Yes, the valuation is high with a P/E over 200, but this has just gone public and has growth rates near 90% for revenues. I wouldn't put the house on it, but Roblox is definitely worth some investment. The risks I see are general market bearishness as yields rise, which has dragged on the tech sector. Roblox may get caught up in these headwinds. But I still expect the stock to strongly outperform all benchmarks for the medium to longer term.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0400 after upbeat US data

EUR/USD consolidates daily recovery gains near 1.0400 following the release of upbeat United States data. Q3 GDP was upwardly revised to 3.1% from 2.8% previously, while weekly unemployment claims improved to 220K in the week ending December 13.

GBP/USD extends slide approaches 1.2500 after BoE rate decision

GBP/USD stays on the back foot and break lower, nearing 1.2500 after the Bank of England (BoE) monetary policy decisions. The BoE maintained the bank rate at 4.75% as expected, but the accompanying statement leaned to dovish, while three out of nine MPC members opted for a cut.

Gold approaches recent lows around $2,580

Gold resumes its decline after the early advance and trades below $2,600 early in the American session. Stronger than anticipated US data and recent central banks' outcomes fuel demand for the US Dollar. XAU/USD nears its weekly low at $2,582.93.

Bitcoin slightly recovers after sharp sell-off following Fed rate cut decision

Bitcoin (BTC) recovers slightly, trading around $102,000 on Thursday after dropping 5.5% the previous day. Whales, corporations, and institutional investors saw an opportunity to take advantage of the recent dips and added more BTC to their holdings.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.