- NYSE:RKT shares giving up gains on Wednesday after stellar Thursday rally.

- Rocket Companies gained 70% on Tuesday as retial traders fizzled over the stock.

- RKT shares have been downgraded at RBC on Wendsday.

Update 2 March 3: RKT shares understandably gave up some ground on Wednesday, as Tuesday had seen stellar gains. RBC downgraded RKT from outperform to sector perform and put a $30 price target on the stock. At the time of writing RKT shares are trading at $37.45 a loss of ten percent. Mortgage data from the US had also seen refinancing deals slow as interest rates rose.

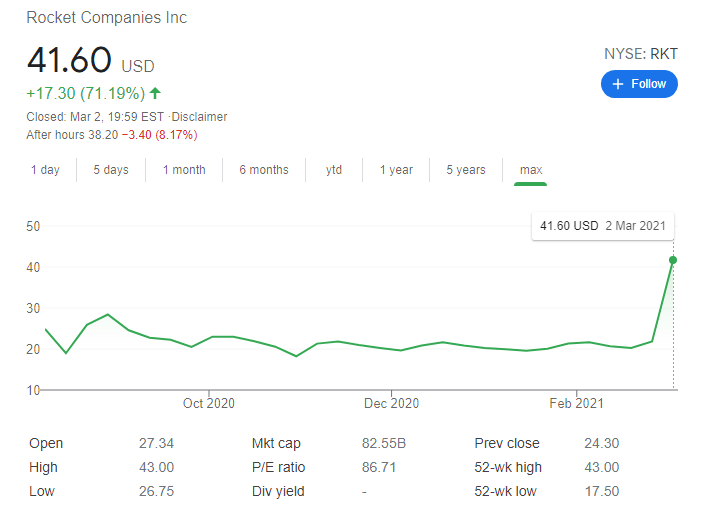

Update March 3: First it was the earnings, later the short-squeeze. Rocket Companies Inc (NYSE: RKT) has closed Tuesday's trading session with a spectacular rise of 71% to $41.60. On its way, it hit a new 52-week peak of $43, which is also a record high. Retail traders on WallStreetBets have been actively discussing hoarding RKT stock in order to trigger a short squeeze. According to the firm's data, short interest has hit $1.21 billion. Some on WSB are suggesting a target price of $60. However, premarket data is pointing to a slide of over 8% on Wednesday.

NYSE:RKT finally had the blowout quarter early investors have been waiting for since the mortgage lending company debuted on Wall Street back in August of 2020. On Friday, despite another rocky day for the broader markets, Rocket Companies added 9.80% to close the trading session at $21.85. During intraday trading, Rocket surged as high as $23.55, which is one of the highest price levels since September, shortly after the stock began trading publicly. Investors who bought into the mortgage leader at its IPO have been disappointed so far as the stock is still trailing the S&P 500 by nearly 25% over the past 52-weeks.

Stay up to speed with hot stocks' news!

Rocket reported a strong quarterly bump on Thursday as it revealed a year-over-year rise in revenues of 144% to $4.2 billion, as well as an incredible 277% rise in net income. The results blew Wall Street’s expectations out of the water and the stock reacted appropriately as investors bought back into a stock that had been trading sideways for the past six months. Rocket Companies enjoyed a 111% rise in loan originations as the housing market has been a surprising winner during the COVID-19 pandemic.

RKT stock forecast

RKT also announced a special dividend for its shareholders as the company begins to re-allocate its generous income holdings. The dividend will be paid out as $1.11 per share, which equates to a very nice 5% yield. Rocket Companies also said that they would be using much of its cash to further grow its software platform as the mortgage landscape shifts to an increasingly digital experience.

Previous updates

Update, March 2: Rocket Companies Inc (NYSE: RKT) is set to extend its upwards trajectory on Tuesday, adding another $1 or 7.41% according to premarket trading. Shares of the financial firm launched to higher ground on Monday after reporting robust earnings. Moreover, hopes for quick recovery in the US – led by vaccines and stimulus from Uncle Sam – raise hopes of even better activity later on.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD tests nine-day EMA barrier near 1.2950 amid a bullish bias

The GBP/USD pair loses ground after registering gains in the previous two sessions, trading around 1.2930 during the Asian hours on Wednesday. The technical analysis of the daily chart indicates a continued bullish bias, with the pair consolidating within an ascending channel pattern.

EUR/USD gains traction above 1.0750 as US consumer confidence tumbles to a four-year low

The EUR/USD pair gains ground to near 1.0780 during the Asian trading hours on Wednesday. The Greenback softens against the Euro due to the weaker US economic data and the uncertainty surrounding US President Donald Trump's trade policy ahead of a new round of tariffs next week.

Gold price bulls remain on the sidelines amid positive risk tone; modest USD strength

Gold price ticks lower on Wednesday amid some USD dip-buying. A positive risk tone further weighs on the safe-haven precious metal. Trade jitters, US recession fears, and Fed rate cut bets help limit losses.

Bitcoin, Ethereum and Ripple could face volatility as Trump’s “Liberation Day” nears

Bitcoin price hovers around $87,000 on Wednesday after recovering 4% in the last three days. Ethereum and Ripple find support around their key level, suggesting a recovery on the cards.

Seven Fundamentals for the Week: Tariff news, fresh surveys, the Fed's preferred inflation gauge are eyed Premium

Reports and rumors ahead of Trump’s reciprocal tariffs announcement next week will continue moving markets. Business and consumer surveys will try to gauge where the US economy is heading. Core PCE, the Fed's preferred inflation gauge, is eyed late in the week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637501917621470593.png)