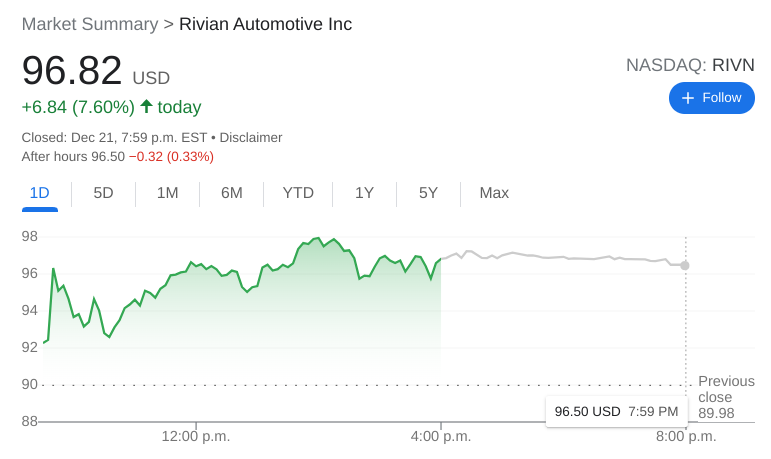

- NASDAQ:RIVN gained 7.6% during Tuesday’s trading session.

- Ford has halted reservations for its F-150 Lightning electric truck.

- Tesla rebounds as stock holds $900 price level.

UPDATE: RIVN stock could not retain its momentum on Wednesday as the stock lost more than 2% at the open. The stock is trading near $94.20 at the time of writing after gaining a steep 7.6% on Tuesday.

NASDAQ:RIVN investors managed to shrug off the recent growth stock weakness on Tuesday as the global markets rallied during the second day of the holiday-shortened week. Shares of Rivian climbed by 7.60% and closed the trading session at $96.82. Rivian has been on a steady decline since its IPO back in November, where the stock peaked at a price of $179.47. All three major US indices bounced back from Monday’s sell off as investors put aside any concerns over rising cases of the Omicron variant. The NASDAQ led the way for US markets as the tech-heavy index rose by 2.4%, erasing some of the losses that tech stocks have seen over the past few weeks. The S&P 500 gained 1.78% and the Dow Jones added back 560 basis points in a bullish day overall for the US markets.

Stay up to speed with hot stocks' news!

In electric truck news, legacy automaker Ford (NYSE:F) announced that it had halted taking reservations for its F-150 Lightning model. There were not many details surrounding the move, but Ford has been public about its supply chain issues during the pandemic. While this may seem like good news for Rivian, the two companies aren’t exactly direct rivals. In fact, Ford owns a fairly substantial stake in Rivian as an early investor so the two companies do have some vested interest in each other.

Rivian stock price prediction

Electric vehicle leader Tesla (NASDAQ:TSLA) has seen its stock beaten down as of late, falling by nearly 20% over the past month. On Monday, the stock threatened to lose the $900 price level for the first time since October. Shares hit a low of $886.12 during intraday trading on Tuesday, but the stock rallied to close the session at $938.53 following a major surge into the closing bell.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD looks solid and approaches 0.6300

The weekly recovery in AUD/USD remained unabated on Wednesday, with spot approaching the key resistance at 0.6300 the figure amid the continuation of the selling bias in the US Dollar.

EUR/USD keeps its recovery in place

Extra decline in the Greenback collaborated with further recovery in the risk complex and helped EUR/USD reclaim the 1.0400 barrier and beyond, adding to Tuesday’s advance and climbing to multi-day highs.

unstoppable record rally continues

Further gains propel the ounce troy of Gold to all-time highs near the $2,880 mark on the back of the weak US Dollar, declining US yields across the curve and safe haven demand propped up by tariffs concerns.

Will Dogecoin outshine XRP? Publicly traded Canadian firm buys 1 million DOGE

Dogecoin (DOGE) and XRPLedger’s native token XRP observe a correction on Wednesday, extending their losses from the past seven days. DOGE is down 2.43% and XRP lost nearly 5% of its value on the day.

Takeaways of Trump 2.0 two weeks in

In this report, we examine a few of the key takeaways from President Trump's first few weeks in office, including why the European Union could be Trump's next tariff target and why Trump has less leverage over China this time than during the first trade war.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.