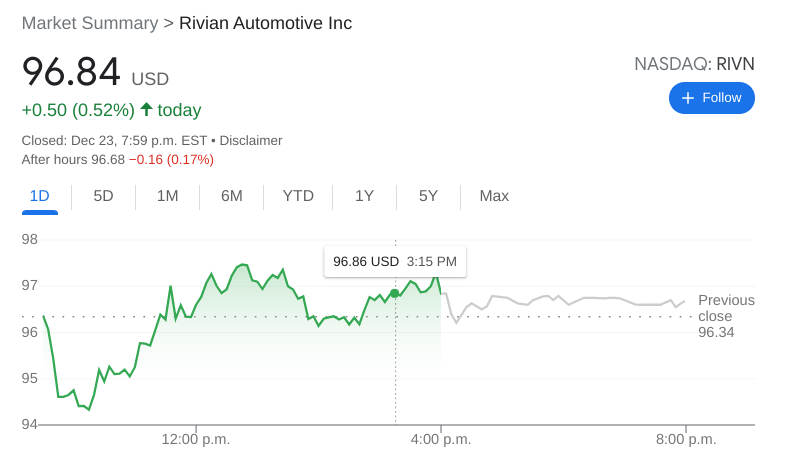

- NASDAQ:RIVN gained 0.52% during Thursday’s trading session.

- Rivian is trading nearly 50% off of its all-time high price from just one month ago.

- Tesla rebounds in style despite cutting video games for its drivers.

NASDAQ:RIVN cruised into Christmas with another small gain on Thursday, as the company continues to battle early volatility following its November IPO. Shares of Rivian gained 0.52% on Thursday and closed the abbreviated trading week at $96.84. It was another banner day for growth stocks as the NASDAQ extended its rebound from the recent selloff. The tech-heavy index climbed a further 0.85%, while the S&P 500 entered Christmas at a fresh new all-time high. Not to be outdone, the Dow Jones added back 196 basis points, as all three indices rose for the third straight day.

Stay up to speed with hot stocks' news!

Rivian has struggled since its much publicized IPO, and the stock is now trading nearly 50% off of its all-time high price of $179.47. Other EV stocks have been beaten down just as much as Rivian over the past month, including Lucid Group (NASDAQ:LCID) which has lost over 28% of its stock price over the last month, and Fisker (NYSE:FSR) which has dropped by 15.5%. Electric vehicle stocks have managed to climb back during this week’s rally, although Lucid was one of the only companies in the red on Thursday as the stock fell by 2.74%.

Rivian stock price prediction

Another EV stock that has been clawing its way back from recent lows is Tesla (NASDAQ:TSLA). The industry leader gained a further 5.76% on Thursday as investors reacted to CEO Elon Musk’s announcement that he has completed his sale of Tesla stock. Meanwhile Tesla also reported that it has conceded to the NHTSA and will disarm the ability for drivers to play video games in Tesla vehicles while using the FSD technology.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trades deep in red below 1.0300 after strong US jobs report

EUR/USD stays under bearish pressure and trades below 1.0300 in the American session on Friday. The US Dollar benefits from the upbeat jobs report, which showed an increase of 256,000 in Nonfarm Payrolls, and forces the pair to stay on the back foot heading into the weekend.

GBP/USD drops toward 1.2200 on broad USD demand

GBP/USD extends its weekly slide and trades at its weakest level since November 2023 below 1.2250. The data from the US showed that Nonfarm Payrolls rose by 256,000 in December, fuelling a US Dollar rally and weighing on the pair.

Gold ignores upbeat US data, approaches $2,700

Following a drop toward $2,660 with the immediate reaction to strong US employment data for December, Gold regained its traction and climbed towards $2,700. The risk-averse market atmosphere seems to be supporting XAU/USD despite renewed USD strength.

Sui bulls eyes for a new all-time high of $6.35

Sui price recovers most of its weekly losses and trades around $5.06 at the time of writing on Friday. On-chain metrics hint at a rally ahead as SUI’s long-to-short ratio reaches the highest level in over a month, and open interest is also rising.

Think ahead: Mixed inflation data

Core CPI data from the US next week could ease concerns about prolonged elevated inflation while in Central and Eastern Europe, inflation readings look set to remain high.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.