- Rivian stock is still waiting for its first down day, rally continues on Tuesday.

- RIVN shares surge roughly 30% in the first two trading days of the week.

- Rivian so far the biggest IPO in the world in 2021.

Update November 17: Rivian (RIVN) extended its rally into the fifth straight day on Tuesday, adding 15% on the day to settle at $172.01. In doing so, the stock has more than doubled up its value since last week’s trading debut. The company recorded a 121% gain from the IPO offering price of $78. Investors remained highly optimistic on the Electric Vehicle (EV) sector, awaiting to cash out on a new stock apart from the industry leader Tesla Inc.

Rivian (RIVN) stock news

The valuation of this one is beginning to raise important questions about the long-term viability of this bull market with the EV space especially seeing some high valuations. Tesla popped above a $1 trillion market cap but is back below it now. Lucid Motors (LCID) is worth more than Ford (F), and Rivian (RIVN) is worth more than Ford (F), GM, Honda, BMW, Volkwagen and a few others.

There is no doubt the electric vehicle sector is one of the hottest investment spaces right now and is attracting huge inflows. Witness the surge in demand for Rivian shares as the investor roadshow progressed. The initial IPO price was slated to be $57 to $62. This was then revised up to $72-74 before the IPO eventually listed at $78. Now within three trading sessions, Rivian (RIVN) shares have nearly doubled from what seemed a hefty valuation in the first place. Even Cathie Wood said she would not invest, and she has been a notable investor in some high-growth companies.

Seperately, Tianjin Motors Dies is forced to issue a clarification this morning as its shares surge in Asia. The company, which is involved in research and design of body cover dies, saw its shares surge 9% today. The company said its partnership with Rivian (RIVN) has not yet generated revenue, and it has signed a total of $11.8 million worth of orders from Rivian between 2019 and 2021. Those orders are still in production.

Rivian (RIVN) stock forecast

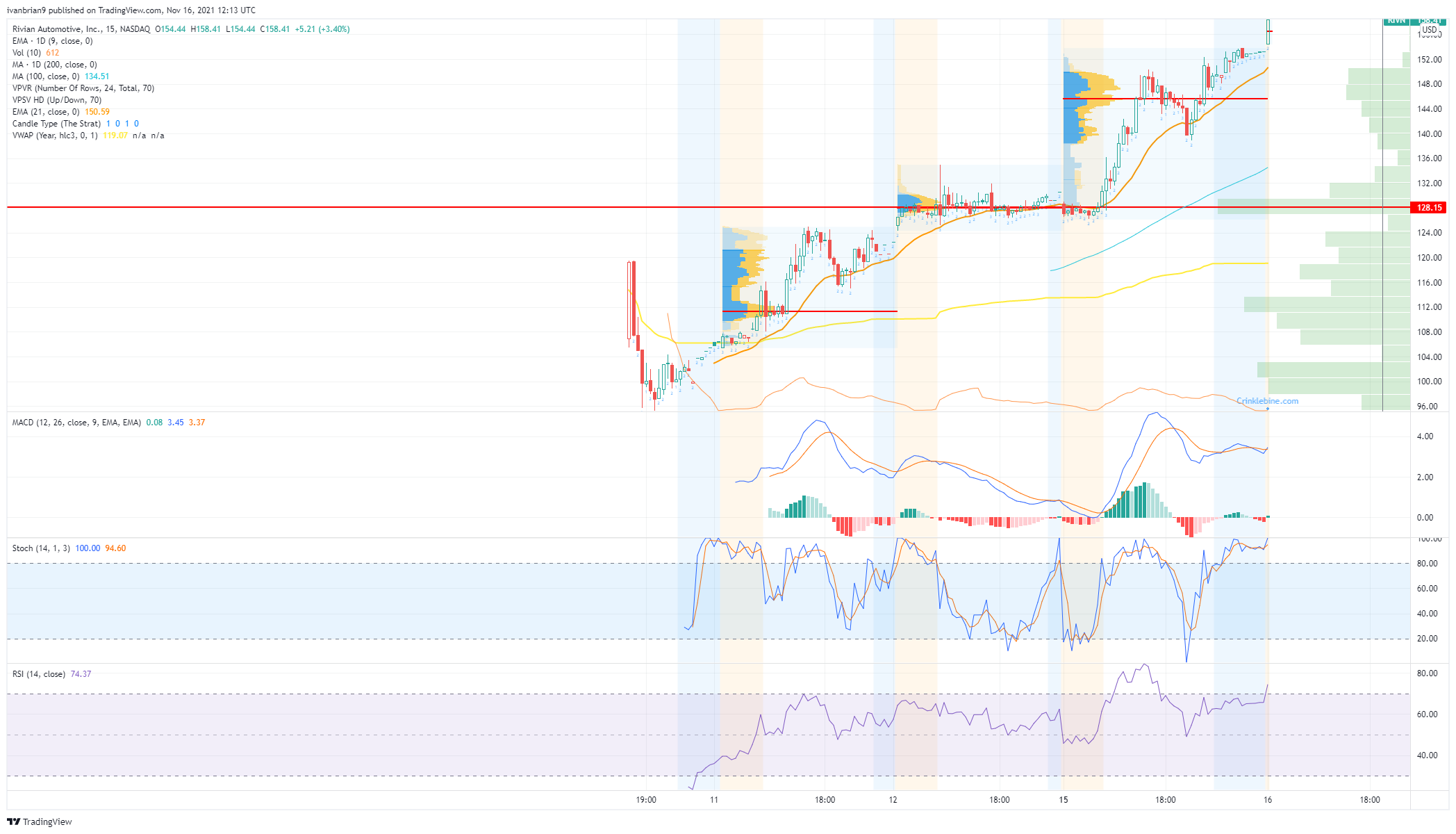

The only way is up with more gains in Tuesday's premarket. Demand for this one still has not been sated from retail and possibly some laggard institutional investors. Given the social media commentary, we suspect most of this late surge is retail based. Eventually, interest will start to slow. For now, strong support is at $127.86, which is the point of control since the IPO. This is the price with the highest amount of volume. Volume always equals stability. Breaking below $144 sees volume thin out until the point of control, so a move could accelerate through this vaccum. Below $128 there is a second volume gap to $112.

RIVN 1-day chart

Previous updates

Update: Rivian (RIVN) is up over 15% ahead of Wall Street's close, trading above $172.00 per share. Less than a week after the IPO, Rivian is up roughly 65%, from its initial price of $106.75. Investors' enthusiasm for the American electric vehicle automaker remains intact. The better performance of Wall Street further supported the share, after a soft start to the week. At the time being, the Nasdaq Composite is up 122 points or 0.77%.

Update: Rivian (RIVN) stock surged another 14 % on Monday as the US electric vehicle manufacturer sees its stock nearly up 100% from the IPO price after just four full days of trading. While many are questioning the valuation of a company in its infancy (including ourselves), this one is pure momentum. Eventually, the music will stop or slow, so just be prepared for when it does. Right now though, momentum is there to be used for speculation, and the retail crowd is loving this one.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD attacks 1.0800 ahead of EU inflation data

EUR/USD is battling 1.0800 in the early European session on Tuesday, undermined by the latest US Dollar bounce. Traders keenly await the EU inflation data and the US jobs survey for further impetus as US President Trump's 'reciprocal tariffs' announcement looms on Wednesday.

GBP/USD treads water above 1.2900 ahead of US data, tariffs

GBP/USD is trading on the defensive while holding above 1.2900 in Tuesday's European trading. The pair loses ground amid a modest US Dollar uptick as traders resort to repositioning in the lead-up to the top-tier US economic data releases and Wednesday's tariffs announcements.

Gold price eases from record high; bullish bias remains amid worries over Trump's tariffs

Gold price retreats slightly after touching a fresh all-time high on Tuesday as bulls pause for a breather and opt to wait for US President Donald Trump's reciprocal tariffs announcement. Adding to this, a positive tone around the Asian equity markets also acts as a headwind for the commodity amid overbought conditions on the daily chart.

PEPE could rally to double digits if it breaks above its key resistance level

Pepe memecoin approaches its descending trendline, trading around $0.000007 on Tuesday; a breakout indicates a bullish move ahead. Moreover, PEPE's long-to-short ratio supports a bullish thesis as bullish bets among the traders reach the highest over a month.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.