Rivian Automotive Stock News and Forecast: Why is RIVN falling below its IPO price?

- RIVN stock closes nearly 6% lower on Monday.

- Rivian stock falls despite a strong intraday turnaround for the Nasdaq.

- RIVN is yet to close below its $78 IPO price.

Rivian (RIVN) stock is approaching its $78 IPO level with each passing day as 2022 starts tumultuously for high growth stocks. The landscape of rising rates and investor caution has seen high-growth names fail to live up to their self-descriptive names. The result is a slump for growth and meme stocks, while old school, boring names such as financials, food and value take the garlands and investment flows thus far.

Rivian (RIVN) stock news

To add to the overall landscape on a broad basis outlined above, we do have some very negative stock-specific news for Rivian this morning. According to Reuters, Rivian produced 1,015 vehicles in 2021 in line with the company's reduced estimates. COO Rod Copes has left the company.

Rivian had initially forecast production of 1,200 vehicles for 2021 but said in December it would miss these targets. While a miss at the startup phase may not seem too significant, losing a key executive is not exactly reassuring for investors. The announcement of a replacement does present an opportunity for reassurance, so watch this space. However, Rivian said that the COO's departure was a retirement that was planned for months, according to CNBC, and that the duties have been taken up by other executives. A big signing would help alleviate investor concerns, so this statement makes that look less likely in our view. Currently, Rivian shares are down again in Tuesday's premarket.

Rivian (RIVN) stock forecast

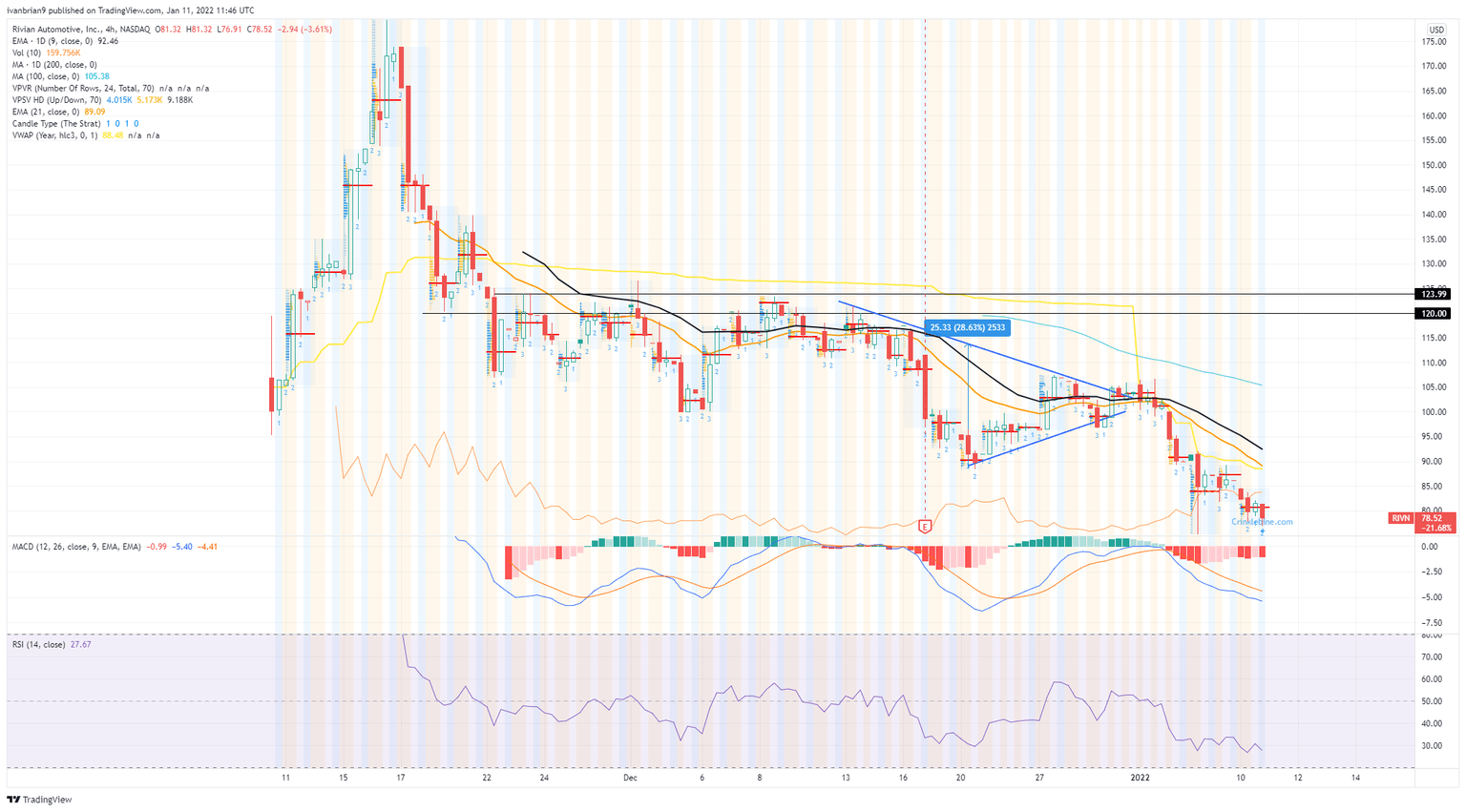

The chart is still pretty much in its infancy on this one, but we did witness a triangle breakout. The target of this breakout is $75. The target of a triangle breakout is the size of the entry wave. Closing below the IPO price at $78 has yet to happen, but Tuesday may be the day. That would set some alarm bells ringing and see further selling momentum and stop losses. The triangle low at $88.40 is the first resistance and corresponds to the yearly VWAP. $75.13 is the intraday low from this week and thus the key support. Below will likely see more momentum selling.

RIVN 4-hour chart

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.