Rivian Automotive Stock News and Forecast: RIVN earnings hurt share price, stock set to slump another 30%

- RIVN stock sees a sharp fall as earnings are released on Thursday.

- Rivian misses on top and bottom lines.

- Searches for EVs online have doubled.

Rivian (RIVN) stock looks set for more losses going forward as earnings disappointed investors after the close on Thursday. Rivian was one of the biggest IPOs ever in the US when it launched at $78 a share in November. The stock pushed on in a wave of euphoria and breached $179, which made it one of the top most valuable auto manufacturers in the world. This was despite the company not actually entering into production.

The valuation always seemed problematic and indeed symptomatic of the larger excess than had been fuelled by the Fed's money printing policy during the pandemic. Now, finally common sense has prevailed, and the stock is beginning to move back to more sensible valuations. However, we feel there is more downside yet to come. The nature of markets is that they tend to stretch too far in each direction like an elastic band before snapping back. We have had RIVN stock stretch too far on the upside, so it is due a move in the other direction.

Rivian Stock Forecast

Rivian announced Q4 earnings after the close on Thursday. They were terrible. Earnings per share came in at -$2.43, missing the -$1.97 estimate by a long way. Revenue came in at $54 million, also missing the estimate of $60 million. Rivian announced it had delivered 909 vehicles in Q4. Earlier this week we noted a report from Morgan Stanley that surging nickel prices would add $1,000 to the price of an EV, but Business Insider went one step better yesterday when it reported that it could be more like $2,000. Rivian had last week announced a price hike that it was forced to roll back on in the face of rising customer anger and order cancellations.

Rivian Stock Forecast

There is nothing positive to be taken from this report. Perhaps the only positive is sector-wide as searches for electric vehicles continue to surge given the recent run-up in oil prices. No doubt the EV market share will increase and perhaps at a faster rate, but that is more likely to benefit existing legacy manufacturers with strong EV models already, such as Tesla (TSLA). Rivian is too high growth in the current environment, and it and Lucid (LCID) are likely to see more losses.

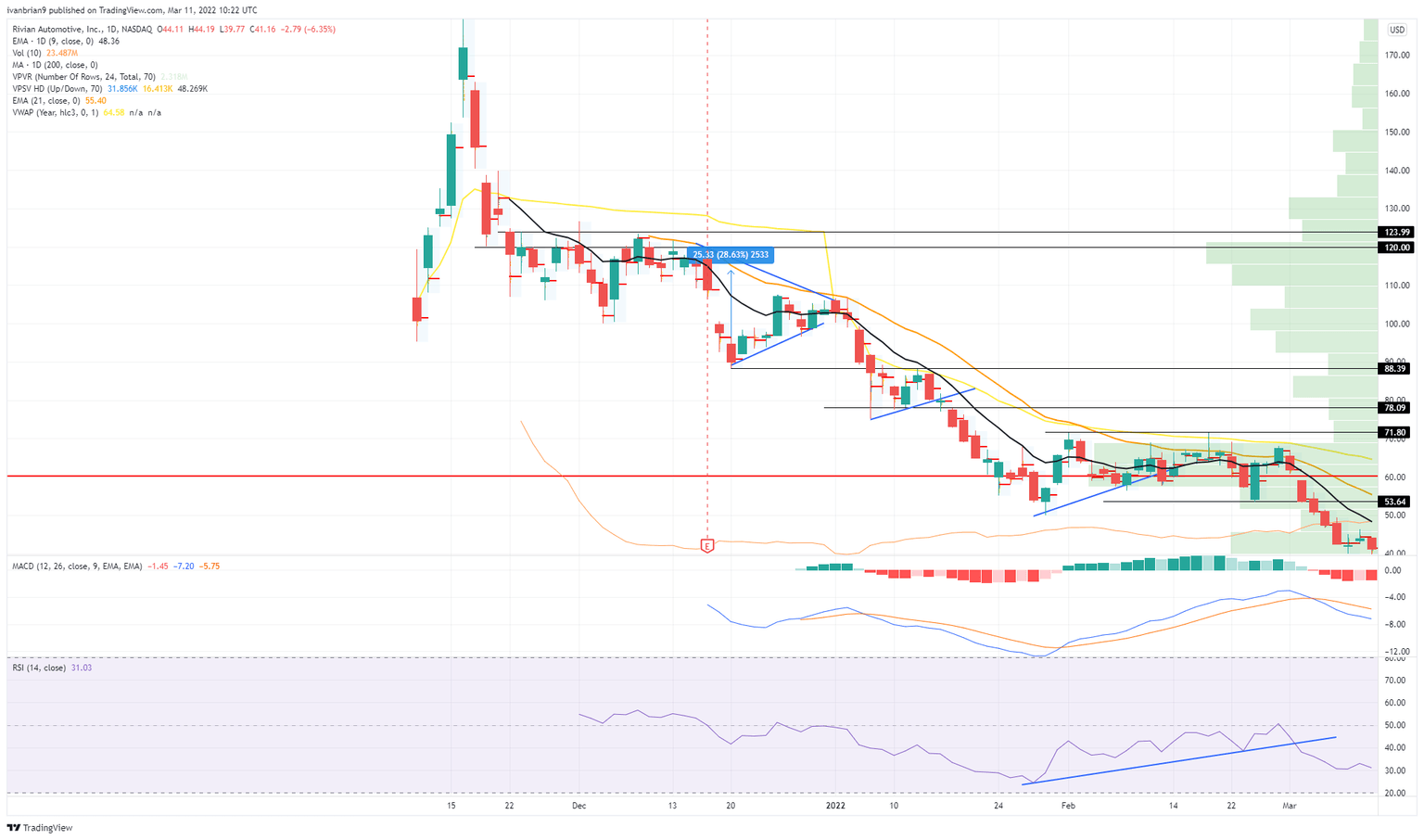

We last spoke about how the move would speed up once $50 was broken due to stops and so it has played out. Now $53.64 is resistance, and below here Rivian remains strongly bearish.

Rivian (RIVN) stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.