- RIVN stock falls on Friday along with most other names.

- High-risk assets suffer but Rivian outperforms.

- The electric-vehicle darling "only" fell 2.4% on Friday to $112.13.

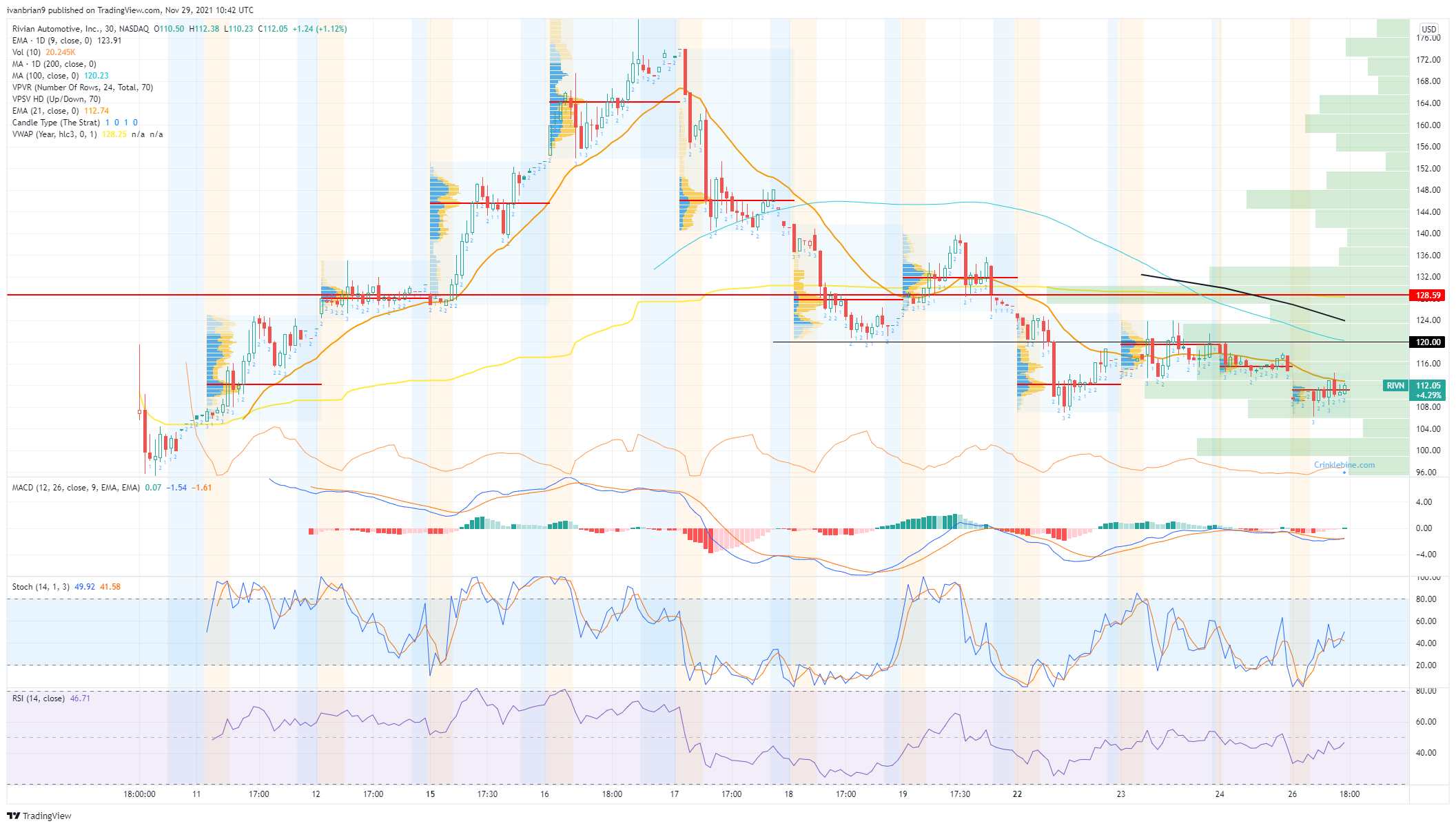

Update: Rivian is looking to re-gain the $120 level lost on the big stock market falls seen on Black Friday. The electric vehicle stock is trading on the green pre-market, about to open above $114 after having closed last week at $112.13.

Rivian can be said to have outperformed on Friday as a serious panic gripped global stock markets. The catalyst was the emergence of a new strain of covid in South Africa which may be more transmissible than delta and also able to avoid the current suite of vaccines. Oil plunged nearly 12% one of its biggest one-day falls ever. Stocks slumped with Europe taking the worst of the selling as the US market was on a half-day for Thanksgiving hangovers. Rivian fell to $112.13 but outperformed many stocks such as sector leader Tesla (TSLA) which fell over 3%.

Rivian stock news

Is it now time to buy Rivian? Is this the dip we have been waiting for? All dips in 2021 so far have proven worth buying so why should this one be any different? Certainly, early price action in the futures is showing a bounce back despite Asian markets still falling. But the evidence so far over just how bad this new variant is going to be is inconclusive. Rivian has been under pressure since telling customers they can expect deliveries of its Launch edition R1S pick-up truck between March and April, according to Electrek and Inside EV's. The reports cited a customer email from Rivian. This matters because it is a delay from the earlier expectations of January 2022. This has put more focus on a company that is valued as the third-largest auto manufacturer in the world despite not yet having delivered any vehicles.

RIVN stock forecast

While the last line above does make you wonder about the valuation world we live in and evokes fears of the dot com valuations for those that remember, Rivian (RIVN) is all about momentum. Most involved here are short term traders who do not give too much concern for long-term valuation metrics. The momentum though is this name has been slowing so even short-term traders need to be aware of that. The last 5 sessions have seen volatility drop and the daily range also reduced sharply, both signs of falling momentum.

$105 is the lat support before moving 5% swiftly lower to test the psychological $100 level. From $105 to $100 as we can see there is a volume gap so the move should be swift. Under $100 there is obviously no volume, so no price discovery. Resistance at $120 remains strong, shown on the chart with good price and volume action here. Breaking above $120 will surely see a quick move to $129 a big resistance. This is the point of control since IPO, the price with the highewst amount of volume.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD touches two-week high after RBA meeting minutes

AUD/USD attracts buyers for the fifth straight day on Tuesday and climbs to a nearly two-week low following the release of RBA minutes, which indicated that the May meeting would be an opportune time to reconsider reacting to potential risks. This, along with a positive risk tone, acts as a tailwind for the Aussie.

USD/JPY trades with positive bias above 143.00; upside potential seems limited

USD/JPY gains some positive traction on Tuesday and now seems to have snapped a three day losing streak to a multi-month low touched last week. The upbeat market mood undermines the safe-haven JPY and lends support amid a modest USD uptick.

Gold price holds steady above $3,200; remains close to all-time peak

Gold price trades above the $3,200 mark following the previous day's modest pullback from a fresh record high as the escalating US-China trade war continues to underpin the safe-haven bullion. Moreover, the Fed rate cut bets lend support to the XAU/USD.

US Homeland Security probes Anchorage digital bank amid Blackrock custody expansion

US Homeland Security’s “El Dorado Task Force” is investigating Anchorage Digital Bank for potential financial misconduct. Anchorage previously faced regulatory action for BSA/AML compliance failures.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.