- Rivian (RIVN) stock quote opened for trading on Wednesday.

- Rivian (RIVN) stock opens at $106.75 a big move from the IPO price.

- RIVN stock already has a huge following from retail traders.

Update November 11: Rivian Automotive (RIVN) marked the biggest IPO of 2021, as it raised nearly $12 billion on its first day as a public company, which is valued at almost $88 billion. The Electric Vehicle (EV) company opened with a bang at $106.75, way higher than the listing price at $78. Rivian’s shares rose as much as 53% to $119.46 before retracing sharply to finish at $100.73, still up 29% from the IPO price.

Rivian (RIVN) shares opened for trading on Wednesday, a little late, at $106.75 per share. The stock IPO'd at $78 after institutional investor interest saw the price range upped considerably from earlier estimates. The volume in Rivian (RIVIN) stock is already huge and is sure to be the biggest volume stock on the Nasdaq today.

Rivian (RIVN) stock news

Rivian listed at $78 having upped the price range twice. Initially, Rivian (RIVN) was slated to price the IPO in a range from $57 to $62. Rivian was on an investor roadshow last week. This involves meeting all the major fund and investment managers who may have an interest in buying shares in the IPO. Institutional investors will indicate how many shares they want to buy and specify a maximum price they will pay. Some funds will buy at the market others will put a maximum price. Once the bookrunners estimate demand for shares this helps them formulate the IPO price. Obviously the greater the demand the higher the price.

Clearly, in this case, the investor roadshow went well as the price range was guided up to $72 - $74 at the start of the week. Demand continued and Rivian (RIVN) eventually went on to IPO at $78. This has given Rivian (RIVN) a market cap of about $77 billion putting it on a par with Ford (F) and ahead of such notables as BMW and Stellantis. Rivian raised nearly $12 billion from the share sale. The Rivian CEO said on Tuesday the company aims to build at least one million vehicles annually by 2030. Rivian CEO RJ Scaringe said the company would have four assembly plants globally. "We better be growing at least that quick; certainly before the end of the decade is how we think about it," Scaringe said. Rivian currently has one plant in Normal, Illinois which has the capacity to manufacturer 150,000 vehicles. Rivian currently is producing the R1T pickup truck with a starting price of $67,500. The SUV R1S is due soon. The company also has an order from Amazon for 100,000 electric vans.

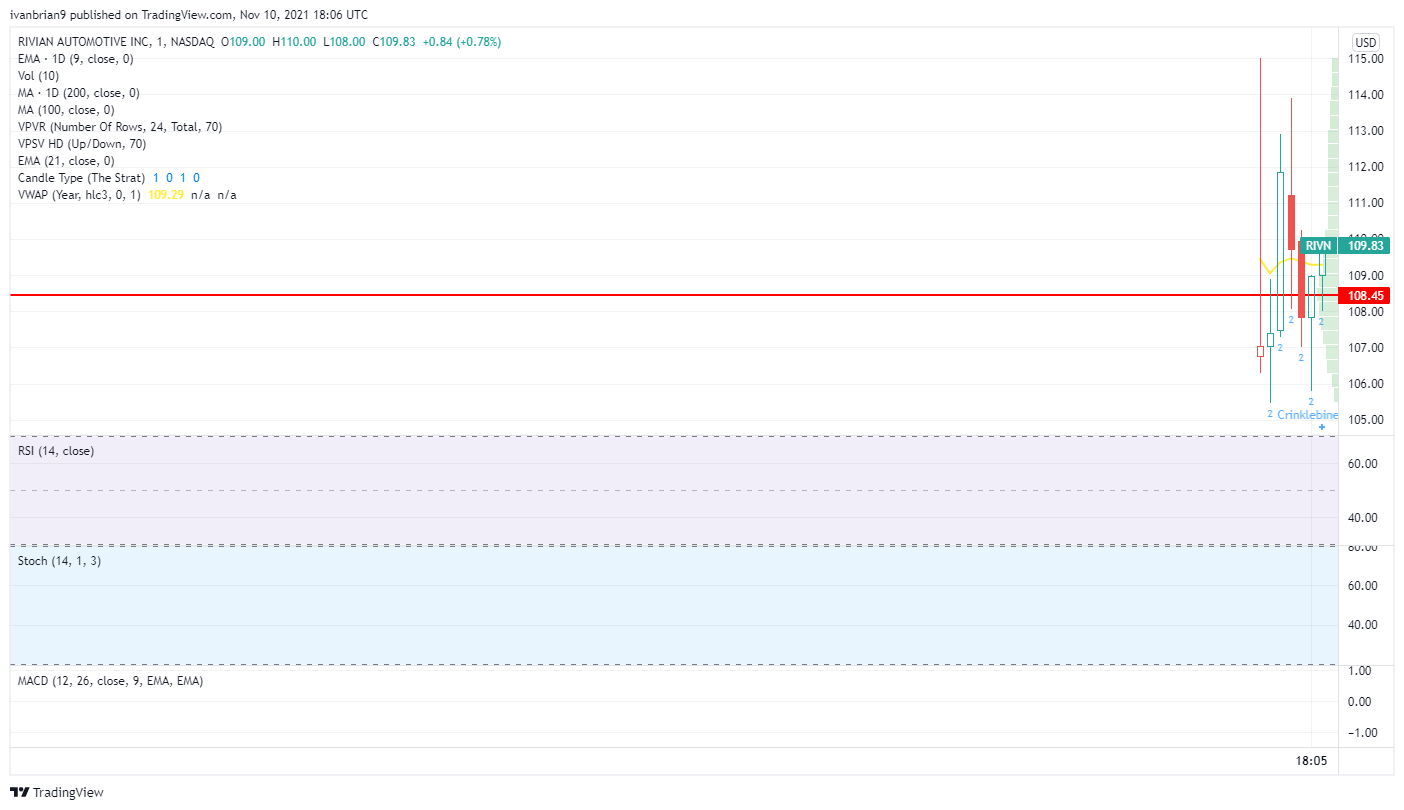

Rivian (RIVN) stock quote

Currently RIVN is trading $111.94.

Rivian (RIVN) stock graph

Previous updates

Update: After an outstanding debut, Rivian (RIVN) trades just below the $100.00 mark, retaining impressive gains despite the sour tone of Wall Street. US indexes plunged on Wednesday, following news that US inflation soared to 6.2% YoY in October, its highest in three decades. Stocks accelerated their slumps on news that the Chinese giant Evergrande officially defaulted on $148.13 million in interest payments and market talks hint at the Deutsche Marktscreening Agentur (DMSA) preparing bankruptcy proceedings against the Evergrande Group. Ahead of Wall Street's close, RIVN is trading roughly 28% higher on the day.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.