- NASDAQ:RIOT skyrockets by 30.92% as it outpaces the broader markets.

- RIOT continues to ride the price of Bitcoin and other cryptocurrencies as the industry heats up.

- Riot hits a new hashrate milestone as it deploys its army of miners.

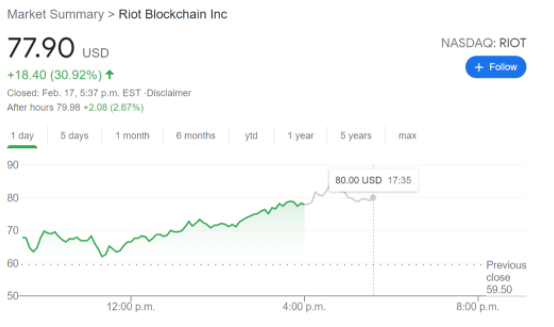

NASDAQ:RIOT has been one of the hottest stocks so far in 2021, as it continues to hitch itself to the Bitcoin price surge. Riot Blockchain entered the year trading at $16.48, but has vaulted up by 372% since then and an astounding 3,100% over the past 52 weeks. Wednesday saw the stock make a further leap as it gained 30.92% to close the trading session at an incredible $77.90, with additional growth after hours. As long as the price of Bitcoin continues to rise, investors can expect the price of Riot to follow suit.

Several major institutions have announced their investments into Bitcoin this week starting with Tesla (NASDAQ:TSLA), which reported a $1.5 billion stake in the digital currency. Also adding to Tesla’s stake have been financial giants MasterCard (NYSE:MA), Bank of New York Mellon (NYSE:BK) and even investing site The Motley Fool announced a $5 million investment. With more companies and large investment vehicles buying up Bitcoin, the supply is quickly disappearing, which has been one catalyst for the extreme surge in price. We can definitely expect more firms to come forward as Bitcoin continues to be a popular alternative to investing in the stock market.

Riot stock news

Riot Blockchain also announced that it recently met a hash rate capacity milestone of 1.06 exahash per second, which is basically a metric of how quickly it can mine Bitcoin on the blockchain. Riot estimates that it will eventually have a total mining hash rate of 3.8 exahash per second, once all of its antminers have been deployed.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold hits new all-time highs above $3,020, Trump-Putin call eyed

Gold price is printing fresh record highs above $3,020 on Tuesday as Middle East tensions intensify. Israel resumed military operations against Hamas in Gaza after the group rejected US proposals for extending ceasefire. All eyes now remain on the Trump-Putin call.

EUR/USD clings to gains near 1.0950 after mixed sentiment data

EUR/USD trades at fresh multi-month highs near 1.0950 in the European session on Tuesday despite mixed economic sentiment data. Optimism around the German vote on the spending plan and Trump-Putin talks offsets escalating Middle East and trade tensions, fuelling fresh US Dollar weakness.

GBP/USD rebounds toward 1.3000 on renewed US Dollar selling

GBP/USD bounces back toward 1.3000 in the European trading hours on Tuesday. The pair finds fresh support from a renewed US Dollar selling as investors look past the Middle East tensions, anticipating the US-Russia takls on Ukraine peace deal.

Canada inflation Preview: CAD positioned for strength ahead of CPI print

Statistics Canada will release the February inflation report on Tuesday, as estimated by the Consumer Price Index (CPI). Annualised inflation is expected to have ticked higher, from the 1.9% posted in January to 2.1%.

Tariff wars are stories that usually end badly

In a 1933 article on national self-sufficiency1, British economist John Maynard Keynes advised “those who seek to disembarrass a country from its entanglements” to be “very slow and wary” and illustrated his point with the following image: “It should not be a matter of tearing up roots but of slowly training a plant to grow in a different direction”.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.