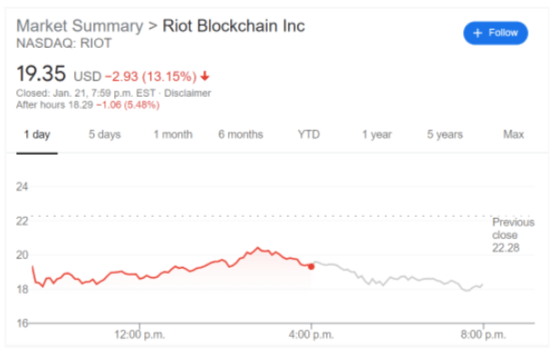

- NASDAQ:RIOT crashes a further 13.15% as Bitcoin and other cryptocurrencies plummet.

- Despite RIOT’s recent investment in more assets, it is struggling to keep up with the everchanging crypto world.

- The crypto industry turned negative after Janet Yellen’s comments this week.

NASDAQ:RIOT investors have not had a very fun start to the new year as the stock continues to spiral downwards amidst a global correction in the price of several cryptocurrencies. Thursday marked the third straight trading session that RIOT has fallen, resulting in a 30% dip in the price of the stock from its 52-week high price of $29.28. Shares fell 13.15% to close the trading day at $19.35, mirroring the 13% dip in Bitcoin’s price which suffered its largest single-day loss since March when the global financial markets briefly entered into a bear market. Despite the terrible week Riot Blockchain is having, the stock is still up a remarkable 1,668% over the past 52-weeks.

RIOT recently added 2,500 new Antminers which are used to mine Bitcoin and other forms of cryptocurrency. In total, RIOT anticipates deploying over 37,000 Antminers by October of this year. While the company continues to battle rising hash rates and an ever-crowded market of Bitcoin miners, it is still positioned well to bounce back if, or perhaps more accurately when, the price of Bitcoin comes back up.

RIOT stock forecast

Much of the negativity this week around the cryptocurrency landscape was brought on by incoming Treasury Secretary Janet Yellen, who suggested that Bitcoin should be ‘curtailed’ as it is mainly used for nefarious purposes which she called ‘illicit financing’. Whether this is foreshadowing some sort of government regulation under the Biden administration remains to be seen but crypto investors turned bearish this week and the prices have suffered as a result.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats toward 1.0850 as mood sours

EUR/USD stays under modest bearish pressure and declines toward 1.0850 on Tuesday. The US Dollar benefits from safe haven flows and weighs on the pair as investors adopt a cautious stance ahead of this week's key earnings reports and data releases.

GBP/USD stays pressured toward 1.2900 as US Dollar stabilizes

GBP/USD is on the defensive toward 1.2900, struggling to find a foothold on Tuesday. The US Dollar holds steady following Monday's pullback amid a negative shift seen in risk sentiment, not allowing the pair to regain its traction.

Gold recovers above $2,400 as US yields retreat

Gold stages a rebound and trades above $2,400 on Monday after closing the fourth consecutive trading day in negative territory on Monday. The pullback seen in US Treasury bond yields help XAU/USD stretch higher despite the US Dollar's resilience.

Bitcoin price struggles around $67,000 as US Government transfers, Mt. Gox funds movement weigh

Bitcoin struggles around the $67,000 mark and declines by 1.7% at the time of writing on Tuesday at around $66,350. BTC spot ETFs saw significant inflows of $530.20 million on Monday.

Big tech rebound ahead of earnings, Oil slips

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

Tesla and Google are due to report earnings today after the bell, and their results could shift the wind in either direction. Despite almost doubling its stock price between April and July, Tesla sees appetite for its cars and its market share under pressure.