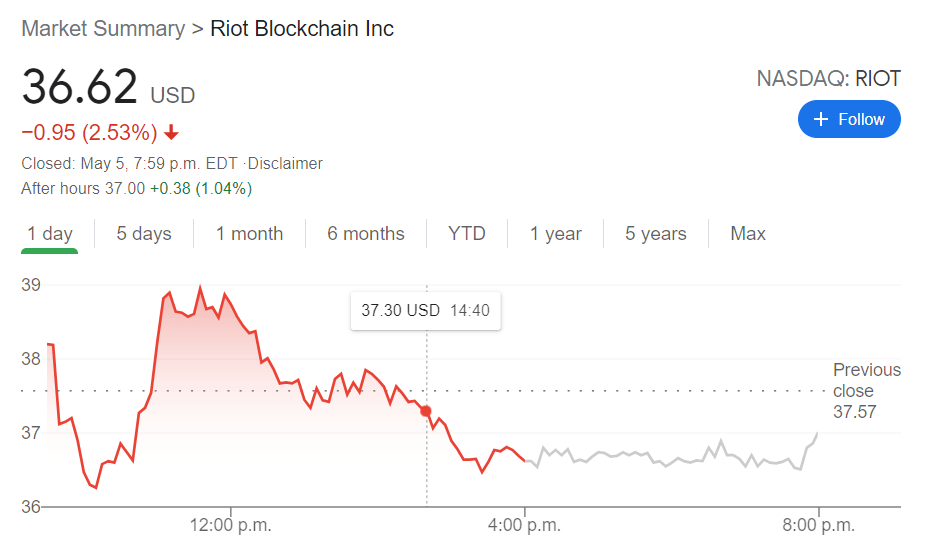

- NASDAQ:RIOT fell by 2.53% as NASDAQ stocks took another breather as the choppiness continued.

- Bitcoin is on the rise again but miner stocks ended Wednesday in the red.

- A prominent voice in the Bitcoin industry makes a strong proclamation for the future price.

NASDAQ:RIOT had an April to forget, but thus far, May has not been any friendlier to the Bitcoin mining company based out of Castle Rock, Colorado. Wednesday saw another red day for Riot, as the stock fell 2.53% to close the trading day at $36.62. Shares have now lost over 30% during the past month as Riot inches lower towards its 200-day moving average price of $28.71. Generally this can act as a support level for stocks in technical analysis, but it is curious to see Riot struggle even when action in the crypto markets have picked back up.

Stay up to speed with hot stocks' news!

The price of Bitcoin rebounded over the past few days and at the time of this writing, is trading at approximately $57,000 USD per coin. Despite this, Riot and other Bitcoin mining companies like Marathon Digital Holdings (NASDAQ:MARA) were trading lower on the day, perhaps signaling that the share price is moving away from its direct correlation to the price of Bitcoin. Investors are faced with the dilemma of investing in the Bitcoin miners or just buying Bitcoin itself now that it is so readily available. While these companies may artificially rise and fall with the price of cryptos, the underlying strength of Riot and Marathon is still yet to be determined.

RIOT stock forecast

CoinDesk editor Ollie Leech made headlines by reiterating his stance on Bitcoin’s future price of $1 million per coin. Leech points to the next Bitcoin halving, which is set to take place at some point in 2024, where he predicts a strong price surge due to a lack of supply. How this will affect mining companies like Riot remains to be seen, and investors will be looking to management for some forward looking guidance at its quarterly earnings call next week.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD drops below 1.0450 as USD gathers strength

EUR/USD stays on the back foot and trades below 1.0450 on Wednesday. The cautious market stance helps the US Dollar (USD) stay resilient against its rivals and weighs on the pair as markets wait for the Federal Reserve to publish the minutes of the January policy meeting.

Gold climbs to new all-time high near $2,950

Gold retreats slightly from the all-time high it touched at $2,947 but manages to stay above $2,930 on Wednesday. The benchmark 10-year US Treasury bond yield clings to modest gains above 4.55%, limiting XAU/USD's upside.

GBP/USD retreats below 1.2600 despite strong UK inflation data

GBP/USD struggles to hold its ground and trades in the red below 1.2600 on Wednesday. Earlier in the day, the data from the UK showed that the annual CPI inflation climbed to 3% in January from 2.5% in December. Market focus shifts to FOMC Minutes.

Maker Price Forecast: MKR generates highest daily revenue of $10 million

Maker (MKR) price extends its gains by 6%, trading around $1,189 on Wednesday after rallying more than 20% so far this week. Artemis data shows that MKR generated $10 million in revenue on February 10, the new yearly high in daily revenue.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.