RIOT Blockchain Stock Price and Forecast: Why is RIOT stock down?

- RIOT stock does not rally on Thursday, one of the few crypto stocks in the red.

- Crypto stocks rally as Bitcoin bounce continues, targets $55,000.

- RIOT released production numbers on Tuesday, which showed continued strength.

RIOT Blockchain stock failed to rally with most of its peers on Thursday and was, from what we can tell, one of the few crypto stocks that finished the session in the red. With crypto stocks getting a boost from the ongoing strong performance of Bitcoin. It was not much of a surprise to see the crypto stocks rallying, but why the relative underperformance then from RIOT? Well, a strong performance on Tuesday may have something to do with it, and so it actually was ahead of its peers in the performance stakes. Bitcoin did also actually slip a bit on Thursday despite being at high levels. Bitcoin though is beginning to look more and more bullish with strong green candles in the recent move up. The red candles are small, and Thursday's move lower was not strong in comparison.

RIOT stock news

On Tuesday RIOT released September production numbers and operations updates. The headline was strong with a yearly increase in production of 346%. In September 2021 RIOT Blockchain produced 406 BTC compared to 91 BTC in the same month a year earlier. As of September 30, 2021, RIOT said it holds approximately 3,534 BTC, all of which are from its own mining operations. The company currently has 25,646 miners with a hash rate capacity of 2.6 exahash per second. RIOT aims to increase this to 7.7 exahash per second by Q4 2022. This would be a strong growth rate and strong outlook if the targets are achieved. With 3,534 Bitcoin, at current prices that equates to nearly $184 million worth of Bitcoin.

| Market Cap | $2.5 billion |

| Enterprise Value | $3.15 billion |

| Price/Earnings (P/E) | 84 |

|

Price/Book | 7.5 |

| Price/Sales | 92 |

| Gross Margin | 46% |

| Net Margin | 45% |

| EBITDA | $28 million |

| 52 week high | $ 79.5 |

| 52 week low | $2.96 |

| Short Interest | 19% |

| Average Wall Street rating and price target |

Buy $54 |

RIOT stock forecast

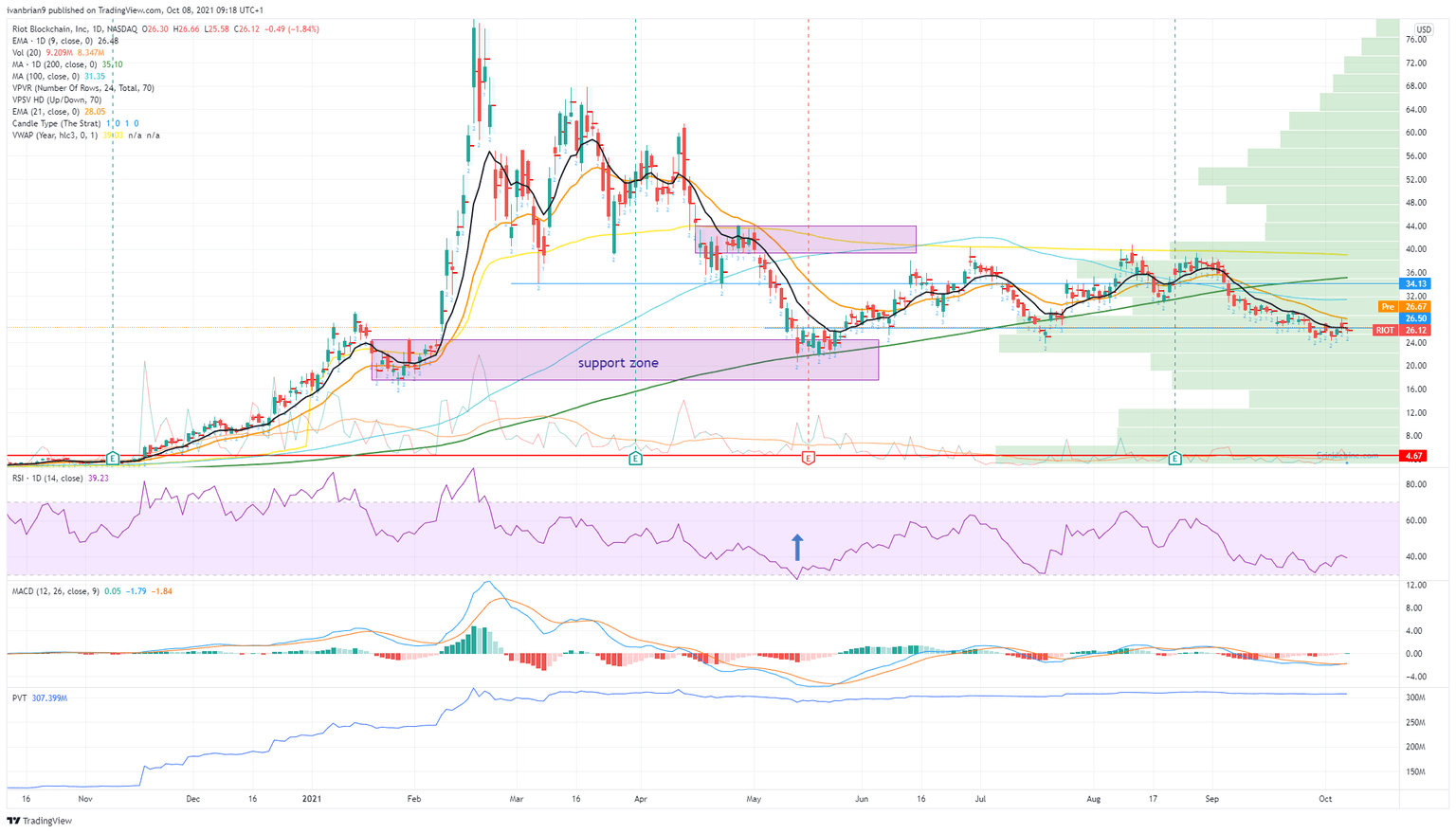

This one is starting to look more and more interesting to us from the long side despite the downward trend evident on the chart since August. For starters, the Moving Average Convergence Divergence (MACD) has bottomed out and is crossing into a bullish signal. The Relative Strength Index (RSI) also looks to have bottomed out. As mentioned, the sector was strong on Thursday, but RIOT stock lagged a bit and Bitcoin has powered ahead and looks to remain bullish with consolidation above $50,000. We need confirmation though before going long. A strong move with confirmation from the RSI breaking the down trend line would do the trick.

FXStreet View: The chart remains bearish, neutral above $27, bullish above $33.

FXStreet Ideas: Looking to buy a breakout. Look for a strong move with confirmation from the RSI.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637692794670134414.png&w=1536&q=95)