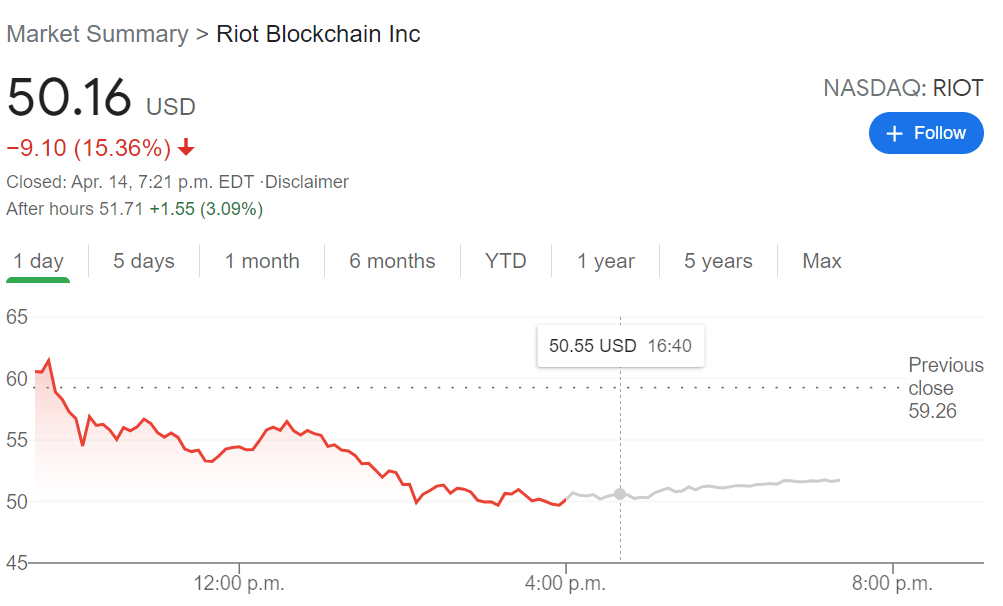

- NASDAQ:RIOT dropped 15.36% on Wednesday as growth stocks were hit hard once again.

- Noted short seller Citron Research dismantles Riot in a scathing report.

- Crypto miner stocks took a hit as Coinbase makes its Wall Street debut.

NASDAQ:RIOT has had an incredible run as a sympathy play to the surging price of Bitcoin and Ethereum, and has returned over 5,000% to investors over the past 52-weeks. On Wednesday, the wheels started to fall off as Riot fell by over 15% to close the choppy trading session at $50.16. The drop took Riot back below its 50-day moving average as the stock is now 36% off of its 52-week high price of $79.50 set in late February.

Stay up to speed with hot stocks' news!

Despite announcing that it would no longer be writing short reports, noted short seller Citron Research was back at it with a scathing assessment of Riot’s business. Citron tweeted that Riot was better off buying Bitcoin rather than mining it, after the company has repeatedly raised capital to deploy into its mining infrastructure during the past year. By Citron’s calculations, purchasing actual Bitcoin would have given Riot 26 times more Bitcoin than the amount they have mined, and that investors looking to get into cryptos should just buy Bitcoin itself rather than buying shares of Riot. Citron ended the attack with a $2 price target for Riot, although the stock actually went up following the report which may show that after the Reddit short squeeze, Citron may not have the influence it once had.

RIOT Stock news

Riot wasn’t the only stock getting hit hard on Wednesday following the debut of crypto exchange Coinbase (NASDAQ:COIN). Marathon Digital Holdings (NASDAQ:MARA) was down 15.75%, Bitcoin miner maker Canaan (NASDAQ:CAN) was down 7.12% and noted Bitcoin holder MicroStrategy Incorporated (NASDAQ:MSTR) was down 13.32%. Even fintech giant Square (NYSE:SQ) who has notable influence on Bitcoin via its Cash App fell 5.43% as investors booked gains from these stocks to put towards buying Coinbase shares.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hovers around 1.0400 amid a souring mood

EUR/USD loses its early traction but holds within familiar levels around the 1.0400 area on Monday. The negative shift seen in risk mood, as reflected by Wall Street's bearish opening, supports the US Dollar and makes it difficult for the pair to hold its ground.

GBP/USD stabilizes around 1.2550 in dull trading

GBP/USD turned south and dropped toward 1.2500 after reaching a 10-day-high above 1.2600 earlier in the day. The pair recovered as fears eased and stabilized around 1.2550 in holiday-thinned trading. Demand for safety skews the risk to the downside.

Gold struggles around $2,600 as USD demand recedes

Gold briefly traded below the $2,600 level in the American session on Monday, with US Dollar demand backed by the poor performance of global equities and exacerbated by thin trading conditions ahead of New Year's Eve.

These three narratives could fuel crypto in 2025, experts say

Crypto market experienced higher adoption and inflow of institutional capital in 2024. Experts predict the trends to look forward to in 2025, as the market matures and the Bitcoin bull run continues.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.