Rigetti computing RGTI hit another target. Possible extension ahead

RGTI has risen rapidly in value in recent days attracting the attention of investors. Here we have the 15-minute chart. Applying the Elliott Waves principle, the stock should find support in 5.89 – 7.07 area to complete a wave 4. This would generate a new rally on wave 5 that could reach around 8.94 – 10.25 or extend higher.

RGTI 15 Min Chart 12.11.2024

In any case, as long as the market respects the 5.89 – 7.07 area, RGTI must continue with the upward movement and break above wave 3 to reach at least 8.94 – 10.25. If the market closes below 5.89, it would open the possibility that the value of the stock will drop to 4.00 before looking for another move higher.

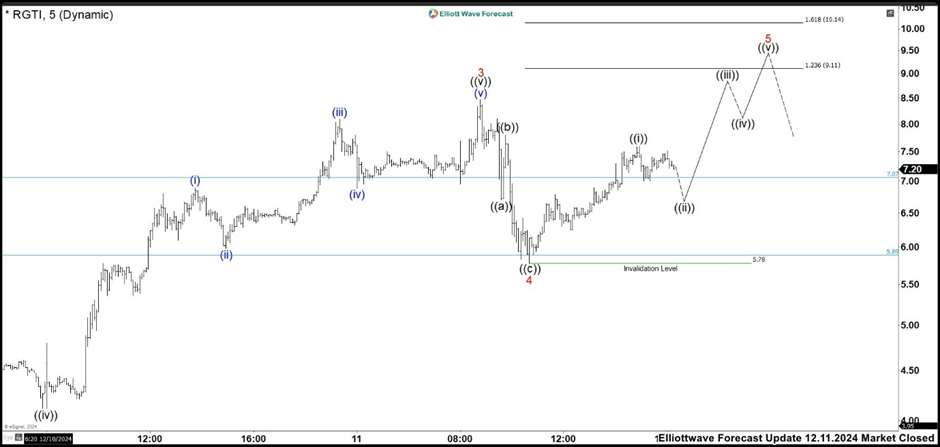

RGTI 5 Min Chart 12.11.2024 (Market Closed)

RGTI found support at 5.78 low and rallied. From here, we are looking to build an impulse structure as wave 5. Wave ((i)) could be completed already and while the pullback as wave ((ii)) is above 5.78 low, RGTI should continue higher. The target for this wave 5 comes in 9.11 -10.14 if there is not more extension in the rally.

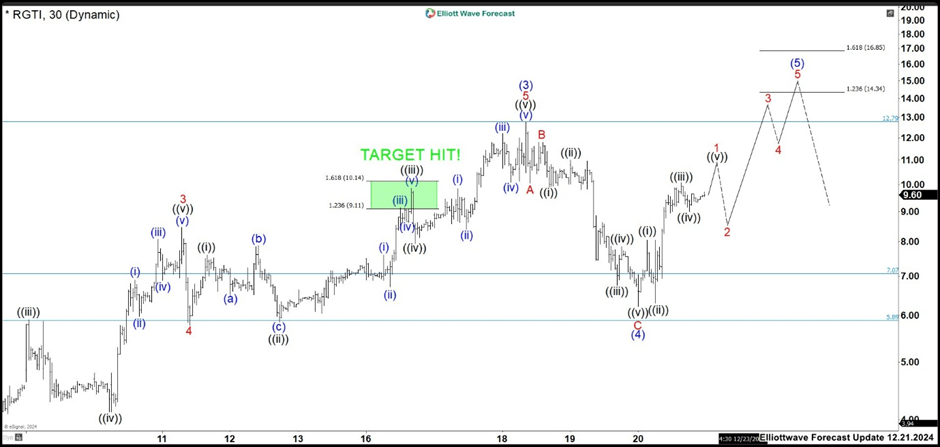

RGTI 30 Min Chart 12.20.2024

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com