RDBX Stock Forecast: Redbox Entertainment looks to rebound from a 30% loss last week

- NASDAQ:RDBX dropped by 29.9% during the past five trading sessions.

- With short interest still high, Redbox could squeeze at any moment.

- Lightyear disappoints at the box office in its opening weekend.

NASDAQ:RDBX has been a difficult meme stock to predict. Shares of the meme stock were lower by more than 12% on Friday but Redbox still managed to close the session in the green. Overall the stock fell by 30% last week, but shares are still up by a staggering 108% during the past month of trading. Overall, Redbox has been outperforming the broader markets, following another bearish week on Wall Street. The S&P 500 recorded its worst trading week since 2020 as the relentless bear market continues to place downward selling pressure on US stocks.

Stay up to speed with hot stocks' news!

Retail traders seeking out the next big short squeeze might want to think about holding Redbox for a little bit longer. According to Fintel, the stock continues to boast a short interest of 103.5% as of Monday. That remains one of the highest amongst stocks on Wall Street and with short interest that high, there is certainly a chance that it could squeeze again. Social sentiment remains high as well as short squeeze hunters look for stocks specifically with high short interest. The interesting thing with Redbox is that it is set to be acquired by Chicken Soup for the Soul Entertainment (NASDAQ:CSSE) by the end of this year.

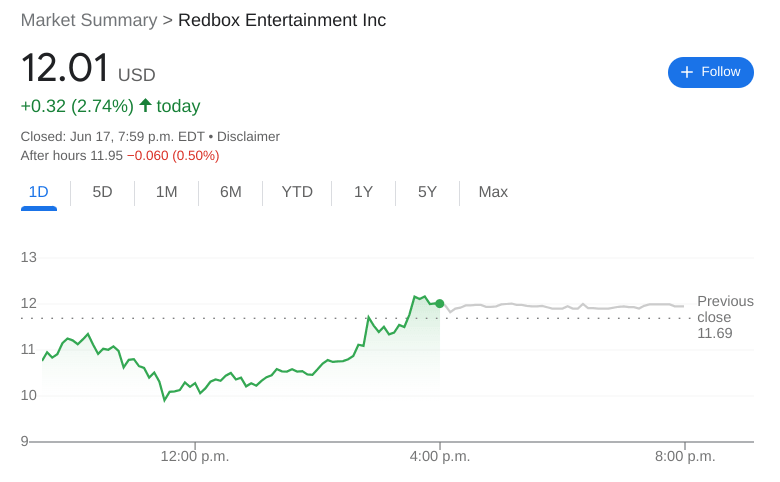

Redbox stock price

AMC (NYSE:AMC) could be in for some volatility this week as the latest blockbuster from Disney (NYSE:DIS) failed to deliver. Lightyear, the stand-alone movie for the beloved Toy Story character Buzz Lightyear failed to meet expectations, bringing in only $51 million during its opening weekend. It failed to knock off Jurassic World from the top spot. Initial estimates for Lightyear was an opening weekend of more than $70 million.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet