Update March 12: Roblox shares continued to remain strong on Thursday as shares consolidated above $70 for the full session. RBLX shares have been one of the new favourites among retail investors, trending heavily on Reddit forums and other social media sites. Cathie Wood of ARK Invest had also boosted sentiment as her fund purchases half a million shares on Wednesday. Roblox shares are trading at $71.30 down 3% in Fridays pre-market trading.

Update March 10: Roblox is on a roll also on Thursday, with shares of the social video gaming company rising to $73.34 at the time of writing after hitting a new all-time high of $77.78. The company that only listed on Wednesday has been flirting with a valuation of $50 billion, placing it within the likes of medium-large companies. For those looking for quick gains, it means that additional fast swings may be limited at these valuations. However, the fundamental case for gaming remains robust.

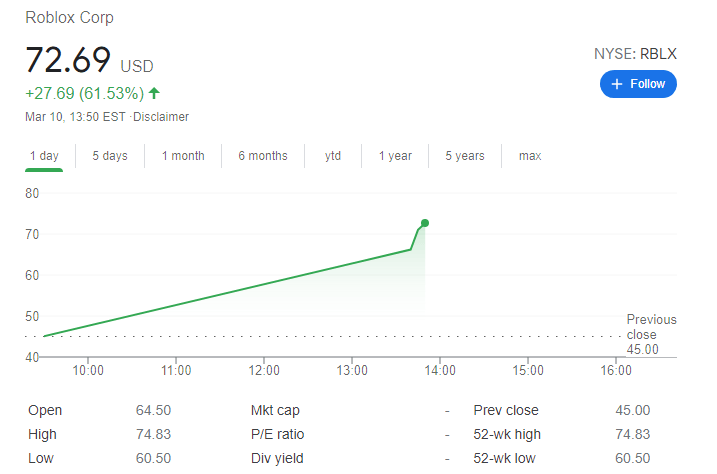

Roblox Corp (NYSE: RBLX) has kicked off trading on Wall Street with a post-direct listing pop, hitting a high of $74.83, up some 14% and surpassing estimates of a $60-65 price range. Senior staff at the video game developer have dismissed concerns that it has become a "meme stock."

See Roblox (RBLX) Stock Price prediction: The new game in meme town is Roblox

The reference price set by NYSE on Tuesday was $45 – which already gave it a valuation of around $30 billion – so the leap to current highs only amplifies the rise.

Roblox has gained popularity during the pandemic as teenagers stuck at home found themselves spending time with its games, but the company has been in business since 2004. The San-Mateo-based company is gaining traction by offering social gaming via entertainment toys.

Wednesday's Reddit market action has been centered on GameStop – where trade was halted several times – while broader markets are relatively calm.

Previous updates:

Update: Shares in Roblox closed at $69.50 on Wednesday having an opening at $64.50, from a reference price for the launch of $45. Retail interest in Roblox stock was strong with Reddit and many other social media sites showing strong trends to RBLX stock price. As of early Thursday, Roblox shares are higher again trading at $85.94 in the pre-market for a gain of 23%.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to recovery gains below 1.0800

EUR/USD is trading under 1.0800, holding the recovery from three-week lows in European trading on Thursday. The pair holds gains amid renewed US Dollar selling as traders digest latest tariff threats from US President Trump. Traders resort to repositioning ahead of Friday's US PCE inflation data.

GBP/USD holds gains above 1.2900 on US Dollar weakness

GBP/USD trades with positive bias above 1.2900 in Thursday’s European morning. The pair holds the latest uptick amid renewed US Dollar weakness as fresh Trump tariff threats rekindle US economic slowdown concerns. Focus remains on tariff updates and mid-tier US data.

Gold price retreats from weekly high; sticks to positive bias amid concerns over Trump's tariffs

Gold price retreats slightly after touching a fresh weekly high earlier this Thursday and trades with modest intraday gains, just below the $3,030 level heading into the European session. An improvement in the global risk sentiment turns out to be a key factor acting as a headwind for the precious metal.

Cardano bulls target double-digit gains as bullish bets increase among traders

Cardano price hovers around $0.74 at the time of writing on Thursday after a recovery of over 4% so far this week. On-chain data hints at a bullish picture as ADA’s stablecoin market cap rises while its bullish bets increase among traders.

Sticky UK services inflation shows signs of tax hike impact

There are tentative signs that the forthcoming rise in employer National Insurance is having an impact on service sector inflation, which came in a tad higher than expected in February. It should still fall back in the second quarter, though, keeping the Bank of England on track for three further rate cuts this year.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.