RBA Monetary Policy Statement: Further rate hikes may be needed

The RBA Monetary Policy Statement released by the Reserve Bank of Australia is out as follows:

Projections are based on a 3.75% rate peak, with rates dropping to 3% by mid-25.

Further monetary policy tightening may be required.

Energy prices will contribute considerably to inflation in the coming year.

We are steadfast in the commitment to return inflation to target.

The board intends to keep as much employment gains as possible.

The longer inflation remains above target, the higher the likelihood of a price-wage spiral.

Goods disinflation has been minimal thus far, but energy price inflation will remain high this year.

Forecast cpi inflation of 4.5% in 2023, 3.2% in 2024, and 3.0% in mid-2025.

Forecast trimmed mean inflation of 4.0% by the end of 2023, 3.1% by the end of 2024, and 2.9% by the middle of 2025.

China is projected to easily meet its 5% growth target this year.

Forecasts GDP growth of 1.2% in 2023, 1.7% in 2024, and 2.1% in mid-2025.

AUD/USD update

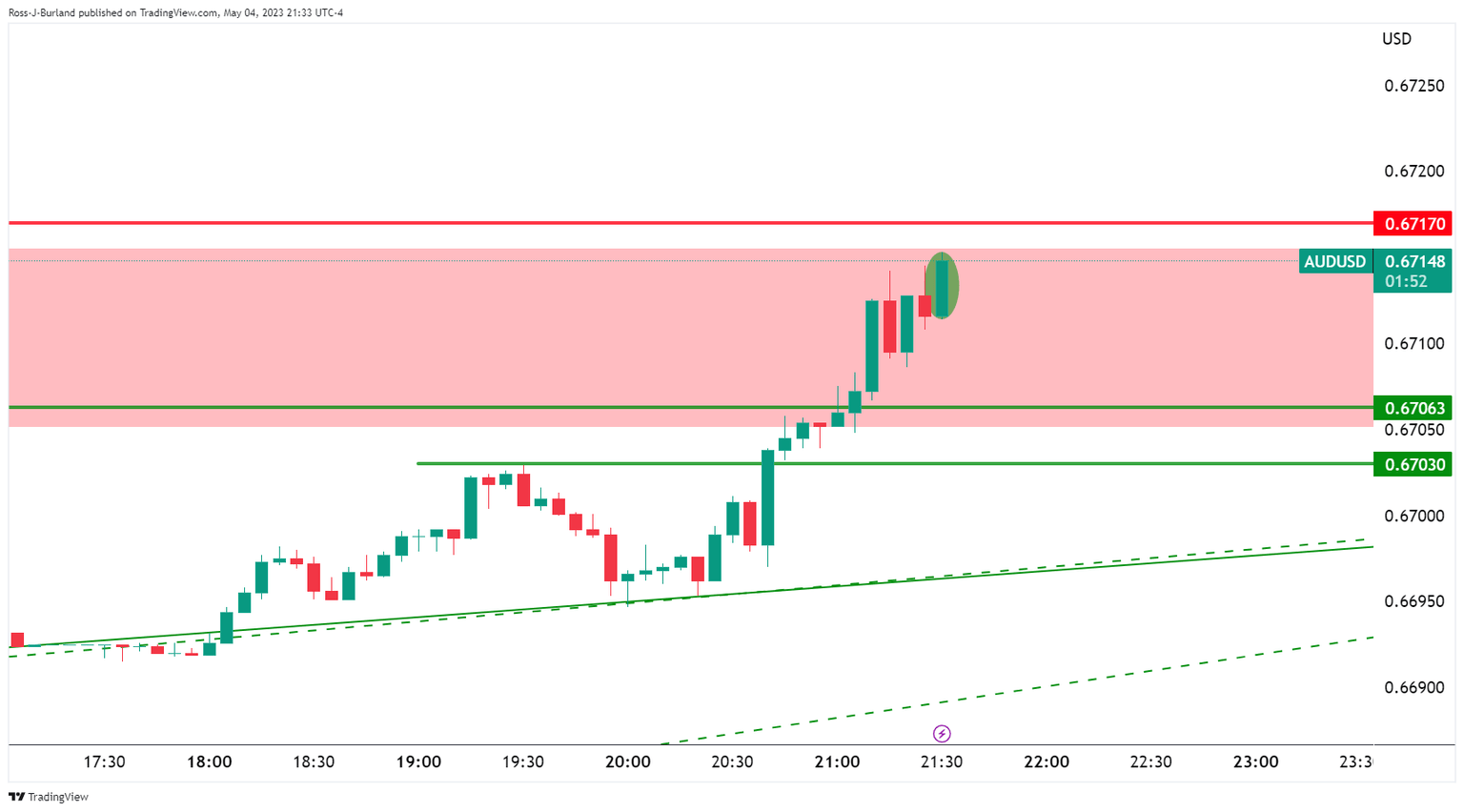

H1 chart above and M5 chart below.

AUD/USD has been given a boost on the statements towards 0.6717, Tuesday's high.

About the RBA Monetary Policy Statement

The RBA Monetary Policy Statement released by the Reserve Bank of Australia reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. It is considered as a clear guide to the future RBA interest rate policy. Any changes in this report affect the AUD volatility. If the RBA statement shows a hawkish outlook, that is seen as positive (or bullish) for the AUD, while a dovish outlook is seen as negative (or bearish).

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.