RBA Minutes: Ready to ease again, economy has reached gentle turning point

- RBA minutes o the dovish side and AUD/USD is slightly offered.

- Australia's central bank has opened the door to another cut in interest rates.

- Some downside risks to global economy had receded.

- Current wage growth not fast enough to reach inflation, consumption goals.

The Reserve Bank of Australia's minutes for the December meeting which fell the day before Australia’s soft Q3 GDP report has been released.

RBA minutes

- Board agreed important to reassess economic outlook at Feb meeting.

- Board felt it would be concerning if outlook for economy, jobs deteriorated.

- Had ability to add further stimulus if required, ready to ease again if needed.

- Economy appeared to have reached a gentle turning point.

- Board noted policy worked with long and variable lags.

- Extended period of low rates needed to meet employment, inflation targets.

- Persistently low growth in household incomes a source of concern.

- Current wage growth not fast enough to reach inflation, consumption goals.

- Rate cuts had been working by lowering bond yields, A$ and mortgage payments.

- Board judged stimulus from rate cuts outweighed any negative impact on confidence.

- Consumers increasingly gloomy on economy, media coverage also more negative.

- Consumers more upbeat on own finances, which correlates better with consumption.

- Recovery in home prices expected to be positive for consumption over time.

- House prices continued to strengthen, but building to fall for several more quarters.

- Liaison with retailers pointed to flat sales growth in Oct and Nov.

- Some downside risks to global economy had receded.

Minutes of its December policy meeting has shown that the Reserve Bank of Australia's (RBA) Board were concerned that wage growth was too weak to revive either inflation or consumption and that they are ready to ease again if need be.

Casting minds back, the statement on the day where the Board held steady at 0.75% repeated that, “the Australian economy appears to have reached a gentle turning point” and added that, “the long and variable lags in the transmission of monetary policy” which argued for a steady hand from the bank.

Analysts at Westpac explained that the minutes were expected to expand an upbeat stance. "One key line to watch for is whether the minutes repeat November’s line “a case could be made to ease monetary policy at this meeting,” even though the arguments rejecting a cut were then listed." Instead, we have been told that the RBA had the ability to add further stimulus if required, ready to ease again if needed and that a long period of low rates would be needed to meet its goals. "The persistently low growth in household incomes continues to be a source of concern," the minutes showed.

The RBA has already eased three times since June, taking rates to a record low of 0.75%, but it has had a limited impact on subdued consumption given slow income growth, a problem repeatedly highlighted in the minutes. The RBA next meets on Feb. 4 when the RBA will have readied its quarterly outlook on the economy.

Description

The minutes of the Reserve Bank of Australia meetings are published two weeks after the interest rate decision. The minutes give a full account of the policy discussion, including differences of view. They also record the votes of the individual members of the Committee. Generally speaking, if the RBA is hawkish about the inflationary outlook for the economy, then the markets see a higher possibility of a rate increase, and that is positive for the AUD.

FX implications

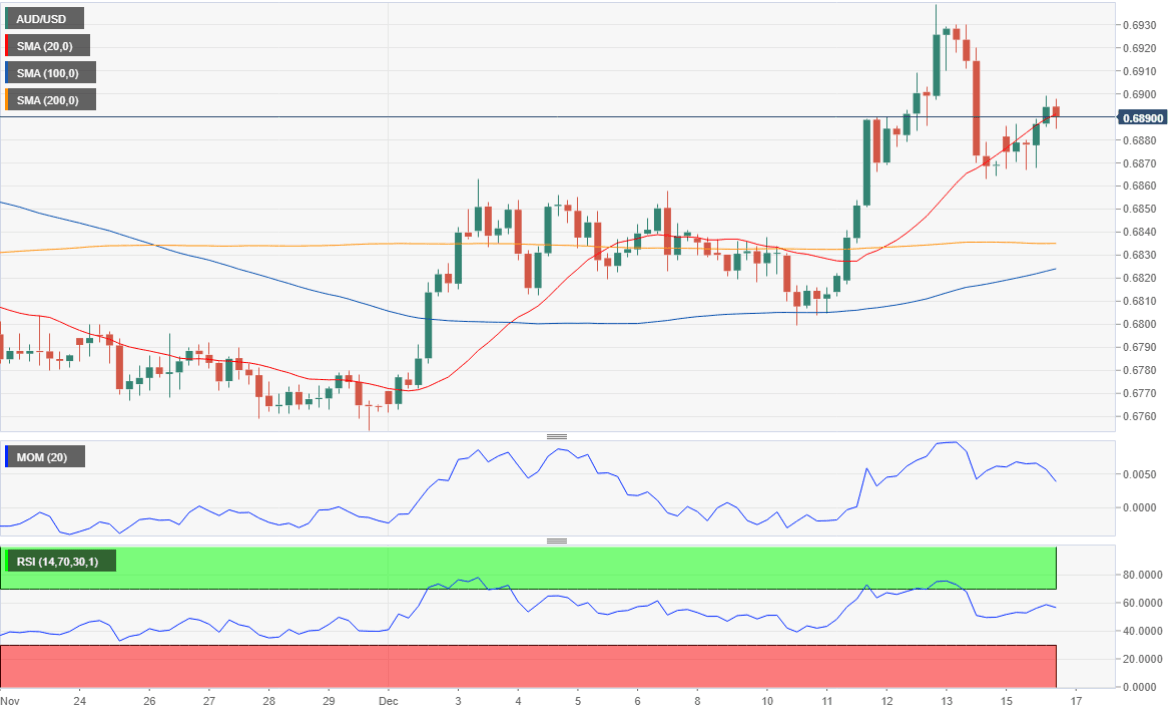

- Support levels: 0.6865 0.6830 0.6800

- Resistance levels: 0.6900 0.6935 0.6970 – (0.6935 is key for bulls)

AUD/USD is slightly offered on the release to trendline support, although, in an early forecast, Valeria Bednarik, the Chief analyst at FXStreet explained that AUD/USD was neutral-to-bullish in the short-term, as, in the 4-hour chart, it held above the 0.6865 support level and that the chances of a bullish extension will increase on a clear advance beyond the 0.6930/40 price zone, where the pair has multiple relevant highs.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.