Qualcomm stock surges on strong earnings, QCOM stock trades 6% higher in Thursday's premarket

- Qualcomm stock surges ahead in Wednesday's after-hours market on strong earnings.

- QCOM and FB earnings help Nasdaq futures to bounce strongly.

- QCOM stock trading at $143.89 on Thursday, up from $135.10 close on Wednesday.

Qualcomm (QCOM) and Facebook (FB) provided just the tonic the Nasdaq needed after it suffered a heavy tanking on Tuesday. Facebook parent Meta stock rallied 15% on average earnings but "relief" was the major theme. Relief that a repeat of the previous earnings performance had been avoided.

Read more stock market research

Qualcomm then stepped up to the plate and produced solid earnings, helping to perhaps turn sentiment around in the tech sector. That may just have gotten harder though after a surprisingly low US GDP release. After the close tonight is also key with Apple (AAPL) and Amazon (AMZN) reporting earnings.

Qualcomm earnings: QCOM beats estimates

Qualcomm reported earnings per share (EPS) of $3.21 which beat the $2.91 estimate. Revenue was $11.16 billion also topped the estimate of $10.6 billion. However, it was strong guidance for Q3 that really got investors bullish. Qualcomm is forecasting EPS of $2.85 and revenue of $10.9 billion for Q3 at the midpoint. These compare to previous analysts' estimates of $2.59 for EPS and $9.98 for Q3 revenue. So a strong upgrade to forecasts.

“We are pleased to announce another quarter of record revenues, reflecting the successful execution of our growth and diversification strategy and strong demand for our wireless and high-performance, low-power processor technologies across multiple industries,” said Cristiano Amon, President and CEO of Qualcomm Incorporated.

Qualcomm said it bought back 6 million shares in its Q2 fiscal quarter.

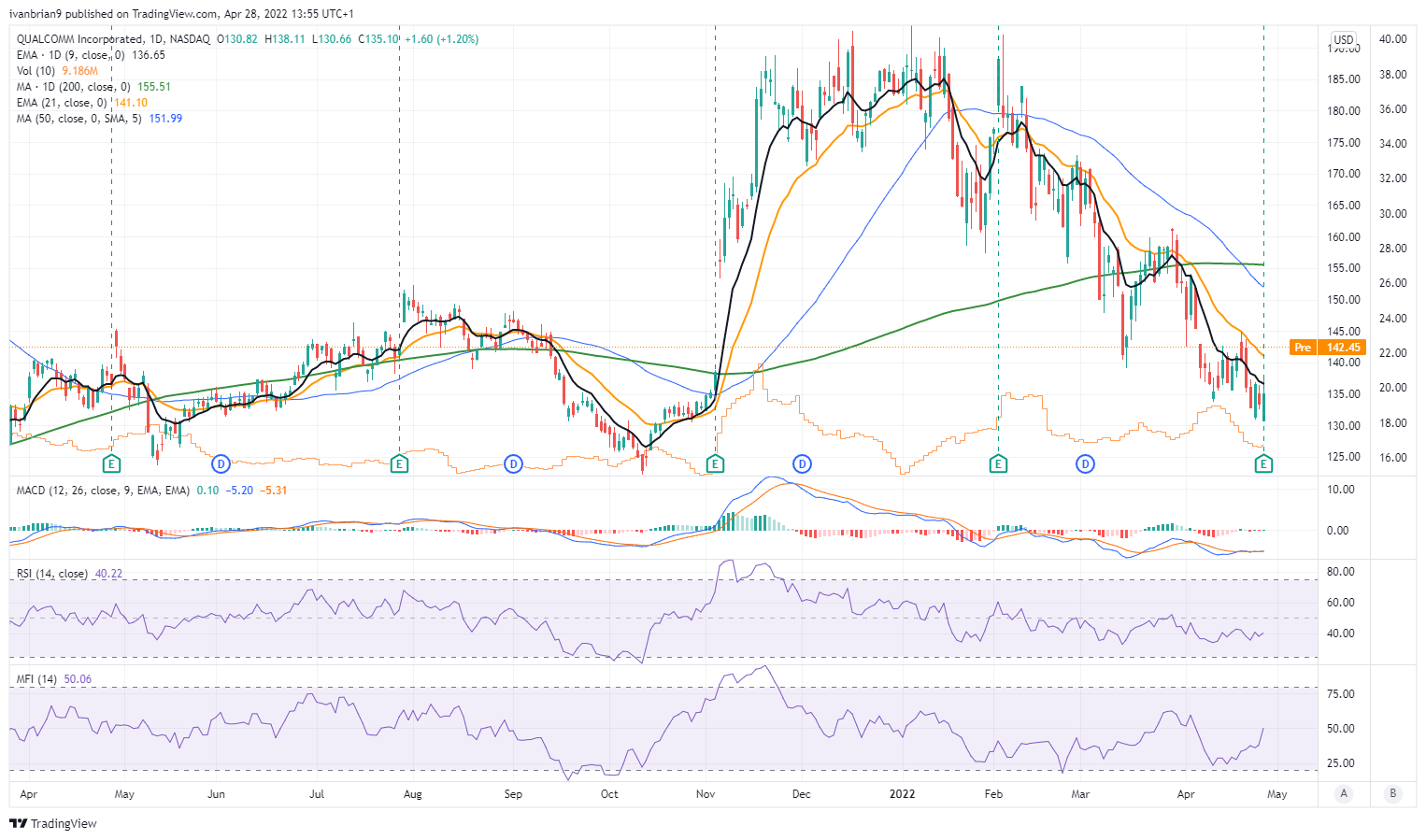

Qualcomm stock forecast: Death cross in place

Despite the bullish earnings release, QCOM stock remains in a powerful downtrend. This is sector-specific and not just down to the company. Recently we have seen the MFI spike higher but it is not until or if the RSI gets back above 50 that QCOM begins to look more interesting on the long side. We are going to set $130 as key support. This is the pre-earnings low.

With such a strong earnings release and forecast this should mark a short-term bottom. If it breaks then sentiment clearly is bearish. QCOM stock has also given us a death cross, strongly bearish. This is when the 50-day moving average breaks below the 200-day moving average.

QCOM stock chart, daily

The author is long Facebook

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.