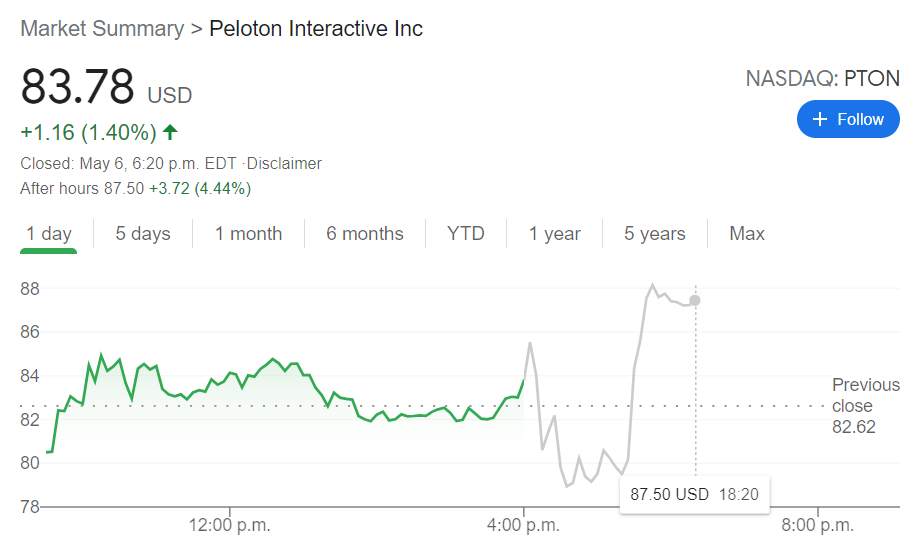

- NASDAQ:PTON gained 1.40% on Thursday during another rocky session for the NASDAQ index.

- Peloton reported its fiscal year Q3 earnings report after the closing bell.

- Peloton still has an uphill battle as it faces recalls of its treadmills.

NASDAQ:PTON has been one of the biggest winners for investors during the COVID-19 pandemic, but some recent issues have caused the stock to pull back. On Thursday, Peloton rebounded by adding back 1.40% to close the trading session at $83.78 and shares continued to rise during after hours trading. Peloton is still trading well below both its 50-day and 200-day moving averages after the recent correction, and currently sits at price levels that Peloton has not seen since September 2020.

Stay up to speed with hot stocks' news!

Peloton reported its fiscal year third quarter earnings after the closing bell on Thursday, and Wall Street seems to be happy with the results. Peloton stated that improvements it made in its supply chain allowed for a 141% year-over-year increase in sales. Earnings per share came in at a loss of $0.03 per share compared to Wall Street estimates of a loss of $0.12 per share, and revenue topped $1.26 billion compared to expected revenue of $1.1 billion, representing a 141% year-over-year increase. Peloton capped off the quarter with a 135% year-over-year increase in subscribers with 2.08 million active users.

PTON stock news

Peloton has been hit with some public relations nightmares over the past couple of months as a total recall of its treadmills came down earlier in the week. The company also experienced a data breach that resulted in user information being leaked, something that may pose a threat to users of connected fitness devices in the future. Despite this, Peloton shares were trading up over 4% after the earnings call.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends slump below 1.0500 after US PMI data

EUR/USD is under renewed selling pressure below the 1.0500 mark. EU PMI data came in better than expected but still indicate contraction in the Union. United States PMIs show a steeper contraction in the manufacturing sector yet upbeat services output in December.

Gold hovers around $2,650 as markets gear up for Fed

Gold opens the week on a moderately positive tone and trades above $2,650, favored by a mild US Dollar (USD) reversal amid lower US Treasury yields. The precious metal, however, is still close to recent lows following a 2.5% sell-off late last week.

Bitcoin rises to new all-time of $106,600, then corrects as markets focus on Fed

Bitcoin price retreats on Monday after reaching a new all-time high (ATH) of $106,648 in the early Asian session. The main factor impacting BTC price this week is likely to be the decision of the US Fed on interest rates on Wednesday.

Five fundamentals for the week: Fed dominates the last full and busy trading week of the year Premium

Christmas is coming – but there's a high likelihood of wild price action before the holiday season begins. Central banks take center stage, and there is enough data to keep traders busy outside these critical decisions.

Five fundamentals for the week: Fed dominates the last full and busy trading week of the year Premium

Christmas is coming – but there's a high likelihood of wild price action before the holiday season begins. Central banks take center stage, and there is enough data to keep traders busy outside these critical decisions.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.