PSNY Stock News and Forecast: Polestar subdued after $10.34 double top

- Polestar stock recovered by 5% on Friday.

- PSNY stock puts in a potential bullish double bottom.

- The EV automaker started trading under PSNY after completing merge with GGPI stock on June 24.

UPDATE: Polestar stock is subdued on Tuesday. The stock has traded in a narrow band between $9.85 and $10.15 this morning and is flat at the moment. It is hard to say whether price action taking a snooze is the result of any one event, but the past week's posting of a double top at $10.34 may have bulls stroking their beard in uncertainty. That double top formation happened once on Friday and then again this past Monday. More than 458 call contracts expiring this coming Friday have been traded this morning for the $10 strike price. The last price was 22 cents, a decline of 27% from Monday.

PSNY stock closed up on Friday as a recovery across equity markets continued ahead of the weekend. EV stocks were also a noted gainer as some company-specific news helped the sector. Investors are now fully up to speed with the new ticker and name for Polestar (PSNY) having seen the merger with SPAC partner Gores Guggenheim (GGPI) complete on June 24.

Also read: Tesla Stock Deep Dive: Price target at $400 on China headwinds, margin compression, lower deliveries

EV stocks provide Polestar a helping hand

EV automaker stocks, as mentioned, ended the week positively on some broadly positive news across the sector which helped. NIO held its Power Day 2022 last week which improved sentiment following on from recent delivery data and further likely Chinese government EV incentives. Tesla outlined accelerated plans to make its charging network available to non-Tesla vehicles and Rivian (RIVN) posted some reassuring delivery data. The chart below plots Polestar (green line) versus TSLA (brown line), NIO (purple line), LCID (yellow line), and RIVN (blue line), showing how the Swedish EV builder company is outperforming all other US and Chinese EV makers.

PSNY stock is spiking up in volatility terms while it does remain the strongest performer so far in 2022 of the main EV automaker stocks.

GGPI merge completion increases Polestar volatility

Gores Guggenheim (GGPI) stock price action looks positively pedestrian by comparison to the range in PSNY stock since its official launch on June 24. Since completing the merge with the Special Purpose Acquisition Company (SPAC), Polestar shares have spiked up to $13.36 before falling back to $8.64 just a few days later. GGPI stock price had largely held above the notional $10 support level due to SPAC rules mandatory requiring to hold $10 in cash to return to shareholders in the event of a no-deal. That backstop has now been removed, and volatility has increased in the current PSNY stock form. The deal progression can be seen as an achievement in itself, as SPAC deals have collapsed in 2022. The doyen of corporate finance types in the pumped-up 2020 and 2021 years has fallen prey to tighter financial conditions and dampened investor optimism.

Polestar new models coming?

Polestar began life with its initial hybrid vehicle the Polestar 1. This is no longer in production and has been superseded by the fully electric Polestar 2, an enviable-looking sedan.

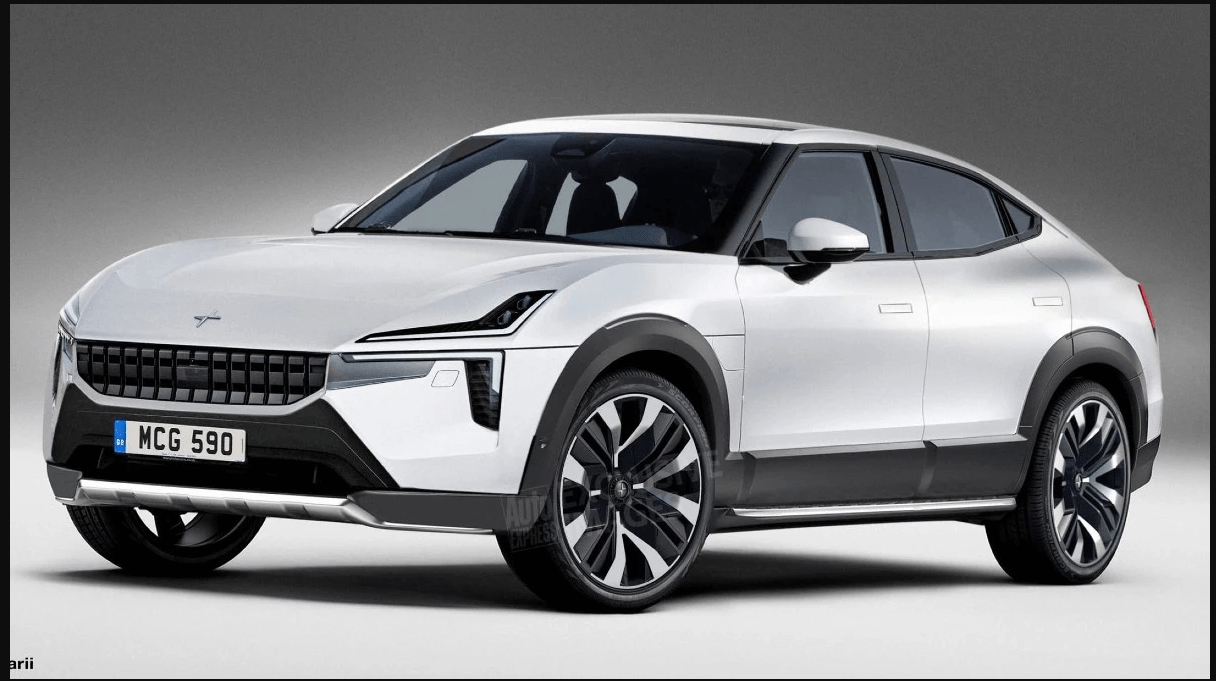

Polestar 3 is the company's entry into the high-margin SUV sector and is key to the next phase in Polestar's development. The Polestar 3 will be made in the US and China and will be followed by the Polestar 4 which is a coupe SUV.

Polestar 3

Polestar CEO Thomas Ingenlath, in a recent interview with TopGear.com, referred to Polestar's stunning-looking O2 concept car. The O2 is an electric four-seat hardtop convertible and was on show at a number of motor festivals around Europe this summer. As of yet, plans for the O2 appear to remain largely in the developmental phase. “My ambition is to make it a production car,” Ingenlath told TopGear.com, “but it’s not that easy.”

Polestar stock forecast: PSNY in price discovery

Polestar stock price remains largely in discovery mode. Investors are still trying to grapple with many unknowns as the company upscales its product range. The completion of the SPAC deal has certainly provided PSNY stock with plenty of cash (over $1 billion) but with limited production and revenue, investors are buying potential rather than cold hard revenue cash.

In the current market environment, potential has been marked lower as interest rates rise. The strong employment report last Friday is actually a headwind for early-stage companies. The Fed has space to continue its aggressive rate rises meaning future cash flows get discounted at higher rates and the equity versus bond premium narrows. We remain neutral here. Note the potential double bottom at $8.60 which could result in a short-term catalyst.

PSNY stock chart, daily

*The author is short Tesla.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.