Power Grid Corp Elliott Wave technical analysis [Video]

![Power Grid Corp Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Automobiles/man-repairing-car-637322356525446730_XtraLarge.jpg)

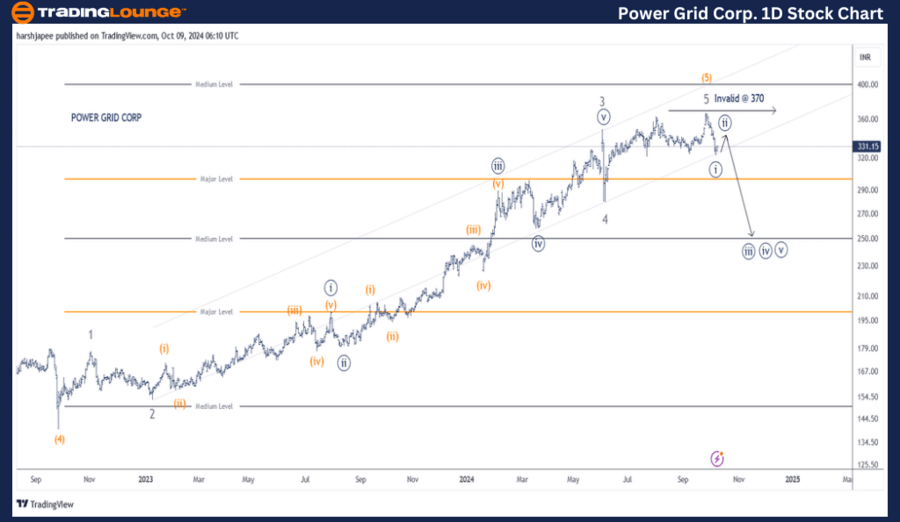

POWERGRIDCORP Elliott Wave Technical Analysis

Function: Counter Trend (Minute Degree, Navy).

Mode: Corrective.

Structure: Potential impulse within larger degree correction.

Position: Minute Wave ((i)).

Details: We have now changed the proposed structure as price action confirms drop through 320. Intermediate Wave (5) Orange could be now complete around 370 mark as prices turn lower to terminate Minute Wave ((i)) around 320. If correct, expect a rally to carve Minute Wave ((ii)) before bears are back in control.

Invalidation point: 370.

Power Grid Corp chart technical analysis and potential Elliott Wave counts

Power Grid Corp daily chart might have changed the proposed structure over the past few trading sessions with the stock dropping through 320 mark. A potential top might be in place around 370, shy of fibonacci projection, terminating Intermediate Wave (5) Orange.

The stock has been rallying since September 2022 after carving a low around 140, marked Intermediate Wave (4) Orange here. Minor Wave 3 of Intermediate Wave (5) was extended and terminated around 350 levels as Wave 4 was sharp to drop through 280 on June 04, 2024.

The rally through 370 might be potential Wave 5 Grey of (5) Orange termination as subsequent price action breaks below 320 support. Alternately the recent low could be an expanded flat Minute Wave ((iv)) with another push higher to complete the structure. We shall bring that count later.

POWERGRIDCORP Elliott Wave technical analysis

Function: Counter Trend (Minute Degree, Navy).

Mode: Corrective.

Structure: Potential impulse within larger degree correction.

Position: Minute Wave ((i)).

Details: We have now changed the proposed structure as price action confirms drop through 320. Intermediate Wave (5) Orange could be now complete around 370 mark as prices turn lower to terminate Minute Wave ((i)) around 320. If correct, expect a rally to carve Minute Wave ((ii)) before bears are back in control.

Invalidation point: 370.

Power Grid Corp four-hour chart technical analysis and potential Elliott Wave counts

Power Grid Corp 4H chart highlights potential sub division of Minor Wave 5 Grey. Minor Wave ((iv)) has been marked as a running flat. The subdivisions within Minute Wave ((v)) are not very clear but this is the best possible count presented as prices drag below 320.

Conclusion

Power Grid Cop might have topped around 370 and bears have further carved Minute Wave ((i)) lower below 320. Expecting a minor pullback now to complete Minute Wave ((ii)) before turning lower again.

Power Grid Corp Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.