Pound Sterling turns neutral above 1.2600

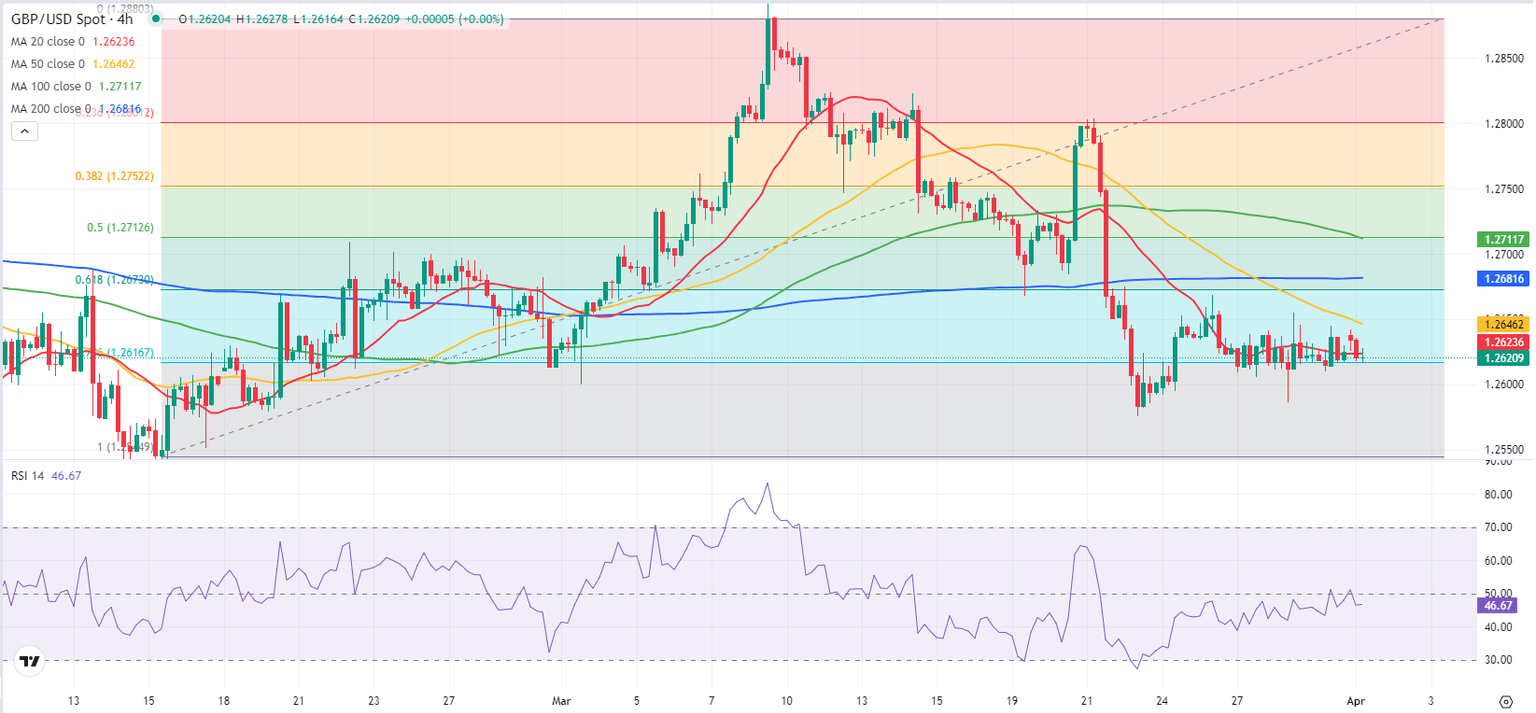

GBP/USD Price Analysis: The initial support level is located at 1.2610

The GBP/USD pair holds positive ground near 1.2628, snapping the two-day losing streak on Monday. The modest recovery of the major pair is backed by the dovish comments from Federal Reserve (Fed) Chairman Jerome Powell. The Fed’s Powell stated on Friday that recent US inflation data was in line with expectations and that the Fed's goal for the interest rate this year remained unchanged. The US central bank maintains projections of three rate cuts this year, and traders anticipate the first rate cuts will begin in the June meeting.

According to the four-hour chart, GBP/USD maintains the bearish outlook unchanged as the major pair is below the key 50-period and 100-period Exponential Moving Average (EMA) on the four-hour chart. Additionally, the downward momentum is supported by the Relative Strength Index (RSI), which lies below the 50 midlines, suggesting the path of least resistance level is to the downside. Read more...

GBP/USD Forecast: Pound Sterling turns neutral above 1.2600

Following Friday's indecisive action, GBP/USD extends its sideways grind above 1.2600 to start the new week. The pair's technical outlook doesn't offer any directional clues as conditions remain thin on Easter Monday.

US stock index futures trade in positive territory on Monday, suggesting that Wall Street's could open higher following the long weekend. The US Bureau of Economic Analysis reported on Friday that the core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's (Fed) preferred gauge of inflation, edged lower to 2.8% on a yearly basis in February from 2.9% in January. Read more...

Author

FXStreet Team

FXStreet