Pound Sterling rebounds against USD even though US inflation remains sticky

- The Pound Sterling recovers from a three-month low of around 1.2750 against the US Dollar after sticky US inflation data for October.

- Market expectations for the Fed to cut interest rates in December have increased.

- BoE Mann sees inflation remaining sticky amid expectations that energy prices could rise again.

The Pound Sterling (GBP) rebounds from the three-month low around 1.2750 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair bounces back as the United States (US) Consumer Price Index (CPI) report showed that price pressures remained sticky in October. The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, drops slightly but is still close to a six-month high of around 106.00.

The headline inflation accelerated to 2.6% from 2.4% in September, with the core CPI – which excludes volatile food and energy prices – rose steadily by 3.3% year-on-year, as expected. The monthly headline and core CPI grew steadily by 0.2% and 0.3%, respectively, in line with market participants.

The inflation data isn’t expected to significantly impact market expectations for the Federal Reserve’s (Fed) likely monetary policy action in the December meeting as recent commentaries from a majority of Fed officials indicated that they are confident about the disinflation trend remaining on track to the bank’s target of 2%.

Still, Minneapolis Federal Reserve Bank President Neel Kashkari struck a cautious note on Tuesday at a Yahoo! Finance event. "If inflation surprises to the upside before December, that might give us pause,” he said. Kashkari added that the monetary policy is "modestly restrictive right now," and he expects economic growth to persist. When asked about the impact of President-elect Donald Trump’s policies on the inflation outlook, Kashkari said: “The tariff is a one-time increase in prices, that's not inflationary in itself.”

President-elect Donald Trump has vowed to raise import tariffs by 10% and lower corporate taxes in his election campaign.

According to the CME FedWatch tool, the probability for the Fed to reduce interest rates by 25 basis points (bps) to 4.25%-4.50% in December is 72%, jumps from 58.7% on Tuesday.

Pound Sterling strives for a reversal as BoE officials show concerns over fears of price pressures remaining persistent

- The Pound Sterling rebounds in North American trading hours on Wednesday after a sharp sell-off on Tuesday. The British currency rebounds as Bank of England (BoE) officials are worried about price pressures remaining persistent. In the European session, BoE external policy member Catherine Mann said in a panel discussion organized by BNP Paribas that the progress in the disinflation process could slow down as energy prices are more likely to rise than fall and highlighted inflation in the service sector as "pretty sticky," Bloomberg reported. When asked about the impact of Trump's tariffs on the economy, Mann said, "I will want to focus on how much UK financial conditions are affected by BoE’s action vs. moves in the US."

- On Tuesday, BoE Chief Economist Huw Pill also showed some concerns over inflation remaining persistent. "As we saw in the labour market data that was released this morning, pay growth remains quite sticky at elevated levels and levels that - given the outlook for productivity growth in the UK - are hard to reconcile with the UK inflation target,” Pill said after the release of the United Kingdom labor market data for three months ending September at the conference of Swiss Bank UBS.

- The Pound Sterling tumbled on Tuesday after the UK labor market data for three months ending September showed that the Unemployment Rate rose more than expected to 4.3%. Fresh payrolls also came in lower at 219K against the 373K jobs added in three months ending August.

- "The higher (UK) unemployment rate could see the market start to price in a higher chance of a rate cut from the Bank of England (BoE) next month," according to analysts at XTB.

- However, not all components of the labor market data were unfavorable for the Pound Sterling as Average Earnings data, a key measure of wage growth that drives consumer spending, came in higher than expected.

Technical Analysis: Pound Sterling finds cushion near 1.2700

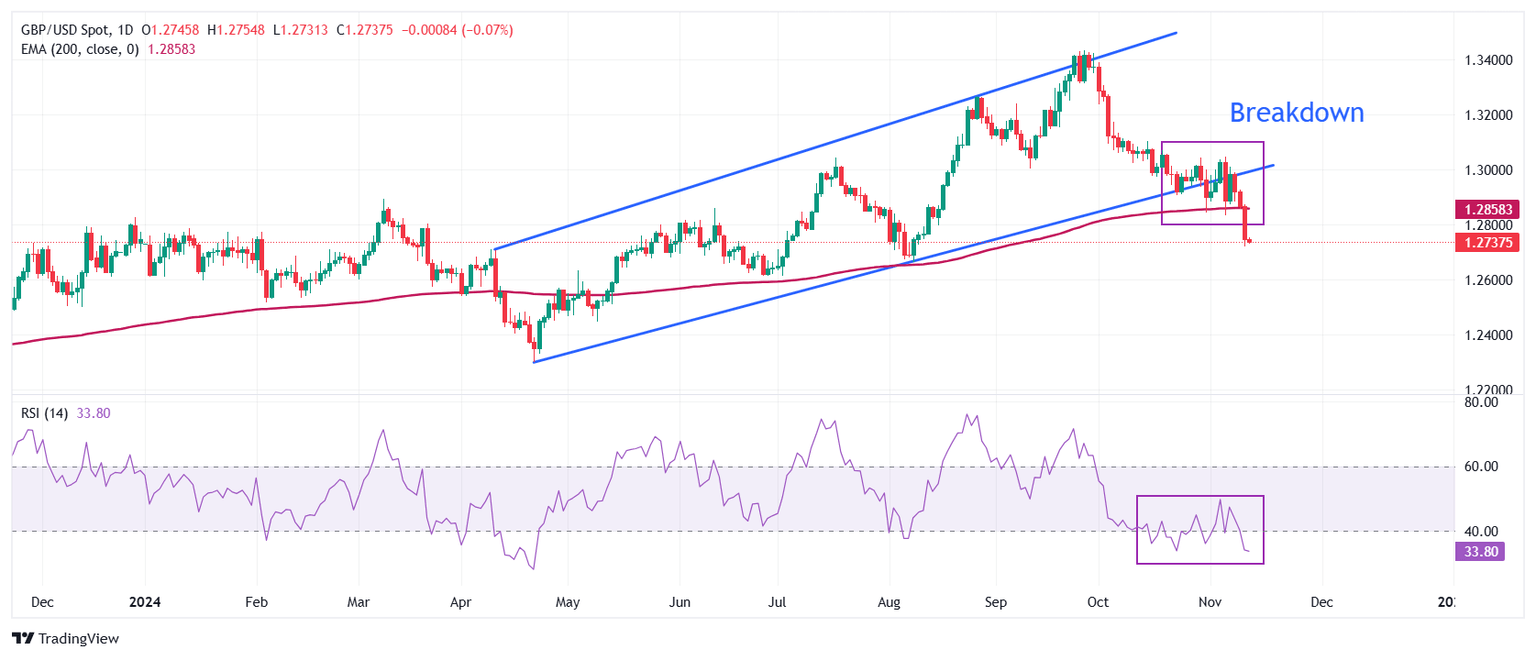

The Pound Sterling finds a temporary support near the three-month low near 1.2700 against the US Dollar. The GBP/USD weakened sharply on Tuesday, breaking below the 200-day Exponential Moving Average (EMA), which trades around 1.2860. The overall trend of the Cable turned broadly negative after price action fell below the lower boundary of the rising channel, which set a bearish reversal.

A bearish momentum has kicked in with the 14-day Relative Strength Index (RSI) falling below 40.00.

Looking down, the August low at 1.2665 will be a major cushion for Pound Sterling bulls. On the upside, the Cable will face resistance near the psychological figure of 1.3000.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.